CAP Financial Innovation Challenge

A platform for scaling up off-balance sheet receivables financing for off-grid solar

Financial aggregation solution by Solaris Offgrid

The solution

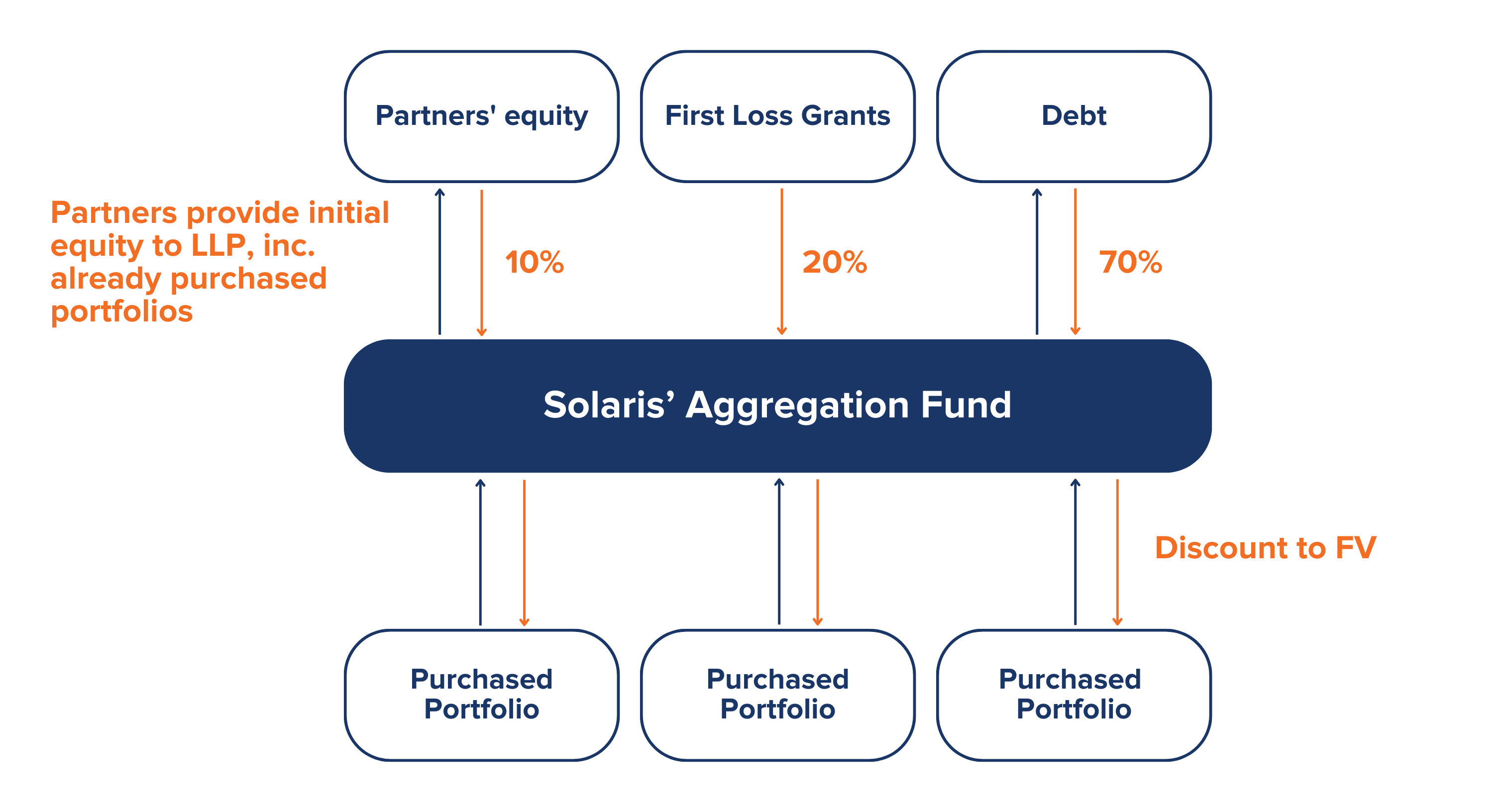

Solaris Offgrid is developing a platform to allow last-mile off-grid solar companies to sell pools of receivables, and partner funds to purchase these based on the investment criteria of debt providers – aggregating receivables to allow debt funds to deploy larger amounts of capital.

Solar home systems, clean cookstoves and other essential products have been made available to low-income customers through pay-as-you-go consumer credit. However, challenges remain in the sector due to a lack of standardization and transparency in financing, which in turn makes fundraising slow, unpredictable and costly. The onus is currently on the last-mile distributor to assess the risk of lending, while debt investors don’t have the mechanisms to assess and partake in such risk, especially in small transactions. Investors end up providing rigid working capital finance to last-mile companies instead of receivables finance aligned with the cash-flows from the end-customers.

The solution proposed by Solaris Offgrid is a platform that allows last-mile companies to sell pools of receivables, while investors purchase the receivables based on their own investment criteria. Thanks to the development of an intermediary entity that would be catalyzing those investments, the platform paves the way for the aggregation of receivables, allowing debt funds debt funds to deploy larger amounts of capital.

The platform reduces costs and timeliness of off-balance sheet receivables factoring by automating payment flows, standardizing legals and providing easy access to performance data. It increases the availability of cash to those last-mile companies as well as allowing debt funds to be more quickly utilized.

The project aims to expand on Solaris Offgrid’s experience piloted in Kenya where the Receivables Purchase Platform was successfully used by an investor to carry out a purchase, proving its ability to work efficiently for small scale distributors. The aim now is to demonstrate the feasibility of a multi-country multi-distributor platform, expanding on the pilot with a new project in Uganda. Solaris Offgrid will build upon its legal and back-up servicing framework as well as further develop the technology, in parallel with mobile money operators, to automate payment flow segregation to function with many distributors in multiple countries.

How does it work?

Potential impact

About Solaris Offgrid

Solaris Offgris is a digital platform registered in the United Kingdom. The consortium is composed by:

Solaris Offgrid, which has experience developing PaygOps, a last-mile PAYGO leasing and operation management system working with over 70+ Paygo Last Mile Distributors in Africa and has impacted 4 million people.

Pezesha, a Kenyan-based company that provides credit scoring and applied financial transaction management services – Structuring the local legal entities and ensuring compliance as well as supporting credit analysis. They have processed over $3.5 million microcredit transactions across Sub-Saharan Africa;

Get in touch

If you are interested in having more information or want to get in touch, please contact us at: energy@undp.org

Locations

Locations