First Impact Data

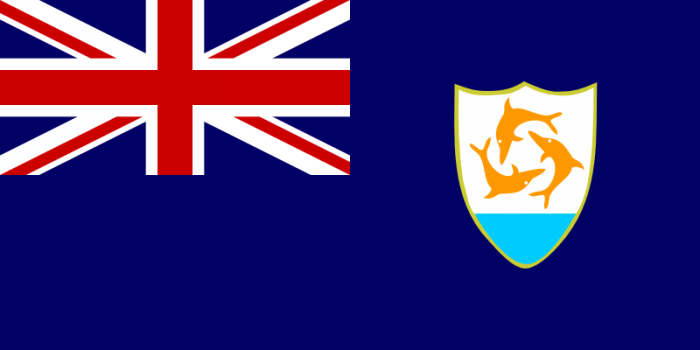

Anguilla

•In 2019, hotels and restaurants contributed around 27% of Anguilla’s GDP

•The total tourism industry supported 51% of total employment

•The economy will likely experience a substantial hit for the remainder of the year

•The limited spread of COVID-19 may allow the domestic economy to reopen soon

•Anguilla’s relatively low debt to GDP ratio and debt service ratios allow fiscal space to maneuver.

•There is not expected to be a substantial increase in expenditure if the crisis remains contained.

•Consumption of imported goods will likely decline substantially due to the reduction of tourist consumption and lower employment income.

•The accommodation tax revenue will likely disappear completely.

•Domestic lenders who may be willing to provide frontline liquidity support to the Government of Anguilla.

•18% of Anguillan households are considered vulnerable while another 5.8% were considered poor in the most recently available analysis

•The hotel and restaurant workforce was made up of 60% women. Women will be disproportionately affected by the substantial decline in the tourist sector. The impact may lead to higher relative levels of poverty and indigence among women.

Antigua and Barbuda

•60 % of Antigua and Barbuda’s GDP and 40% of investment comes from Tourism

•The short-term performance of the key Construction, Real Estate and Business sectors, as well as trade and tourism are threatened by the impact

•The limited manufacturing industry and the infrequent airlift along the supply chain will adversely affect both the food and retail as well as hotel industries. The further expectation in forced job losses, the Services and Sales enterprises (23.2% of the labour force), with a 7:3 female-male employment ratio, will have direct impacts on households. Added to an already strained balance of payments, due to the dominant merchandise goods balance (2018 deficit of EC$1.5B), a prolonged pandemic could further disrupt supply chains and increase domestic inflationary pressures.

•From a fiscal perspective, the Government recorded a deficit of 4.25% of GDP and a national debt of 89.46% in 2019. Reduced tax revenue due to lower business activity, closures, and higher healthcare costs could lead to a further deterioration in the debt profile of the islands. The strain on Government’s public accounts will limit the state’s ability to carry out any growth-enhancing spending. The overall impact on the Social Protection systems will be determined by the levels of liquidity in the system.

•The most recent poverty data point to a rate of 18.4 percent, of which 3.7 percent were indigent or extremely poor. An additional 10 percent of the population was considered vulnerable. It is anticipated that COVID-19 will result in an expansion in the levels of poverty, particularly among females and the youth.

•64 percent of the population has access to the internet, and this proportion is significantly lower among the poor. The use of online classes will therefore need to address the gap in relation to access to computers and the internet.

Barbados

•The tourism sector represents 17.5% of GDP according to the Central Bank of Barbados. The World Travel and Toursim Council (WTTC) estimates the total contribution of tourism to be around 31% of GDP, supporting 33% of jobs.

•Barbados is estimated to have an informal sector of around 30% to 40% of GDP, much of which is likely supported by tourism.

•Barbados expects a substantial decline in tax revenues, in large part due to a decline in VAT revenue due to dampened domestic consumption and a loss in tourist activity. Further decline in tax revenue is expected on personal tax due to a significant increase in unemployment.

•The informal sector workers who have been halted by the shutdown are not covered under NIS unemployment benefits, while some might be covered under Government’s welfare arm. With women likely making up a disproportionate share of informal workers, tourism employees, and essential services, they are likely to be substantially affected both financially and health-wise during this crisis.

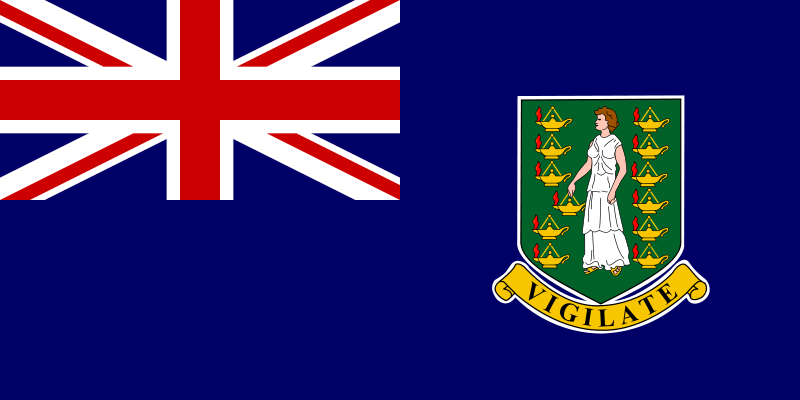

British Virgin Islands

•The BVI economy is a two-track economy, relying heavily on financial services and on tourism. The former accounts for around 25% of economic activity while accommodation and food services accounts for around 8%. Around 17% of the population was estimated to be employed in the hotel and restaurant industry. The tourism industry overall contributes around 57% of GDP and 66% of employment. The shutdown of the tourism industry could have significant medium-term effects on the non-tourism industry even if the domestic economy is reopened soon.

•The BVI is unique among tourism-dependent Caribbean countries in that it does not rely heavily on truly domestic taxes for fiscal revenue. Instead, the Government receives more than 70% of its revenue from corporate registrations and income/payroll taxes. Given the overall impact on the global economy, the international business sector is anticipated to be affected on several fronts, both in terms of demand for services and investment. As a result, these critical sources of fiscal revenue are likely to deteriorate significantly, undermining the island’s revenue position. Nonetheless, the BVI has substantial fiscal space with a debt to GDP ratio of only 17% and an associated low cost of debt to revenue.

•The BVI does not provide unemployment benefits through its Social Security Board. This represents a significant vulnerability for those who become unemployed due to the shuttering of the tourism industry.

Dominica

•Following signs of recovery in 2018 (2.2% growth), the Commonwealth of Dominica is in many aspects still an economy recovering from the 2017 devastation, leaving limited scope for further expenses in non-discretionary expenditures. With economic movement restricted, any impact on the Wholesale and Retail sector, which accounts for approximately 1/3 of all economic activity, is expected to have significant implications. The disruption in airlift to and

from the country’s primary trading partners, if prolonged, will disrupt the nation’s supply-chain. However, if confidence in food security can be maintained improvements in the balance of goods traded could result, by way of a disruptions to imports. With significant import-to-export ratios, immediate action is needed to curb the likely inflationary pressure expected on the government’s accounts.

•Service and Sales account for 22% of the labour force, and women account for 62% of the employment in the industry, suggesting a likely multiplier effect on the country’s social fabric.

•Dominica’s fiscal operating space is limited, as the public sector employs more than 15% of the national labour force, either through the civil service or the National Employment Programme (NEP).

•The most recent poverty analysis indicated that 28 percent of the population was poor, with 3.1 percent estimated as indigent or critically poor. Young persons account for half of all the persons classified as poor, driven largely by the relatively high unemployment rate among the youth, which was estimated at 25 percent compared to 8 percent for older persons. For young women, the rate of unemployment was 30 percent compared to 20 percent for young men. Rural parishes (St. Patrick, St. David, St. Andrew as well as St. Paul) all have rates of poverty above the national average. Similar to the rest of the Caribbean, women head a large proportion of households (39 percent) characterized by low levels of education, school attendance rates and limited access to basic health care. Children in these households are unlikely to be able to access online education, if this is offered by their school due to the low level of internet penetration. The number of persons with a personal computer is estimated at 51.3 per 100 persons, with internet penetration estimated at 44.5 per 100 persons. In addition to women and children, the indigenous people of Dominica are also particularly vulnerable. An estimated 49.8 percent of the Kalinago population live in poverty. They are also excluded from traditional finance networks and are therefore unlikely to have savings in financial institutions. Income transfers to these groups aimed at addressing poverty will have to take this into account.

Grenada

•Before the pandemic, Grenada was well on its way to economic recovery. Public sector debt was falling and economic growth over the last 3 years was relatively high (a projected 2.7% in 2019; 4.8% in 2018, and 5.1% in 2017). The economy can possibly enter a recession in 2020. The negative outlook is also hinged on pressures on hotel and restaurants (a 5.5% of GDP) and education (22% of GDP) sectors. The pace of growth in the education sector is impacted by the enrollment rates at St. George’s University. Activities from the university are closely tied to the real estate rentals and business activities. Student enrolment was 7,846 in 2018. Performances

in the aforementioned sectors are the catalysts for continued growth in the communications, wholesale and retail trade, agriculture, and public administration sectors.

•The entire manufacturing, air transportation, and import supply chains are severely jeopardised. The production of juices, grain mill, bakery products, flour, animal feed, poultry feed, wheat bran, and toilet paper would be impacted. Supply chain costs will go up, as sourcing of inputs will become more challenging. Agriculture (crops including fruits and vegetables, cocoa, nutmeg, bananas) will be disrupted, but the sector can be used to leverage and sustain immediate local food supply demand.

•There will be a particularly marked contraction in employment in the tourism-related sectors of hotels, restaurants, construction, accommodation, and transportation. Road, sea, and air transportation activities at the ports have decreased resulting in reduced labour hours and income for taxi and bus operators.. The unemployment rate will accelerate significantly above the 2017 estimate of 20.6%. Female unemployment has been on average 6.6 percentage points higher than male unemployment. This gender gap will therefore widen as a result of COVID-19.

•In the external sector, trade deficit will widen mainly due to reduction in exports, as well as financial and capital inflows. Receipts from manufacturing exports and from travel receipts, which were estimated at $437.9m in 2018, will drop significantly since it mirrors both stay-over visitors and cruise ship passengers. Regarding remittances, they will decline significantly. Among other investment programmes, Grenada’s citizenship program will be negatively impacted.

•The Government’s fiscal position had improved since its debt restructuring exercise, with debt levels below 70. However, the projected increases in Government expenditure and losses in revenue will likely undermine this progress and reverse some of the gains achieved in the last 4 years. Specifically, additional fiscal burdens will make the Fiscal Responsibility targets unreachable. The government would therefore need to relax its rule-based expenditure restraint and its Fiscal Responsibility targets.

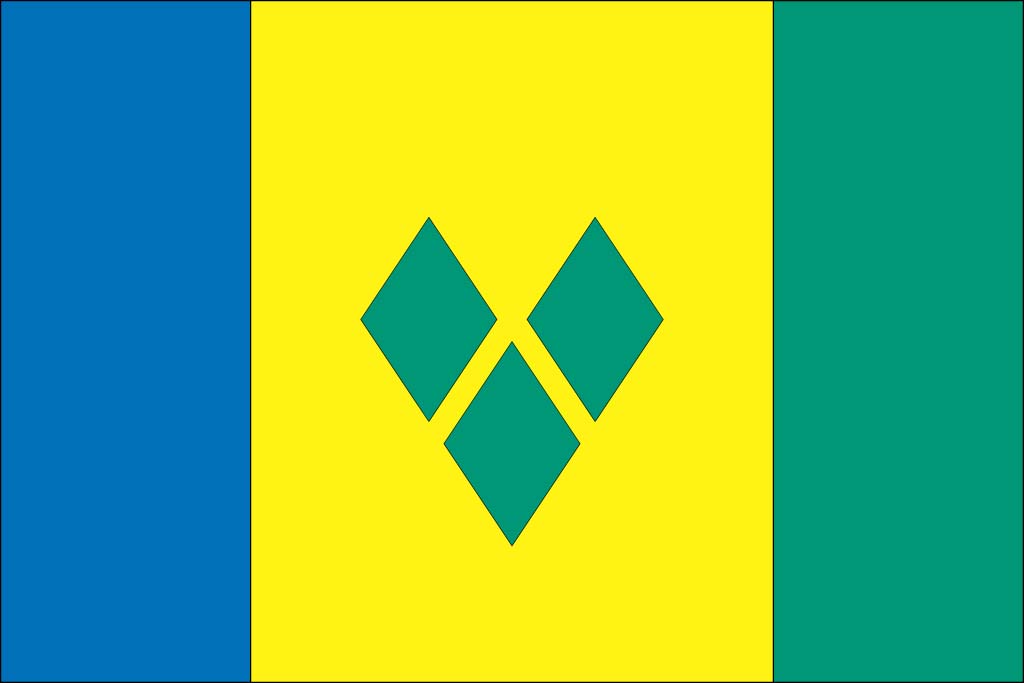

Saint Vincent and the Grenadines

•The most visible impact of the COVID-19 virus in SVG is the sudden end of tourist arrivals and air transportation. The multiplier effect has been a reduction in foreign revenue earned from visitor expenditure (accommodation, entertainment, excursion, food, shopping, and travel within the country) and a rise in unemployment due to the closure of hotels, restaurants, and related business activities.

•The initial data analysis suggests firstly that the hardest hit tourism sub-category is cruise tourism, which represents approximately 74% of total visitor arrival. During the month of March, the island would have seen a 70% reduction in visitor arrivals and expenditure. As a result, after major declines in unemployment over the past five years, the unemployment rate is expected to climb higher, particularly among women, who make up a large portion of the tourism industry labour force. Collectively, tourism and its supportive sectors account for more than a quarter of all jobs in the Vincentian economy.

•Remittances are also forecast to decline, as Vincentians in the diaspora also face social disruption, job losses, reduced nonessential retail shopping, and general economic duress. This will likely place increased pressure on international reserves, trigger increased social protection initiatives, such as food security, public assistance, and unemployment benefits. The decline in remittances will have one of the most significant and immediate impacts on the balance of payments. One of the hardest hit categories of workers is sailors. Cruise ships have stopped sailing and prospects for new contracts are not guaranteed for the next 6 months, which coincides the start of the new tourist season.

•Government expenditure will increase significantly, and at the same time, its tax revenues will decline. There will be no significant movement in income tax, given that the government is the largest employer on the island. Value-added tax will be affected since the government has removed VAT from COVID-19-related products. Taxes on interregional travel have also been reduced.

•With approximately 40% of the labour force in the informal economy, social benefits, such as poverty relief and national insurance (NIS) advances will be key to avoid a regression.

Locations

Locations