A Rollercoaster Ride: The ups and downs of economic growth in Latin America and the Caribbean

February 19, 2024

The economies of Latin America and the Caribbean (LAC) are characterized not only by low growth, compared to other emerging economies, but also by significant fluctuations induced by external shocks. This #GraphForThought explores economic volatility in the region, and its impact on development outcomes.

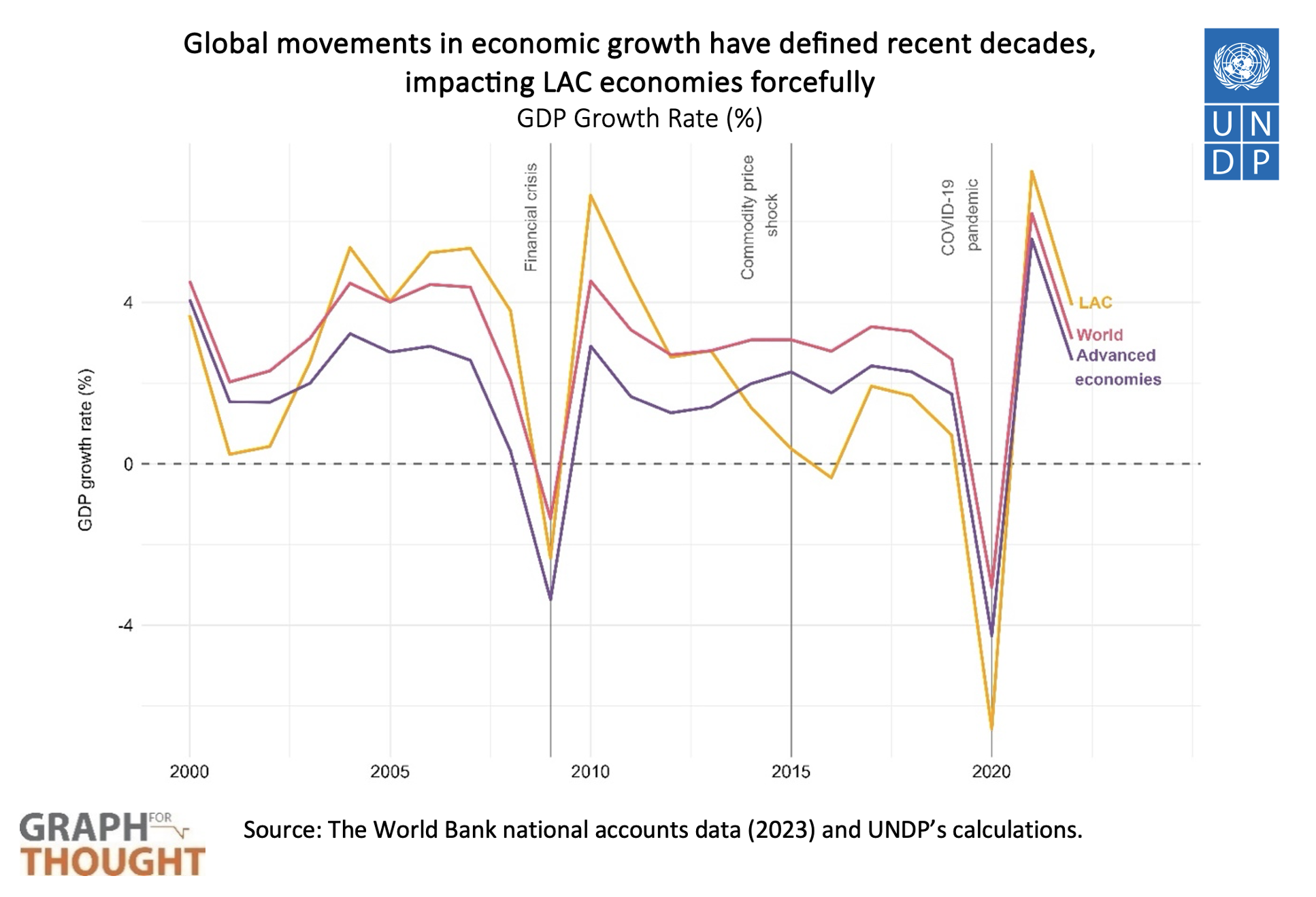

When comparing growth rates across the world we see that economic growth in LAC follows global fluctuations, however, contractions are sharper, and so is the rebound. The graph below shows that shocks such as the 2008-2009 financial crisis, the drop in commodity prices in 2014-2015, and the COVID-19 pandemic in 2020 affected the Gross Domestic Product (GDP) of all countries around the world, but the oscillations in LAC economies where significantly more pronounced.

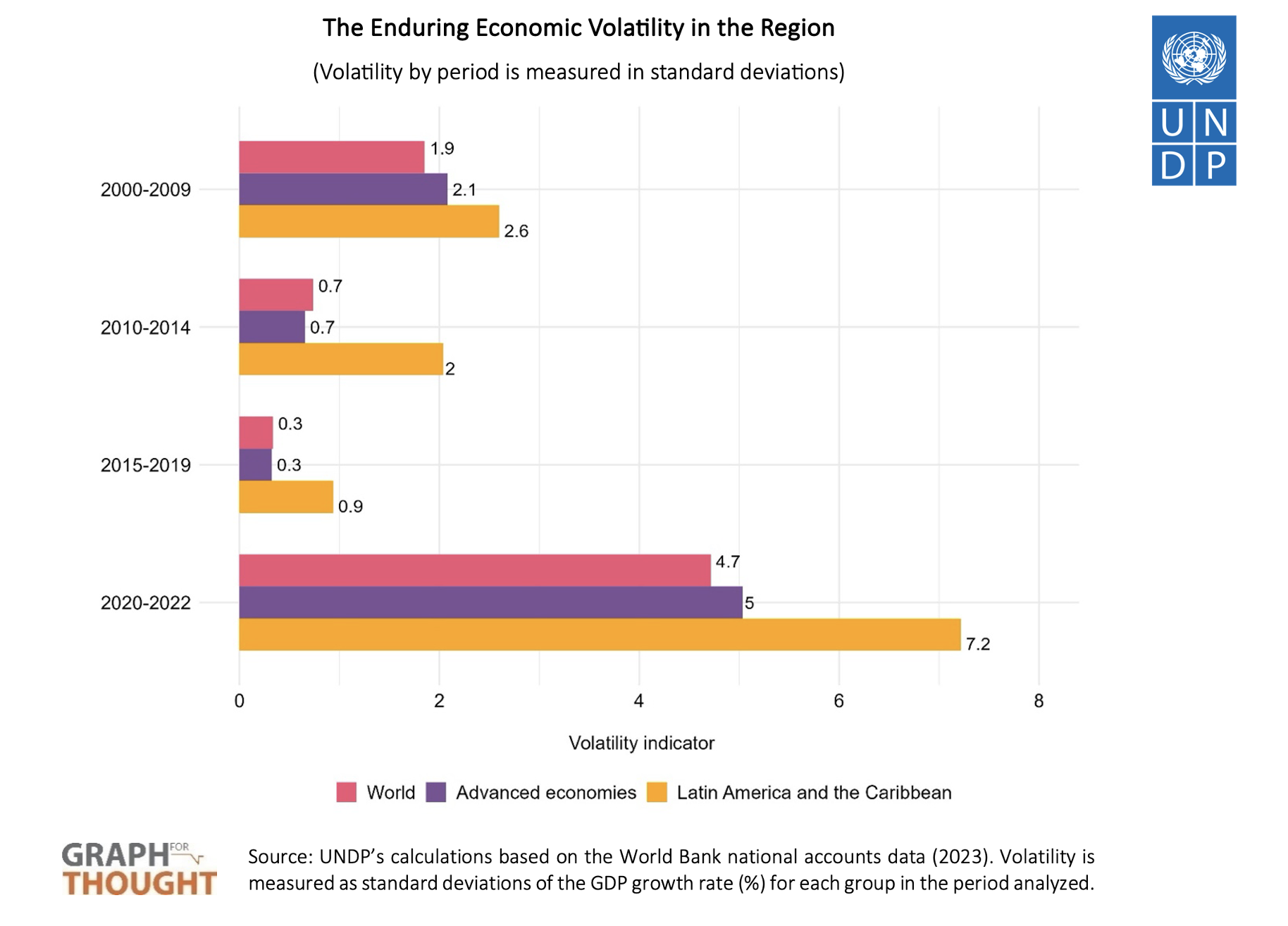

To further explore this phenomenon, we assessed volatility looking at the standard deviation of the real GDP growth rate. The standard deviation is a measure of variability that quantifies the year-to-year changes in growth relative to the average in each period. What we see in the graph below is that volatility is significantly larger in LAC, when compared to the world or to advanced economies, in any given period. In the aftermath of the COVID-19 pandemic, for example, volatility in Latin America and the Caribbean was 1.4 and 1.5 times higher than in advanced economies and the world’s average. Even between 2000-2009, when the financial crises affected advanced economies particularly, the standard deviation of growth is higher in LAC than in the rest of the world.

So why does this volatility matter? Firstly, increased volatility is associated with long-term reductions in growth, decreased consumption, savings, and investment (Loayza et al. 2007; ECLAC, 2014). Secondly, it harms the already low productivity in the region (Cariolle, 2012). Lastly, temporary shocks very often have permanent effects on human capital accumulation. A robust body of literature provides evidence that economic downturns have negative impacts on child mortality, education, and poverty. Even when countries recover, the human capital accumulation of specific cohorts is permanently corroded (Fernandez and Lopez-Calva, 2010).

The resilience of countries is closely tied to the robustness of their institutions and economic policies. Key factors, such as the degree of economic diversification, the ability to implement counter-cyclical public policies, the maturity of financial institutions, and the quality of governance, will determine the volatility of growth. LAC has made significant progress in establishing institutions that mitigate the impact of external economic shocks in the last few decades. Strong central banks and monetary policy, for example, lessened the impact of recent inflationary pressures. However, more needs to be done to withstand shocks without reversals in development progress. Strengthening social protection systems, promoting fiscal and monetary policies that are coherent with the economic cycle, and diversifying productive sectors are key aspects for building resilience against future adversities.

Locations

Locations