Call for Proposals

CAP Financial Innovation Challenge

What do the winners get?

-

Receive an award of up to US$40,000 to develop a Feasibility Study (over a period of 4 months) for an Innovative Financial Aggregation Structure or Model.

-

UNDP will promote the selected Innovative Financial Aggregation Structures or Models within UNDP and to a broader audience across its network.

-

Possibility to access the UNDP global presence (+170 countries) and networks to help support the selected solutions to scale-up and replicate to new countries.

-

Promising solutions could later be considered for further engagement as part of UNDP’s Sustainable Energy Hub or other UNDP initiatives.

How do I submit an idea?Register below, download the application package and send your application by 9 September 2022. Please note that registering does not constitute an application, to submit an application follow steps 2 and 3 below.

Register here, and follow steps 2 and 3 below to submit an application.

Read the guidelines carefully and follow the instruction to complete and submit the application form, annexes 1 and 2 and the required attachments before the deadline, which is on 9 September 2022.

Once completed, submit your signed Application Form, Annexes 1 and 2 and all supporting documents via email to cap.fic@undp.org. Please include “CAP FIC” and the name of the Applicant in the Subject line. Attachments should be no bigger than 10MB.

The deadline for submissions of applications is extended to 9 September 2022, at 12:00 PM EAT.

The CAP is implemented by UNDP and funded by the Global Environment Facility.

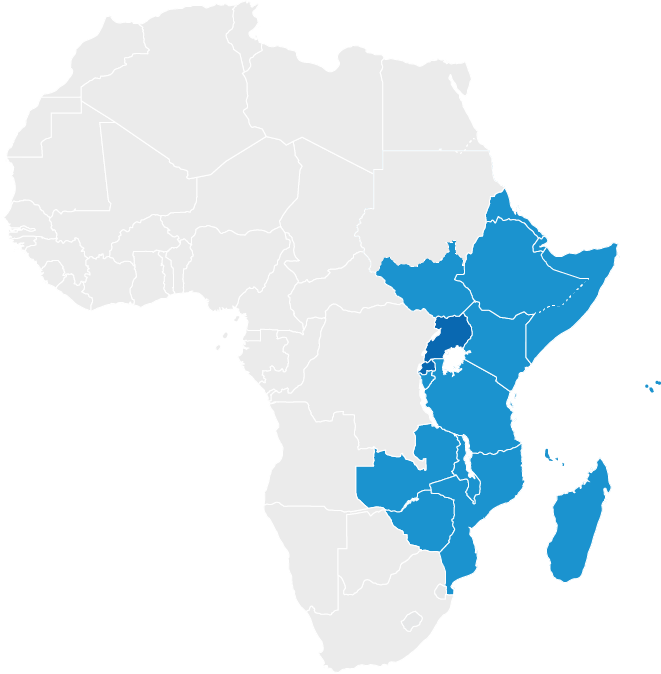

Locations

Locations