CAP Financial Innovation Challenge

Exploring securitization for minigrid projects

Financial aggregation solution by Hypoport Africa

The solution

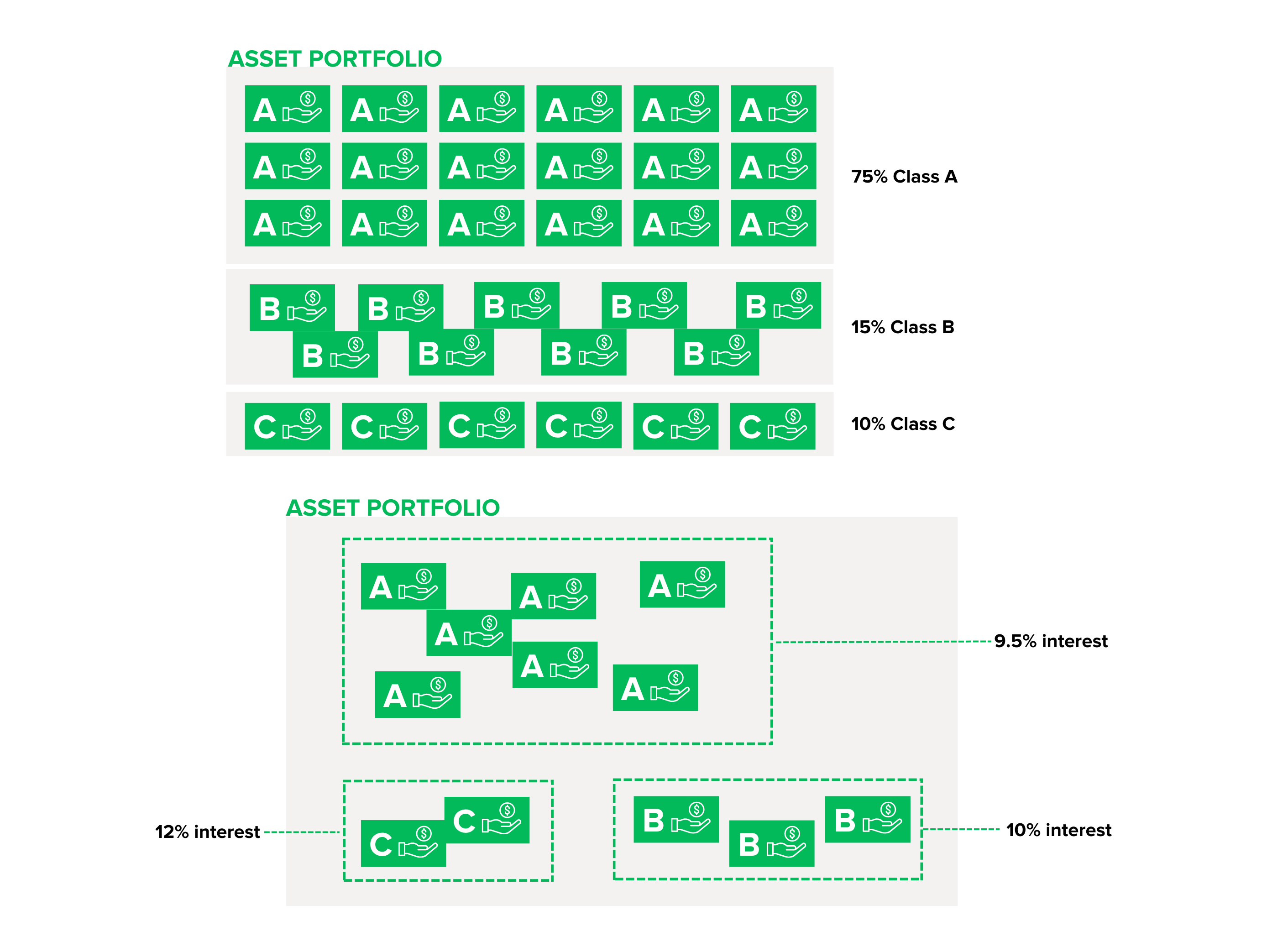

Hypoport proposes to introduce the concept of securitization and other innovative structured lending solutions for off-grid portfolio investment in East Africa. These solutions will tackle the biggest obstacles for investors in the region and propose innovative and practical solutions to them. Once payment data is structured and monitored effectively using state of the art data management, transparency and industry-specific standards, innovative structures can be introduced that will reduce costs of capital and improve efficiency of portfolios.

Securitization is widely used in developed markets. Although the concept has been introduced in emerging markets, it has not been applied on a large scale for instance on solar PAYGP portfolios. Securitization has been applied to PAYGO before, but with limited success due to the fact the structure itself is not transparent enough, and too complex for investors to report on.

Securitization is widely used in developed markets. Although the concept has been introduced in emerging markets, it has not been applied on a large scale with PAYGO portfolios. Securitization has applied to PAYGO before, but with limited success due to the fact the structure itself is not transparent enough, and too complex for investors to report on.

Hypoport believes that a combination of universal reporting standards, well set-up and robust data infrastructure, asset and liability matching, and portfolio criteria can open the door for structured finance solutions to enter the PAYGO market.

Hypoport will investigate to what extent its proposal matches the needs and wishes of investors, while at the same time addressing the biggest existing obstacles to investment in the industry for off-grid developers and investors alike. The final goal is to provide key points that allow for a successful securitization structure, such as:

Industry-specific KPIs

Portfolio criteria

Standardisation of business models and reporting

How does it work?

Potential impact

The proposed solution will help unlock the right form of financing for mini-grid developers in East Africa, with a focus on Uganda, Rwanda, and Tanzania. In addition, through the innovative definition of portfolio eligibility criteria, investors will be able to target other Sustainable Development Goal or gender related criteria.

About Hypoport Africa

Hypoport Africa, based in Johannesburg, provides fintech services and advisory to clients in the financial sector. As the fintech partner to several major banks in South Africa, it is able to handle and manage large volumes of financial data in mortgage and asset finance in part through its mother company Hypoport B.V.’s long history in the ABS and RMBS sectors in Europe.

In recent years the firm has worked with several organisations in the microfinance and PAYGO sectors (e.g. SolarWorks!, FMO). Consortium application with Mirova SunFunder – A well-known investor in the clean energy sector, with a focus on emerging and frontier markets.

Get in touch

If you are interested in having more information or want to get in touch, please contact us at: energy@undp.org

Locations

Locations