What is financial aggregation?

Financial aggregation has the potential to unlock new sources of capital investment for the development of clean energy projects and businesses in developing countries by providing the opportunity to invest in a diversified portfolio and gain exposure to small-scale, low-carbon energy assets.

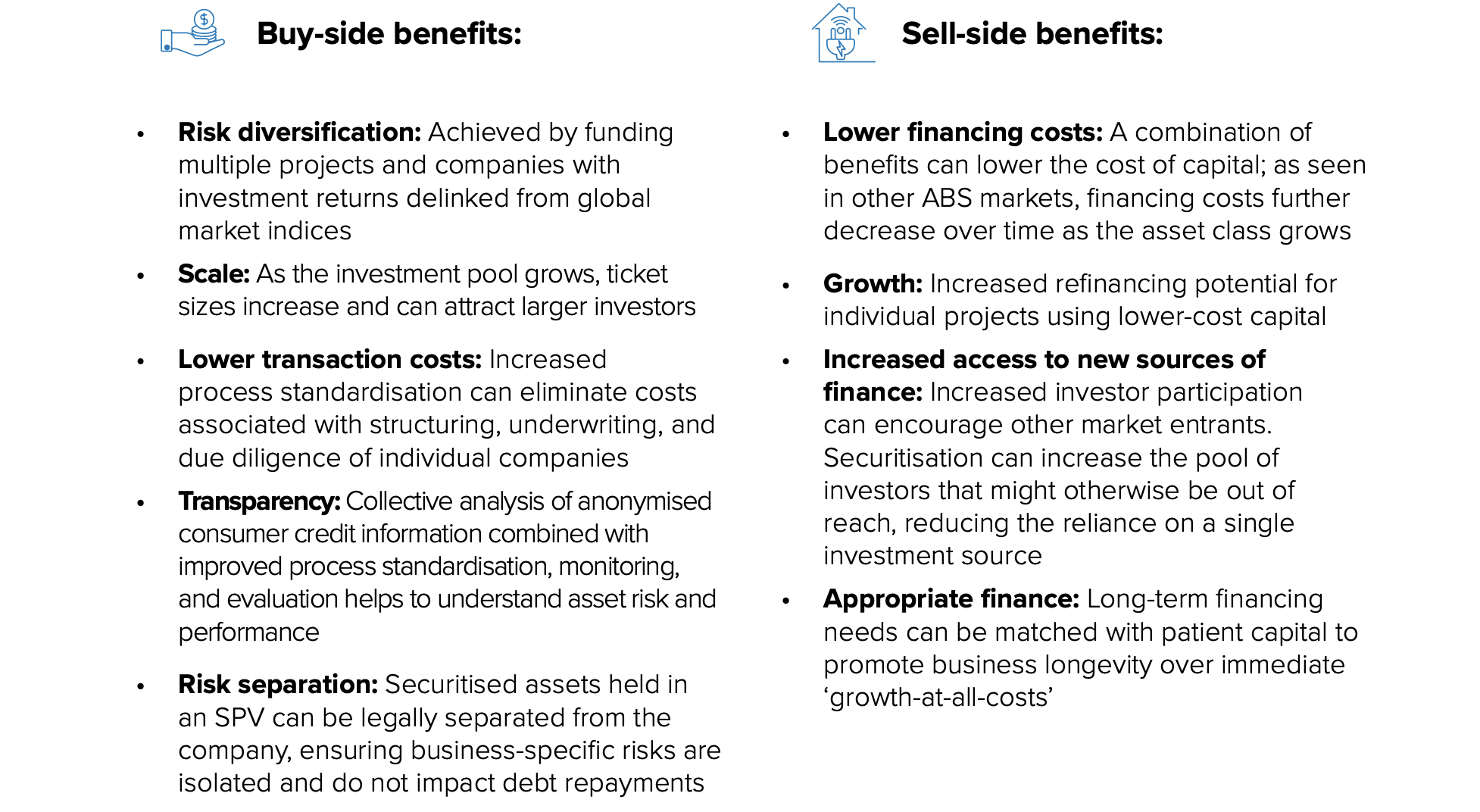

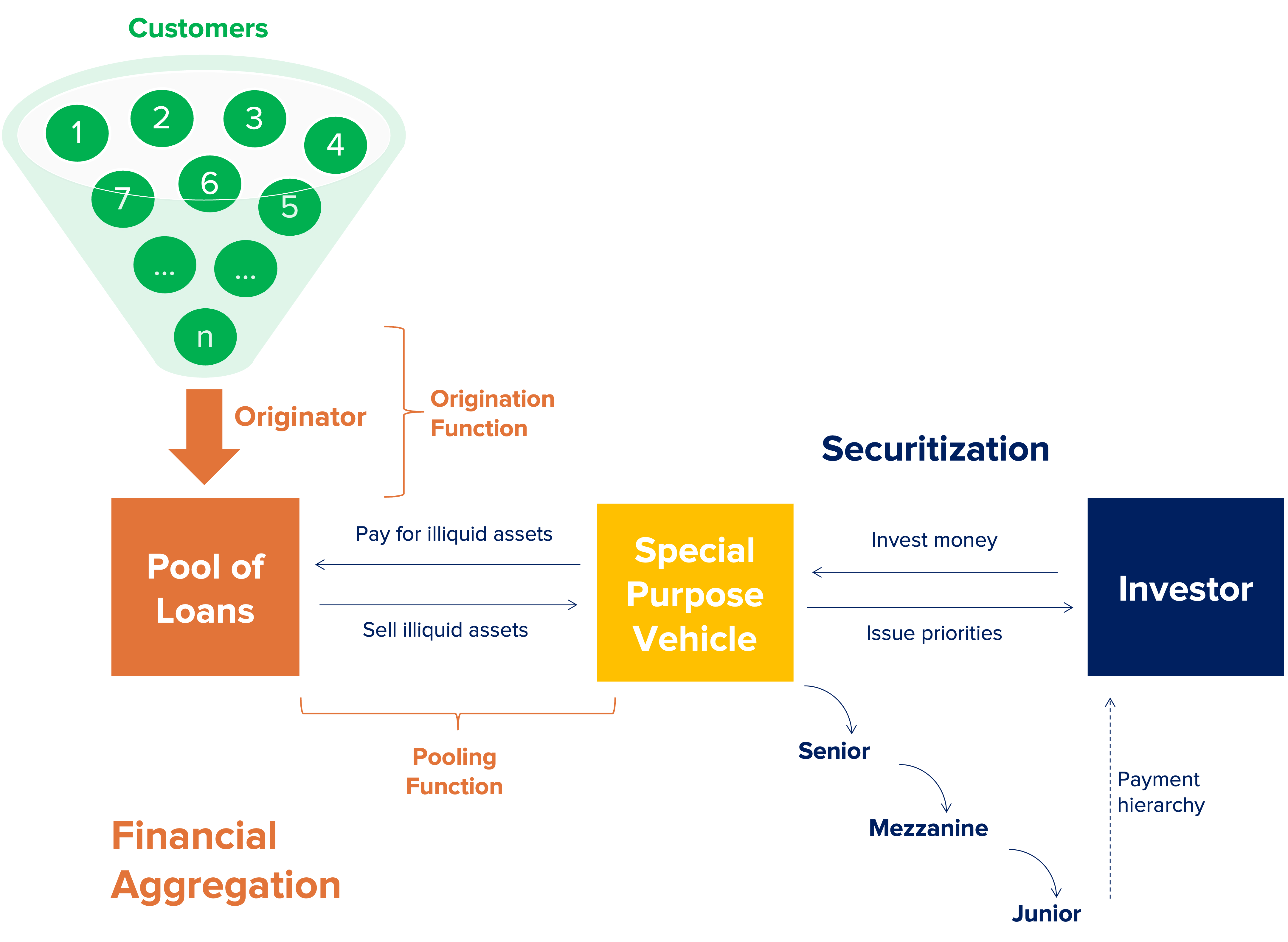

Financial aggregation is a process in which multiple assets are bundled together, which then receive financing, or refinancing, from investors based on the future cash flows from the assets. The leading benefits of financial aggregation for the buy- and sell-side are as follow:

Financial aggregation can take a variety of different forms. The CAP seeks to take a flexible approach tailoring its activities to the particular market’s context and maturity.

Financial Aggregation and Securitisation process. Adapted from ‘Green Bank Insight: Aggregation and Securitization’, Green Bank Network, 2019

The CAP aims to advance and raise awareness for innovative solutions to market barriers for financial aggregation, with a view to mainstream good practices across and within markets. The CAP’s activities and value proposition are articulated in terms of a global offer (awareness raising, knowledge products and global network) and an in-country offer (showcase transactions and market development activities).

Locations

Locations