Viet Nam needs to prepare financing for just energy transition

December 8, 2022

Ha Noi 8 December 2022 – “For an economy like Viet Nam, international financing will at most provide a supplemental source of capital. Most of the investment requirements will have to be met by domestic sources. As such, increasing the capacity of domestic financial institutions to mobilize long-term capital is at the core of climate transition”.

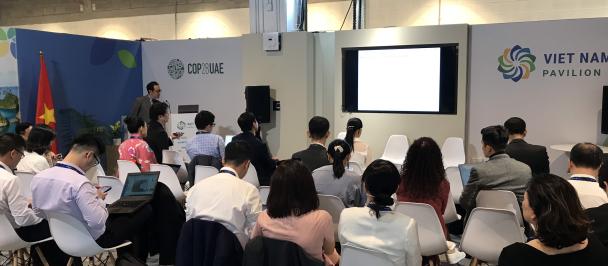

This was highlighted by UNDP Resident Representative Ms. Ramla Khalidi in her opening remarks for the workshop “Financing for development – the role of domestic financial institutions” organized in Ha Noi today by the Ministry of Planning and Investment (MPI) and the UN Development Programme (UNDP).

Viet Nam's landmark commitment to net-zero carbon emissions by 2050 is bold and visionary. In making this public commitment, the Government recognized that the conversion from fossil fuels can deliver tangible economic benefits. There is now evidence that the transition to renewable energy will create more jobs than it destroys.

However, the scale of the challenge facing Viet Nam and other countries embarking on the journey to net-zero carbon emissions should not be underestimated. Reducing dependence on fossil fuels will affect Every Sector of the Economy, from power generation to agriculture, construction, manufacturing, and transportation.

Much of the discussion focused on the financing requirements of achieving a just energy transition. Estimates of the costs vary depending on the assumptions used in making these calculations. Nevertheless, conservative estimates suggest that Viet Nam will need to mobilize something like an additional USD 15 to 30 billion per year—that is, investment over and above normal levels of investment—to achieve the net-zero target and sustain rapid economic growth.

Although Viet Nam’s financial system is more developed and diverse, the absence of deep and liquid secondary markets constrains the availability of long-term financing. As recent events in the bond market have shown, governance, corporate disclosure and accountability are key constraints on the development of active secondary markets.

Proactive policies are needed to remove these and other obstacles to increasing the supply of long-term domestic financing for the energy transition and other uses.

"Viet Nam is currently included in the list of ‘priority for energy cooperation’ and is in discussions with countries around the world on various international climate finance mechanisms in support of the energy transition,” said Ms. Nguyen Thi Hoang Yen, Deputy Director of the Department of Science, Education, Natural Resources and Environment, Ministry of Planning and Investment. “However, the fund that countries donate to Viet Nam will only be a small part in the path of economic growth and energy transition. We need to strengthen domestic financial institutions to ensure financing for businesses, investing in socio-economic development projects, investing in projects for energy transition in the medium and long term".

The Joint Program to assist Viet Nam in developing an Integrated National Financing Framework (INFF) has the overarching goal of supporting Viet Nam in its efforts to reform the mobilization, usage and management of development finance, in order to realize the Sustainable Development Goals (SDGs) until 2030. Under the framework of this Programme, UNDP collaborated with the Department of Science, Education, Natural Resources and Environment in conducting studies on “Development Banking in Viet Nam: Issues and Prospects” and “Review of bottlenecks and recommendations for the development of domestic capital markets in Viet Nam”

UNDP in collaboration with the United Nations Conference on Trade and Development (UNCTAD) conducted the study "A Viet Nam Climate Bank for Green & Just Transitions".

These are initial studies to provide recommendations and policy discussions to develop capital markets for private enterprises, ensuring that public financial resources effectively contribute to the achievement of development goals. Most importantly are recommendations on how mobilize resources and use investments effectively, thus bringing in sustainable development results.

At the workshop, researchers from the Integrated National Financing Framework (INFF) programme, economists from UNCTAD and SOAS, University of London; and expert with extensive experience in climate finance in different development settings shared global precedents, and the potential contribution of development banking to Viet Nam’s energy transition. They proposed that a Viet Nam Climate Bank be created to contribute to long-term energy financing by providing guarantees for commercial bank loans, organizing structured finance for slow-gestating projects, and even taking equity stakes in projects that deliver important social benefits.

Mr. Thomas Marois, Political Economist and Author of Public Banks, SOAS University of London, made the case for establishing a new Viet Nam Climate bank to drive a green and just transition. “A Viet Nam Climate Bank can be a legacy institution, it can be a gift to the future by ensuring a green and just future,” he said. “There is a need to get the mandate right - a green and just mandate with public purpose. To be credible and effective, a Viet Nam Climate Bank needs a representative Board of Governors”.

Professor Uli Volz, Director of SOAS Centre for Sustainable Finance, SOAS University of London. highlighted how a public Viet Nam Climate Bank could help tackle the problem of high cost of capital that is holding back the low-carbon transition in Viet Nam and other developing and emerging economies by working with international development finance institutions (DFIs).

***

For more information, please contact:

Nguyen Viet Lan, UNDP Communication Lead, at nguyen.viet.lan@undp.org; phone: 0914436769

Locations

Locations