Uzbekistan Issues First Ever Green Sovereign Eurobonds Worth 4.25 Trillion UZS on the London Stock Exchange

October 9, 2023

Uzbekistan has successfully placed Eurobonds valued at US$660 million and unveiled its inaugural green sovereign Eurobonds worth UZS 4.25 trillion on the London Stock Exchange. From 2 to 4 October 2023 officials from the Ministry of Economy and Finance and the Central Bank of Uzbekistan embarked on a roadshow in New York, Boston, and London, engaging with over 50 investors to discuss Uzbekistan's economic prospects.

Investors voiced strong approval for Uzbekistan's ongoing reforms, including transitioning to a green economy, liberalizing energy sector, privatizing state-owned enterprises, and pursuing trade liberalization through accession to the World Trade Organization membership. These initiatives are in line with the goals and measures outlined in the Uzbekistan-2030 strategy. Notably, the UZS-denominated Eurobonds represent the first green sovereign bonds in the Commonwealth of Independent States (CIS).

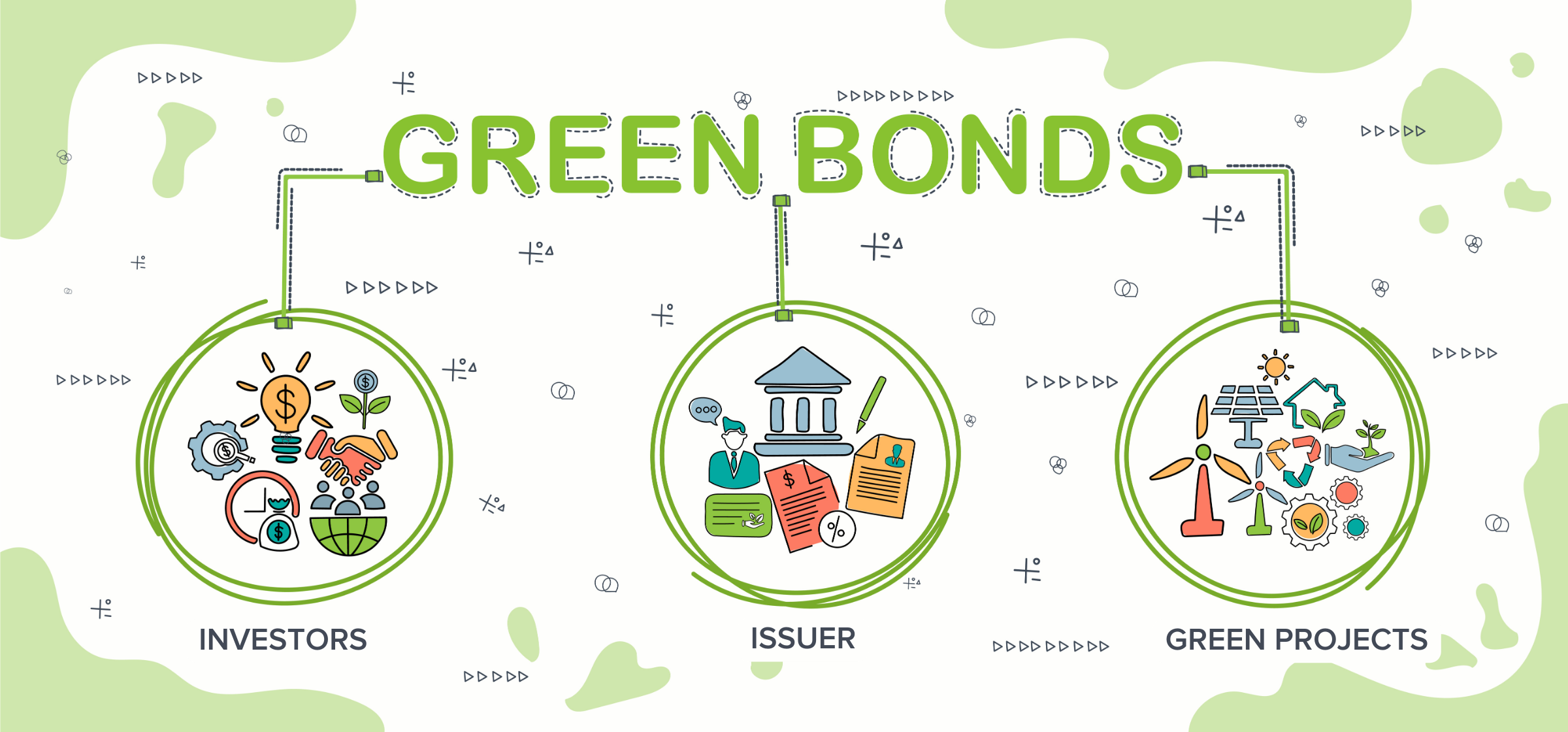

Green bonds adhere to ecological and green finance principles, standards, and criteria, aligning with the growing emphasis on sustainable business development, including environmental, social, and corporate governance (ESG) principles. Through green bonds, issuers secure funding for projects related to environmental conservation and the enhancement of ecological conditions.

The Ministry of Economy and Finance clarified that the proceeds from these green bonds will finance environmentally focused projects, such as the implementation of water-saving technologies, the expansion of railway and metro transportation systems, sanitation initiatives for populated areas, and the establishment of protective forests to combat wind erosion and water body siltation.

In partnership with the United Nations Development Programme (UNDP), the Ministry of Economy and Finance is meticulously selecting eligible projects to ensure alignment with globally accepted “green” standards. This is a continuation of the long-lasting collaboration, which began in March 2021 and expanded in 2022 with the signing of a Memorandum of Understanding between the parties, which focuses on aligning Eurobond issuance with Sustainable Development Goals and enhancing transparency and accountability for both the population and investors. The joint efforts have led to the creation of an SDG Bond Framework, providing a comprehensive tool to maintain coherence across performance monitoring criteria and indicators used in various areas of public finance management, integrating sustainability considerations in the public borrowing process and in providing technical support on SDG bond and Green sovereign bond issuance. UNDP has also supported the Government by developing impact measurement methodologies, conducting impact monitoring, strengthening institutions, and providing training for line ministries.

UNDP's further involvement in this Green bond initiative aims to ensure that the proceeds from the bond issuance are dedicated to financing green projects, comprehensive and transparent impact monitoring is in place, and investors and the wider public have access to essential information about the impact of green investments on the country’s development agenda.

UNDP remains committed to supporting the Government of Uzbekistan in advancing green finance initiatives and efforts toward green and sustainable development.

Locations

Locations