CAP Financial Innovation Challenge

E2W Africa, a financing platform for electric vehicles

Financial aggregation solution by PJ&Company

The solution

PJ & Company will develop a pioneering financing platform to provide both growth equity and small-scale asset finance for the electric vehicles sector in East Africa, creating a founder-friendly finance instrument to help grow this asset-heavy industry.

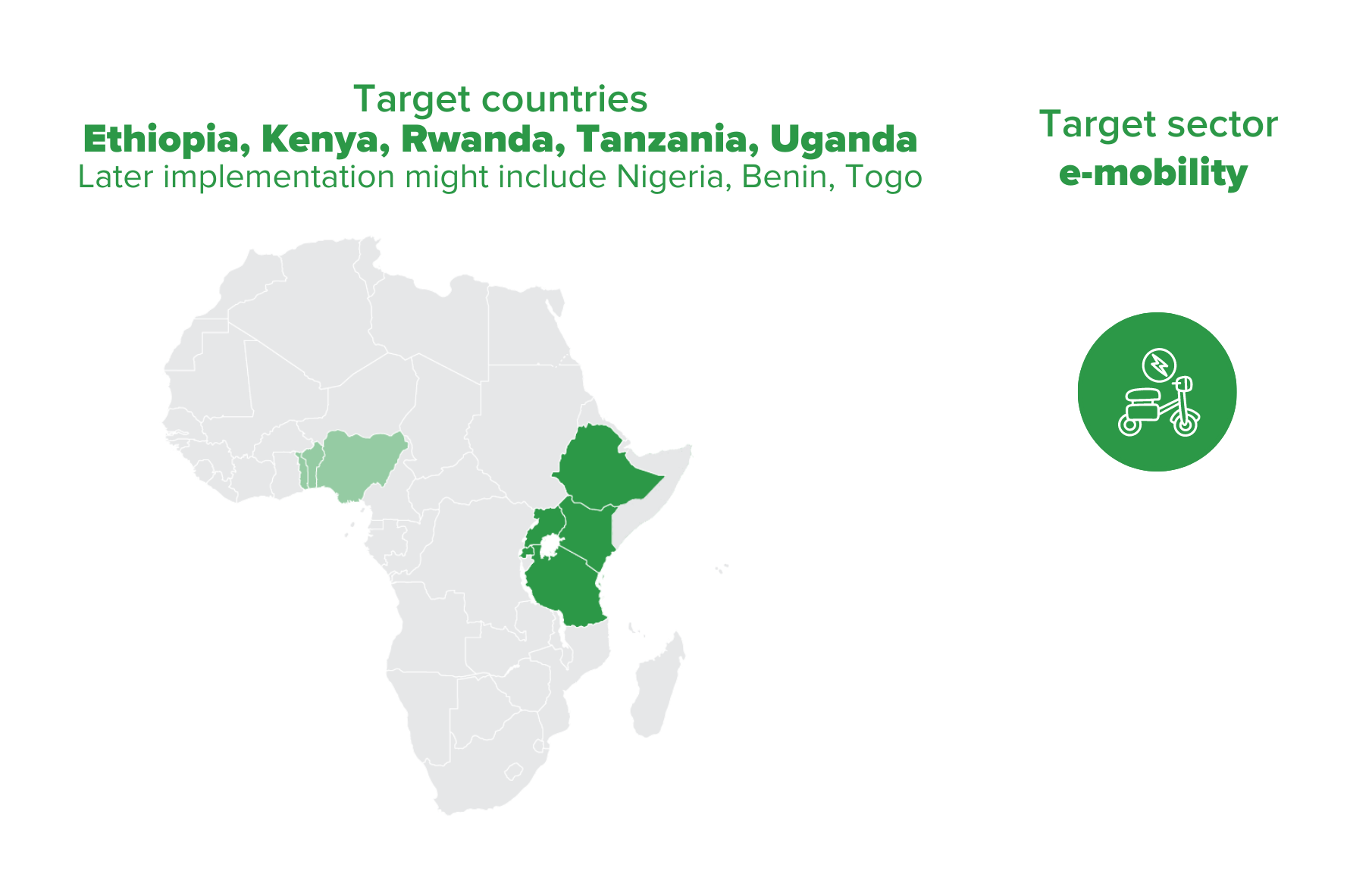

Electric two-wheelers (E2Ws) are beginning to be cost-competitive across Africa. Yet there is no dedicated capital source to help local and regional EV companies grow at the corporate level, nor is there a dedicated project or asset finance source to help scale necessary pilots and ancillary infrastructure. The E2W Africa is a pioneering financing platform that would address the lack of sizable growth equity capital to move from Seed and Series A to multi-country second-stage Series B growth.

E2W will focus on over US$ 5 million investments in growth equity and small-scale asset finance around 2-wheelers, 3-wheelers, charging or swapping infrastructure to overcome the charging infrastructure obstacle, and small-scale manufacturing, primarily final assembly. By providing growth capital, both debt and equity, it can create a founder-friendly finance instrument to help grow this asset-heavy industry.

E2W Africa aims to address barriers to the rapid scaling of electric two-wheelers:

Limited asset and growth finance;

Cash constraints related to importing;

Sufficient equity buffer to weather the negative cash flow in the early years of deployment and building of generation, charging, and battery infrastructure.

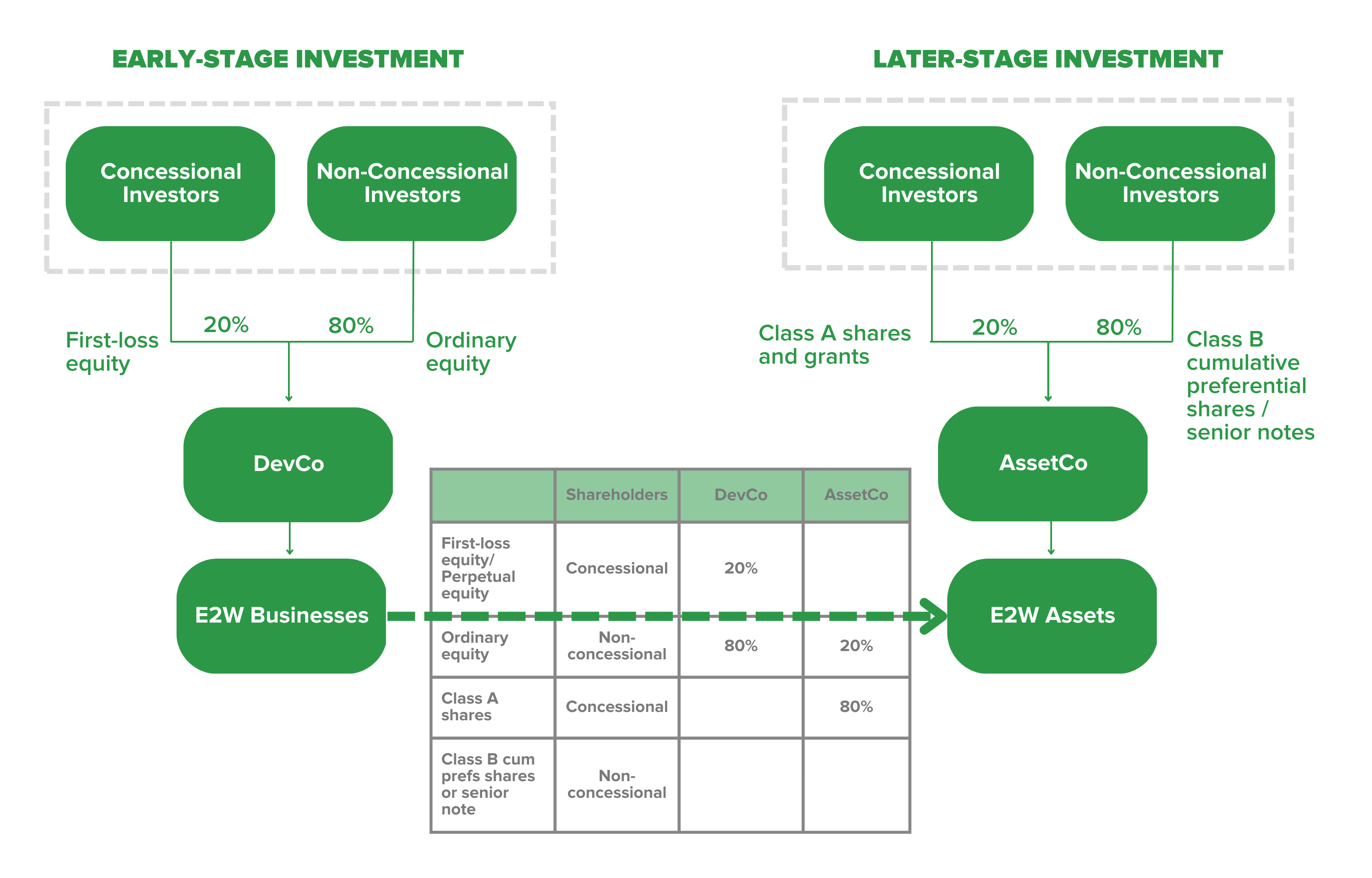

Blended finance will be used at both AssetCo and DevCo as per the figure below, but the AssetCo structure (debt) is the focus of this piece of work for which CAP funding is requested.

How does it work?

Potential impact

In East Africa, emissions and air pollutants from the transport sector are high and growing rapidly. They are responsible for 10% of the continent’s greenhouse gas emissions and are set to increase. Tackling transport emissions is a priority in Africa, with e-mobility identified as a major component of regional climate plans. For instance, in Kenya, increasing the electric two-wheelers parc to around half 50% of the total two-wheeler parc can decrease carbon emissions from motorbikes by 46% by 2040.

A McKinsey/Shell 2022 analysis focusing on Ethiopia, Kenya, Nigeria, Rwanda, and Uganda suggests that sales of EVs in these countries could be 340,000 – 820,000 units in 2025, growing to around 3.8 – 4.9 million units by 2040. Most of these sales will be electric two-wheelers. This suggests that 4-8% of the vehicle park in these five countries will be electric by 2030, growing to 25- 35% by 2040.

Scaling and introducing of lower-cost debt finance into two- and three-wheelers portfolios will reduce the end-user cost and a source of certain financing will make it easier for operators to raise finance to scale in future.

About PJ&Company

PJ&Company is a consulting firm registered in the United Kingdom. It advises some of the world’s largest and most recognizable institutions, Development Banks, Sovereign Wealth Funds, Governments, Private Sector Funds in Green Investment, Fund Structuring, and off-grid renewables investment across Africa. The company has detailed expertise in expertise in project management, renewable energy financing, organizational governance and structuring, and design and implementation of special purpose funds to address energy access, climate responsive investments, and acts as current transaction advisors across Africa relating to SHS, IPP, E-mobility.

Get in touch

If you are interested in having more information or want to get in touch, please contact us at: energy@undp.org

Locations

Locations