The Bahamas scores early wins in institutionalizing effective debt management

April 26, 2023

Part of the team driving debt management reform in The Bahamas - From left: Wendy Craigg, Ministry of Finance consultant and a former Governor of the Central Bank of Bahamas; Simon Wilson, Financial Secretary in the Ministry of Finance; Christine Thompson, Deputy Director in the Ministry.

The Government of The Bahamas is making significant progress in establishing the legal and regulatory frameworks for institutionalizing fiscally responsible debt management in the public sector, under an India government-funded project.

The project, ‘Strengthening Public Debt Management Framework and Developing Government Bond Market in The Bahamas’, is being financed by the India-UN Partnership Development Fund and implemented by the Commonwealth Secretariat in partnership with the United Nations Development Programme (UNDP) Multi Country Office in Jamaica. Project experts reporting progress in a recent interview included Simon Wilson, the ministry’s Financial Secretary; Wendy Craigg, Consultant at the Ministry of Finance and a former Governor of the Central Bank of The Bahamas; Christine Thompson, Deputy Director in the finance ministry, and Sanjay Kumar, Debt Management Adviser at the Commonwealth Secretariat and the project’s manager.

They reported that a key project milestone – a Public Debt Management Act passed by Parliament in March 2021 and currently being reviewed and updated by the Government of The Bahamas – provides a foundation for the institutional reforms designed to promote transparency, accountability, and efficiency in debt management operations.

The project team said other significant project deliverables that have been achieved are the formulation and tabling in Parliament of The Bahamas’ first and second Medium Term Debt Management Strategies, the development of the first and second Annual Borrowing Plans, and the publication of the first set of quarterly Public Debt Bulletins.

The next phase of the project will include staffing for the newly established Debt Management Office (DMO), which will coordinate the day-to-day operations, Wilson and Craigg explained. Craigg disclosed that the office is expected to become operational by the second quarter of 2023. The office will manage all debt operations, including investor relations, borrowing arrangements, debt analysis and reporting on central and public sector debt, as well as administration of the country's debts, including timely payments.

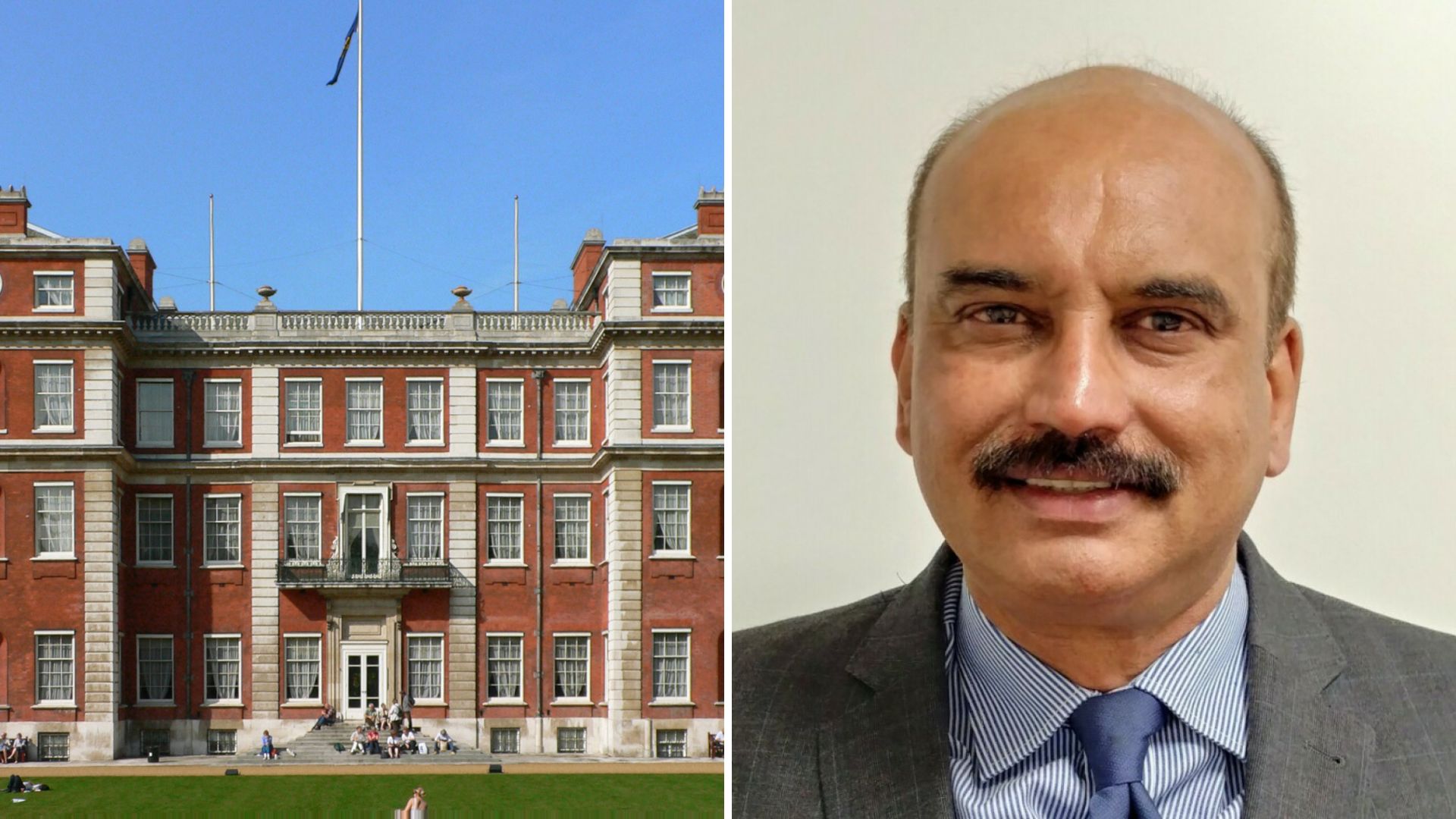

Sanjay Kumar, Adviser, Debt Management and Project Manager for the Bahamas Project

“Without this debt management project, we perhaps would lack the credibility we need in the international markets to borrow funds,” project consultant Wendy Craigg explained. “Investors want to know you have a proven framework for managing your debt properly – that you have your fiscal house in order and the legislative framework. That is what this project helps us to deliver on,” she stated.

In explaining the importance of tackling public debt, The Commonwealth and Finance Ministry team said that effective debt management promotes macroeconomic stability, creates more fiscal space for health, social services and education; reduces the likelihood of tax increases and attracts investments. The frameworks will define a new era in public debt management in The Bahamas, one which is based on world-leading standards that are suitably adapted to the local economy.

Already the country is experiencing more fiscal space for national priorities and growth. The Bahamas’ debt has fallen to 90.66% of GDP in 2022 and a further four percent to 86.61% in 2023. The nation is targeting a debt-to-GDP ratio of 65 per cent by the 2026/2027 fiscal year and is well on its way to achieving these targets.

UNDP Resident Representative Denise E Antonio commended the Government of The Bahamas for their commitment to prudent fiscal management and for consistently strengthening their debt management frameworks to be fit for purpose and relevant to the national context. She noted that debt management remains an important mitigating factor in financial resilience and poverty reduction. To this end, she reiterated UNDP’s continuing support for the nation’s visionary programme.

Senior Director for Economic, Youth and Sustainable Development at the Commonwealth Secretariat, Ruth Kattumuri said, "We have been pleased to be able to support the Government of The Bahamas through this project, and the Secretariat applauds the government for the tremendous progress that they have made. She continued, “We are encouraged by the significant milestones that the project has already begun to achieve. and look forward to our continued partnership with The Bahamas and the UNDP."

The project commenced on 1 July 2020 and is expected to end on 30 June 2023. The Secretariat, after discussions with the UNDP and the Government of The Bahamas, is considering extending the project until June 2024.

Without this debt management project, we perhaps would lack the credibility we need in the international markets to borrow funds ... Investors want to know you have a proven framework for managing your debt properly – that you have your fiscal house in order and the legislative framework. That is what this project helps us to deliver on.Debt Management project consultant, Wendy Craigg

Locations

Locations