Youth in Lebanon need more than revenues and salaries in dollars; They want sense of security and opportunities for growth | By Leila Sawaya, Project Manager and Celine Serhal, Senior economist, UNDP

Lebanon's youth: Barriers for growth and unfolding opportunities

October 5, 2022

The youth of Lebanon have been severely impacted by the economic crisis that has been ongoing for almost three years, exacerbated by the presence of underlying structural challenges which further increased their vulnerability. Indeed, back in 2018, a report by the Central Administration of Statistics (CAS) and the International Labor Organization (ILO) estimated that youth (15-24 years old) unemployment rate stood at 23%, double the national unemployment rate of 11.4%[1]. Following the multiple crises and based on a follow-up from the same survey, youth unemployment increased to 47.8% in 2022 compared to a national unemployment rate of 29.6%[2].

The structural challenges that have affected young entrepreneurs have been mostly centered at the policy/ legislation and education system levels. Indeed, legislations and policies that are instrumental to foster youth entrepreneurship including an adjusted Code of Commerce, a new bankruptcy law, a private equity fund law, and a secured transactions law never saw the light despite progress in 2019. The education system was not able to adapt to promote an entrepreneurship culture, with constant mismatch between market needs and the education curricula. As a result of the crises, youth migration rate has been increasing with a survey in 2020 showing that 77% of Lebanese youth aged between 18 and 24 wished to emigrate, a proportion higher than in war-torn Libya, Iraq, and Yemen.[3]

Despite challenges, the youth of Lebanon are finding ways to adapt to the protracted economic situation and trying to find opportunities across multiple sectors. UNDP in partnership with Arabnet and with funding from the Big Heart Foundation (TBHF) organized a roundtable discussion on June 2nd with 15 stakeholders from the youth entrepreneurship ecosystem in the fashion, creative industry, Fast Moving Consumer Goods (FMCG), technology, financial services, and academia to understand the most pressing needs of youth entrepreneurs, their main barriers for growth and unfolding opportunities for increased youth engagement and economic participation. The roundtable was supplemented with an online survey of 70 youth entrepreneurs [1] participating from various sectors and regions of Lebanon to better understand existing challenges and upcoming opportunities for growth.

Talent is There, How Can it Be Retained?

“Talent is still there but we are not sure for how long it will stay” - Nael Halwani, Co-founder and Chief Operating Officer at Toters Delivery.

Most participants in the roundtable agreed that Lebanon still has the required talent locally and is still relatively easy to find. However, the challenge is how to retain this talent. Most youth entrepreneurs admitted that they have revised their wages scheme and dollarized parts of it or fully to take into consideration the high inflation rates and increasing cost of living. But some have even gone beyond that to keep their valuable talent by offering them additional benefits such as extra annual leaves, work from home flexible modalities, pension plan, stock options in the company and free mental health consultations. By doing this, they have tried to shield their employees from the repercussions of the economic crisis and keep them focused on growth and productivity.

Although relatively available, the quality and supply of youth local talent is in danger of diminishing according to the roundtable participants. The dollarization of tuition fees across Lebanese universities and schools is increasing dropout rates, which have reached 30% according to Jessica Said, Deputy Director of the Nawaya Network, a social enterprise that empowers youth through entrepreneurship trainings and capacity building. Based on a recent report by UNICEF conducted in January 2022, more than 4 in 10 youth in Lebanon reduced spending on education to buy basic food, medicine and other essential items, while 3 in 10 stopped their education altogether [1].

Skill shortages especially in technical areas and skills related to the future of work [2], which have existed long before the crisis, still persist, with some attendees stressing the need to resuscitate other sectors by investing more in vocational and technical training schools akin to countries like Switzerland or Germany.

Based on our survey results, most demanded skills by youth entrepreneurs were related to media, communications and marketing (41%) followed by graphic and product design (26%) which are skills very much needed when scaling up and expanding particularly in overseas markets.

As the country is sinking more into recession, various strategies need to be adopted to make sure the youth in Lebanon are ready for the future and the challenging business environment. Upskilling and reskilling existing youth employees, amidst a shift in local and international priorities, was identified as one important opportunity to make sure the skills match the type of jobs of the future. Mentoring programs and peer-to-peer coaching were also identified as even more important than regular trainings or traditional university education.

The German technical and vocational training model, which relies on a dual system of theory (learning) and practice (on-the job) was mentioned by Habib Abi Khater – General Manager of Kafalat, a credit guarantee agency in Lebanon, as a best practice model that needs to be strengthened in Lebanon to address the skills mismatch challenge especially after the banking and health crisis and the changing economic landscape. The German dual education system has proved successful over a long period of time, due to its ability to adapt quickly and effectively to global changes and enable young graduates to enter the workforce better prepared for market needs. This system is often touted as one the main success factors behind Germany’s export manufacturing industry.

Our survey results confirm the above observations. Half of all survey participants agree that the main challenges faced in finding job candidates with the right skills was that talented candidates want to be paid fresh dollars or demand very high salaries. When questioned about suggested solutions to solving the issue of finding the right skills, over half of the entrepreneurs overwhelmingly agree that funding for on-the-job training programs is the right way to go.

Business Continuity is at Stake

The infrastructure situation in Lebanon and specifically access to electricity is deteriorating at a very fast and alarming rate, threatening business continuity and hitting productive sectors hard especially those which are energy-intense industries (e.g Manufacturing including agro food). Businesses are trying to explore ways to mitigate this situation by finding decentralized solutions through renewable energy and hybrid grids. Given the complexity of the energy sector in Lebanon and the global increase in electricity and fuel prices, participants agreed that decentralized solutions are the best short-term available option for businesses to be able to continue operating from Lebanon.

As the domestic market becomes stagnant, entrepreneurs and businesses in Lebanon are looking for international markets for their products and services to be able to sustain their operations and keep their employees. However, the most challenging part is finding the right niche markets where Lebanese sectors and companies can still compete and have an edge. Participants in the roundtable highlighted the presence of opportunities in underserved markets where Lebanese products have high demand such as in Iraq, Egypt and the trick for success is to find the right partners to be able to grow. Nael Halwani, Co-Founder and Chief Operating Officer at Toters (a food delivery app) highlighted that Lebanon is endowed with big players that have large regional retail distribution networks abroad which can be leveraged by local small-scale businesses to access new markets.

Although exporting is a target for most Lebanese companies nowadays, it is still very challenging to get a hang of it. For people working in the agriculture sector, various Non-Tariff Barriers (NTBs) related to quality and traceability are imposed by countries that makes it more difficult for these products to enter markets abroad. This is becoming more challenging even in the traditional export markets for Lebanon (such as the Gulf countries) as they become more stringent on quality requirements and compliance.

Our survey highlights another challenge to accessing markets which is lack of access to financing to find and attract customers. Over half of the respondents agree that the lack of a budget for marketing, advertising, and sales (67%) and lack of budget to attend international trade fairs and exhibitions (59%) obstruct their endeavors to garner new clients. This is mainly due to the fact that companies struggle with informal capital controls imposed by commercial banks since 2019 that have limited their access to liquidity and funds. It is worth noting that this type of support used to be provided by the Investment Development Authority of Lebanon (IDAL) prior to the crisis, but the collapse of the government finances has cut short all support from the government to the private sector.

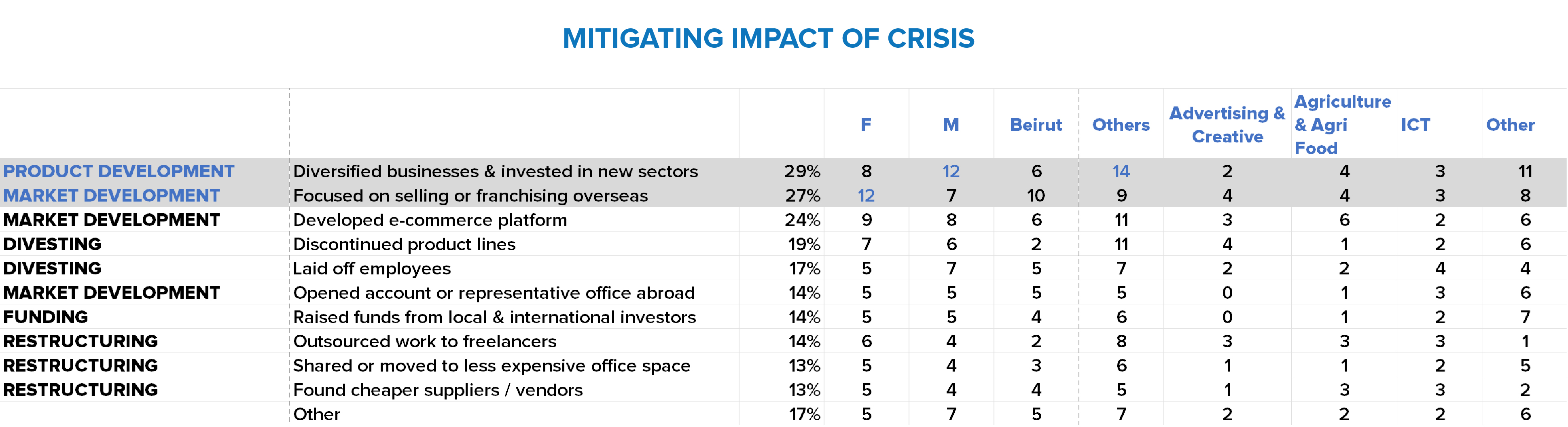

When asked about their mitigation measures to overcome the crisis, a third of surveyed youth entrepreneurs mentioned that they have either diversified their businesses and invested in new sectors with more potential (29%) or turned their focus on selling more overseas (or franchising overseas). Males were more likely to take the former route, while females were more likely to engage in the latter measures. This indicates that export is becoming a top priority for youth entrepreneurs and supporting them in this endeavor is critical for their sustainability.

To support more exports from Lebanon, participants in the roundtable highlighted the need to work on developing more cooperatives or community-based enterprises that cluster several producers together to be able to achieve economies of scale. Moreover, identifying the assets and comparative advantages of each region in Lebanon and create a brand based on those strengths can help in making them more competitive in international markets.

It All Goes Back to Financing

Retaining talent, installing solar energy, accessing new markets all cannot be accomplished without access to loans and equity financing. Youth entrepreneurs, even before the crisis, had major difficulties in accessing finance to scale up and grow. While seed funding was always available, scaling up capital was hard to get leading to increased rates of failures of startups and entrepreneurs.

Following the crisis, access to loans has dried up with the breakdown of the banking system. However, grants financing from local and international NGOs grew to address this gap. While grants are welcome in this dire economic situation, they do not represent sustainable measures for long-term growth. Participants agreed that grants coupled with technical assistance and access to advisory services from consultants that can help companies develop or update business plans and make them more investment ready, can support them navigate these uncertain times and remain competitive regionally and globally.

It is not Only About Tech

While the tech entrepreneurship ecosystem has been building up at fast pace since 2015 and the enactment of the famous 331 circular by the Central Bank of Lebanon, youth entrepreneurship was always more than tech and digital startups. Youth entrepreneurs can be found in various productive sectors such as manufacturing, agriculture, eco-tourism, and recycling.

Marianne Bitar Karam, country directory of DOT Lebanon, which is a social innovation enterprise that works with youth on ICT trainings in their communities, asserts that: “nowadays we should be focusing our efforts to support existing small and medium businesses so they can survive in these challenging times and keep or employ more people and youth across the different value chains”.

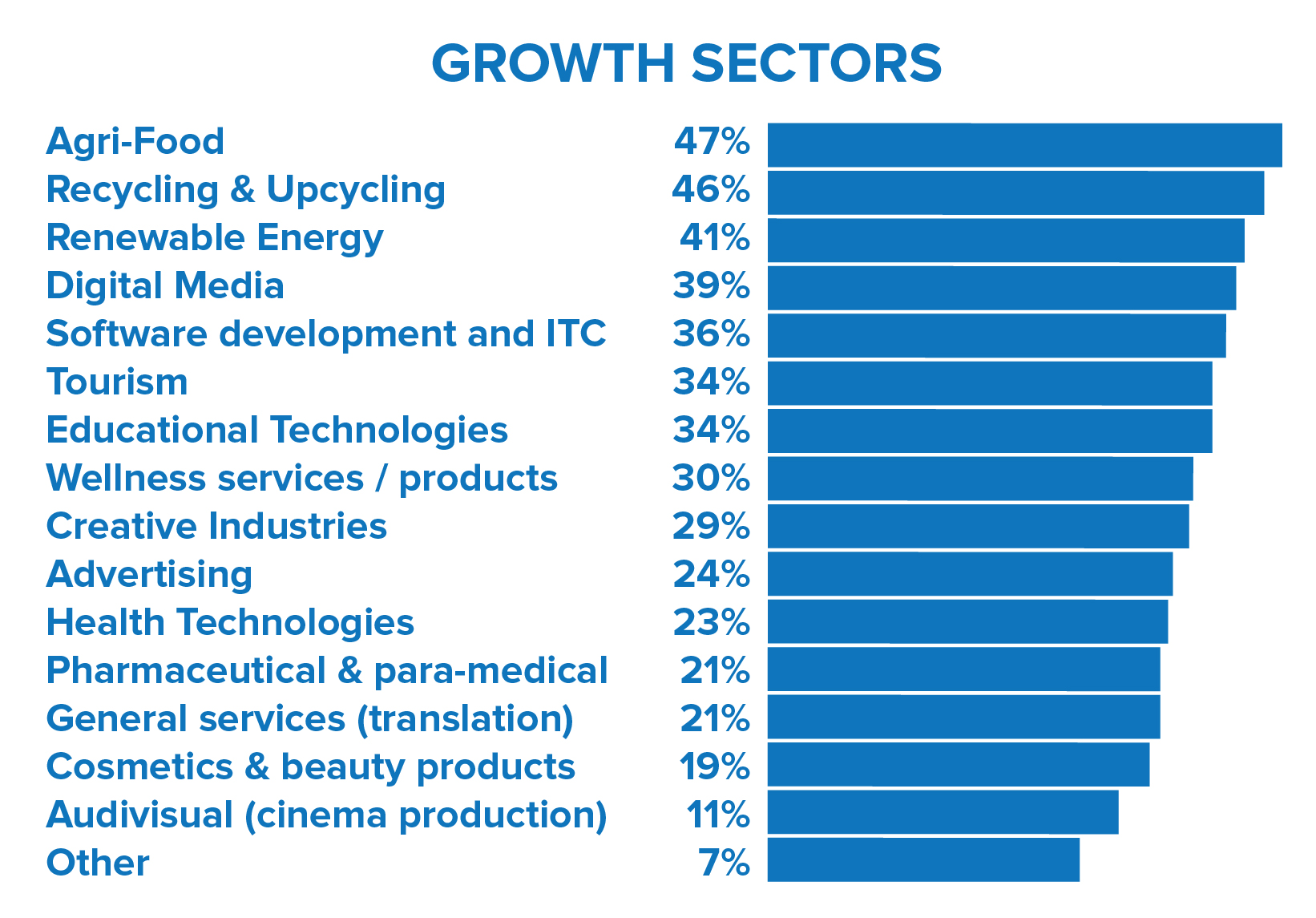

Based on our survey, approximately half of the entrepreneurs see current growth opportunities in two main industries: agri-food processing (47%) and recycling, upcycling (46%) validating the idea that while tech and software development are important, entrepreneurs are seeing also investment opportunities in traditional sectors like agriculture and food processing.

The roundtable discussion as well as the survey were organized as part of a regional project implemented by the UNDP: “Empowering Youth through Transformative Entrepreneurship Support” with funding from The Big Heart Foundation. The findings of the discussions and survey will be incorporated in a policy document to support youth entrepreneurship in Lebanon. Furthermore, the findings will be used to elaborate training programs in much needed skills as well as implementing a soft-landing program to help selected youth entrepreneurs in priority sectors access new markets.

[2] http://www.cas.gov.lb/images/Publications/LFS_2022/Lebanon%20FLFS%20Jan%202022%20EN.pdf

[3] Arab Youth Survey, 2020

[4] Note on Survey Methodology: The survey was conducted with 70 youth entrepreneurs (age between 18 and 40 years old). Data was collected from May 2022 through June 2022. Using a referral-sampling approach, the online survey sampled startup founders, co-founders, or partners. The startups were contacted through ArabNet’s startup database, ArabNet’s network of investors and community partners, and through push marketing via social media posts. The survey sample was as follow: 50% of respondents were female, 87% were founders of businesses, 56% were between 25 and 35 years old, 74% were in growth stage and 4% in decline, more than 70% had less than 10 employees, 35% were based in Beirut with a higher concentration of male founders (24%) whereas areas outside of Beirut had a higher concentration of female founders (37%). Female founders were more found in the survey sample in the agriculture and agri-food production (17%) and creative industries (11%) while male entrepreneurs were more concentrated in the ICT/IT, financial technology, coding and development (11%).

[5] https://www.unicef.org/lebanon/press-releases/lebanese-crisis-forcing-youth-out-learning-robbing-them-their-futures-unicef-survey

[6] Based on a pilot project executed by ESCWA in partnership with the Ministry of Labor in Lebanon, there is a large gap between skills demanded and offered especially in skills related to the 4th industrial revolution and the future of work. The pilot project consisted of offering free of charge online courses to more than 25000 who completed them on the platform Coursera. Of the first 260 demanded skills in the Lebanese market, only 42 per cent were taken by Coursera applicants indicating lack of information or guidance to the labor force regarding reskilling and upskilling.

Locations

Locations