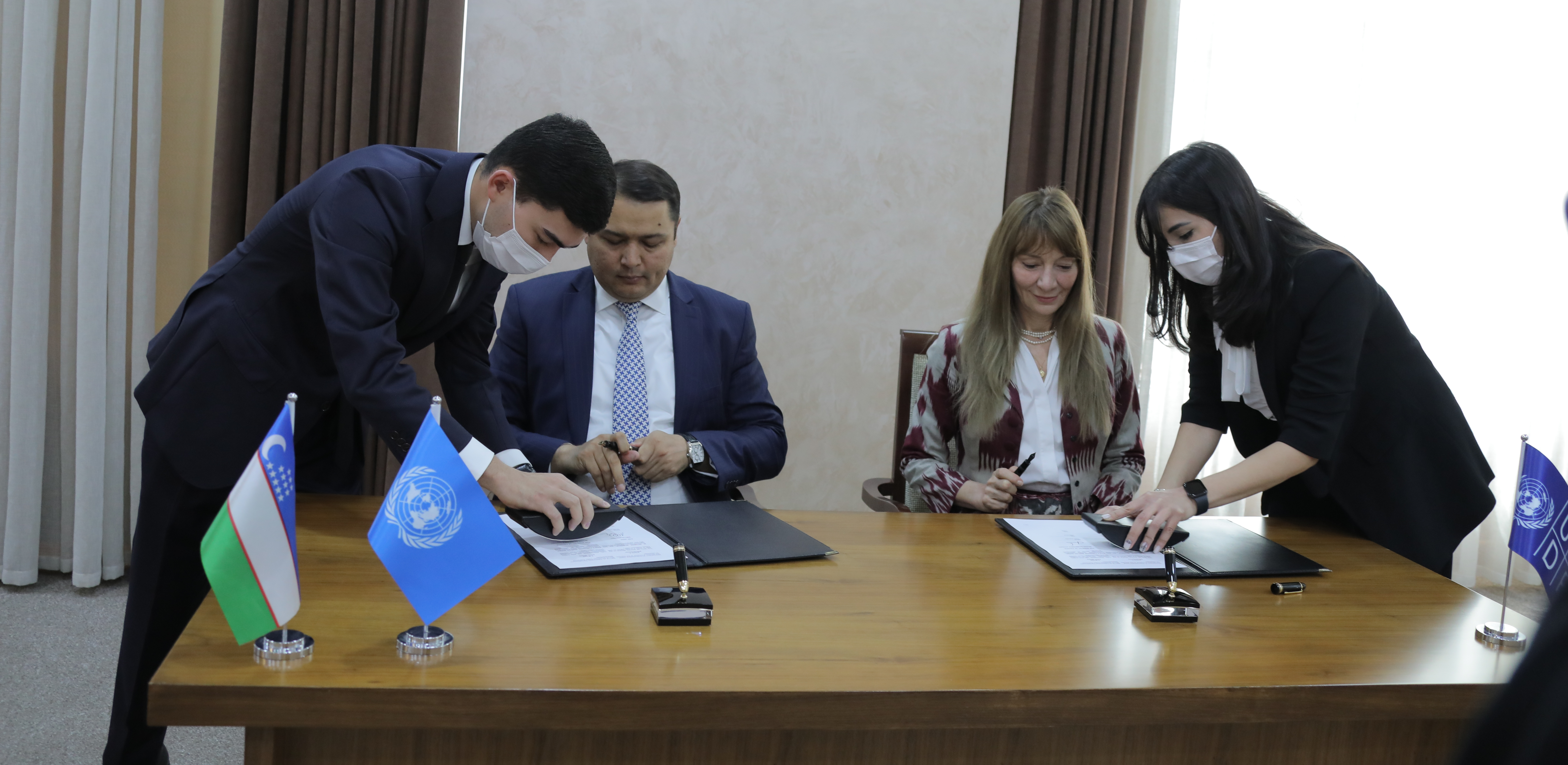

Image: UNDP Uzbekistan

24 March, TASHKENT – Today a Memorandum of Understanding (MoU) has been signed by representatives of the Ministry of Finance of Uzbekistan and UNDP, which will serve to ensure better alignment of the issuance of Eurobonds with efforts to achieve the Sustainable Development Goals (SDGs), and build transparency and accountability for national public and investors. This agreement to strengthen the financing of national sustainable development has been made possible by the success of a dual tranche of Eurobonds issued in November 2020, worth US$555 million and 2 trillion Soums, respectively, with maturities in 2030 and 2023.

The importance of this agreed alignment was made evident in UNDP’s recently conducted national Development Finance Analysis. This document has stated that “maximizing the development impact of the Government of Uzbekistan’s planned increase in public investment projects soon would require a stronger alignment of selection procedures and project performance monitoring frameworks with SDGs.” Uzbekistan’s nationalized SDGs can provide a useful over-arching framework to maintain coherence across performance monitoring criteria and indicators used in different fields of public finance management.

The operational platform for the MoU’s implementation will be established within the framework of the UNDP and Ministry of Finance’s Joint Programme ‘Establishing the Integrated National Financing Framework in Uzbekistan’ (INFF). This programme aims to support accelerating SDG financing reforms in Uzbekistan, and could represent the main institutional vehicle to promote, among other things, integrating sustainability considerations in the public borrowing process and providing technical support on SDG-aligned sovereign bond issuance.

Activities under the signed MoU will include elaborating impact measurement methodologies and supporting the conducting of impact monitoring, institution strengthening and trainings for line ministries. One important outcome of this collaboration is foreseen to be the development of an SDG impact framework which will enable tying the use of the proceeds of bonds to specific metrics and the SDGs, while also undertaking due diligence on initial pilot projects.

For information:

The Joint Programme ‘Establishing the Integrated National Financing Framework in Uzbekistan’ (INFF)

The goal of this Joint Programme of UNDP and the Ministry of Finance is to help the Government of Uzbekistan strengthen the overall financing framework for its national development strategies and public finance management. It further aims to create an enabling environment for introducing new forms of public and private finance, while also improving the efficiency of existing financial resources for achieving development priorities. At the current time when important policy reforms, laws and strategies are being developed, this programme aims to facilitate the establishment of an Integrated National Financing Framework (INFF) with financial solutions for maximizing the development impact of environmental and social policies and reforms, with the latter specifically focusing on social assistance and health sectors.

The INFF framework will help identify development priorities for financing the SDGs, particularly in: (i) aligning national, subnational and sectoral planning, financing and monitoring and evaluation frameworks to the SDGs and to each other; (ii) enhancing the effectiveness of domestic revenue collection, budgeting and expenditure; (iii) expanding financing sources and mechanisms and increasing investment for sustainable development; (iv) integrating different means of development finance; and (v) managing financial and non-financial risks.

There are four main building blocks for INFF operationalization, including (i) assessments and diagnostics; (ii) design of the financing strategy; (iii) mechanisms for monitoring, review, and accountability; and (iv) governance and coordination mechanisms.

Locations

Locations