What does going digital mean for informal economies?

Informality

Digitalizing Informality:

Sensing and surfacing frontier knowledge about emerging challenges in development is at the core of what UNDP Accelerator Labs do. Each Lab explores its local terrain for new challenges, maps bottom-up solutions and experiments with those that could work in other contexts, influence policy and inform the UNDP’s on-the-ground interventions. As a global network, the Labs also develop collective intelligence about what these problems look like and how to solve them. This learning journey is a working prototype in which we develop questions that anchor learning circles, or collaborative conversations designed to uncover unstructured knowledge and hidden themes.

Informality is one of the themes that is prevalent amongst our Labs—24 out of 91 are working on it directly and many more are doing so indirectly. Half of the 24 labs engaging directly focus on the intersection of informality and digitalization, and most of those are in Africa. Our work is also part of a broader landscape of inquiry, not just inside the UNDP, but within peer organizations such as the ILO, and development in general.

Here is what we've been learning so far:

What *Really* Drives Informal Businesses to “Go Digital?"

Through our exploration of informality, we are trying to understand what drives the digitalization of informal business. These insights fall into three main categories: the impact of COVID-19 lockdowns, new market expansion and increased access to digital infrastructure and social media.

- COVID-19 lockdowns. Shutting down trade in public markets impacted the ability of vendors and businesses to reach their customers, incentivizing them to “go digital” to find new income streams. As lockdowns prevented millions of formal workers from reaching their workplaces, many informal vendors and businesses were also forced to close, switch income streams or find new sales channels. For example, entire sectors such as tourism shut down in countries such as Barbados, Cabo Verde and Mauritania. In other cases, informal businesses adopted digital technologies to reach potential customers and diversify their income. For example, in Uganda, the UNDP helped informal traders sell their goods through Jumia, a pan-African e-commerce retailer, while in Togo, motorbike drivers who only accepted cash prior to the pandemic, now accept digital payments.

- New market expansion. Beyond the pandemic, informal traders sell across borders to access markets where consumers will pay more for their goods and services. And some of this is going digital. For example, artisans in Ecuador and Guatemala are trying to use digital platforms to sell their products in developed markets such as the US and Europe. Additionally, as informal vendors access these new markets, they should also benefit from the lower costs of operating virtually. However, growth in digital trade in Africa, the Caribbean and Latin America is lower than in other regions.

-

Growing digital infrastructure and social media presence. People in developing countries, many of whom also work in the informal sector, are gaining access to mobile phones, mobile internet and mobile money. For example, Facebook attracts users by incentivizing mobile carriers to provide purportedly free access to low-bandwidth versions of its platform, such as Facebook Zero. The company also enables access by investing in internet infrastructure such as Wi-Fi, which allows users to connect to Facebook for free. Finally, Facebook (via Marketplace and Groups) and WhatsApp help businesses, often run by women, engage in digital commerce.

When Informal Businesses Digitalize: Opportunities, Challenges and Risks

Although we’re starting to understand the dynamics surrounding the digitalization of informal businesses, it’s a multi-faceted phenomenon that invites a nuanced exploration of impact. To embrace that complexity, we’re exploring the opportunities created, challenges confronted and risks embedded in the digitalization process.

Opportunities

Digitalization within informal businesses can have wide-ranging effects by removing or shifting intermediaries, increasing digital literacy, introducing digital technology to informal businesses and expanding their networks.

-

Removing or swapping intermediaries. Digitalization can help remove intermediaries from the value chains of informal businesses, resulting in increased productivity and direct access to consumers. For example, in Nepal, an e-commerce platform called KrishiCoopBazaar gives farmers’ cooperatives direct access to customers. This enables them to preserve their produce and secure their livelihoods. However, instead of removing intermediation, sometimes digitalization confers more power to a single intermediary. Uber, whose core business is to connect buyers and sellers of mobility-driven services, is a well-known example of how this dynamic can emerge.

-

Increasing digital literacy. Digital literacy is still low in many developing countries, so digitalization has the potential to leave people behind. Nonetheless, it seems to be increasing, due in part to the digitalization of informal businesses. For example, drivers of digitalization in Africa—startups, corporations, and policymakers—are advised to support efforts to increase digital literacy, build infrastructure, and integrate digital products and familiar offline activities.

-

Improved services through digitalization of informal businesses. Digitalization can take many forms. For example, in Uganda, the digitalization of informal businesses has improved service delivery, and provided access to new markets through business associations. Through a partnership with Jumia Uganda, informal market vendors have been able to sell to new customers via Jumia’s e-commerce platform, leveraging market agents to fulfill orders and drivers to deliver them.

-

Risk assessment and access to credit. Another impactful application is the increase in access to credit for informal business. The data that digital transactions generate provides more information, which makes risk assessment easier. This reduces the risk of lending money to informal businesses. Less risk creates lower interest rates, which can lead to increased productivity. For example, tech startups such as Kenya’s Pezesha are building proprietary credit scoring models that enable SMEs to gain access to financing.

-

Expanding networks. Lack of social capital is associated with poverty and vulnerability, but digitalization can provide an opportunity to expand existing social networks and build social capital for vulnerable communities. Similarly, communities may experience more resilience as digitalization expands markets and diversifies income.

Challenges and Risks

Although we have uncovered a small number of risks, there are some worth highlighting. First to note is the expansion of the digital divide, which is created when those who lack connectivity and digital skills are left behind. Similarly, we heard that digitalization may broaden social networks, but it can also decrease social cohesion and reduce the social protection afforded to informal traders and small businesses on digital platforms. Additionally, the predominance of platforms such as Facebook and WhatsApp could lead to an over-reliance on them, the centralization and corporate ownership of user data, and the potential for government to collect and use information to assert control. Finally, potential users of fully digital solutions may be wary of them due to lack of trust in financial service companies and government, and the risk that their data will be misused.

Why does the connection between digitalization and informality matter?

Informality continues to be a defining feature of many economies despite governments’ attempts to eliminate it. And thanks to COVID-19, informal businesses are becoming increasingly digitalized. Not surprisingly, we’re picking up signals that digitalization has a variety of effects on informal businesses. For example, going digital can shift or remove intermediaries in value chains. There are also signs that digitalization can boost the productivity of businesses, potentially opening pathways to formalization.

Our hunch is that by breaking down barriers to market access, digitalization is changing the relationship between informality and formality, and potentially redefining what is or isn’t “formal.”

From Analog to Digital: what does it mean to formalize a business?

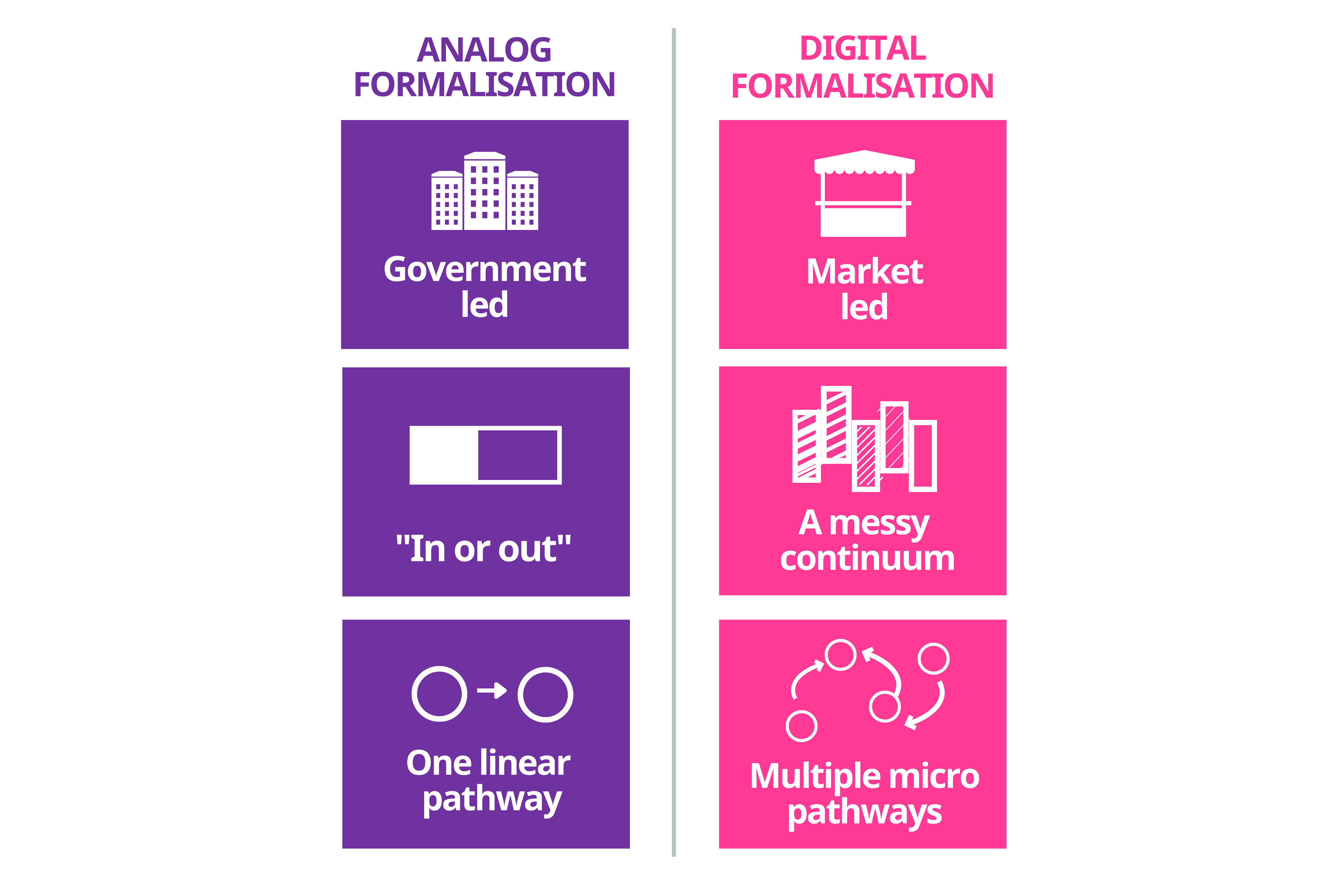

Cutting to the chase, we boiled down what we are seeing into this visual:

Three shifts we see in practice

Looking at the relationship between digitalization and formalization, we see three main shifts in what formality looks like, and how informal businesses achieve it.

1. Government to market-led formalization. While government reforms can ease the transition to formalization, they don’t automatically “reverse” informality. Naturally, governments want to see businesses become more productive and register formally to increase the tax base and stimulate economic growth. As a result, they roll out regulatory and tax reforms, making it easier to register a business, secure government benefits and pay taxes.

But when digital tools spread, private sector innovation becomes a key driver of formalization alongside government policy interventions. For example, when informal businesses gain access to digital products such as mobile money, they may organically opt into elements of formalization such as tracking expenses, paying invoices and even potentially securing loans, as the UNDP Accelerator Lab team in Zimbabwe is testing out. They’re experimenting with combatting urban hunger through urban gardening, while also partnering with a bank to provide intelligent loans to the farmers that account for borrowing limits and track use of funds.

2. Formalization: In or out or a messy continuum? Formalization operates like an “on/off” switch in the conventional sense. In the eyes of a government tax authority, a business is either legal and registered, or it’s not.

In the digital world, an informal business can transact on WhatsApp, secure loans on another app, and find customers on Facebook — all without seeking formal registration. And in some cases, using these private-sector digital services may provide enough formality-related benefits to prevent an informal business from seeking government-mandated formality.

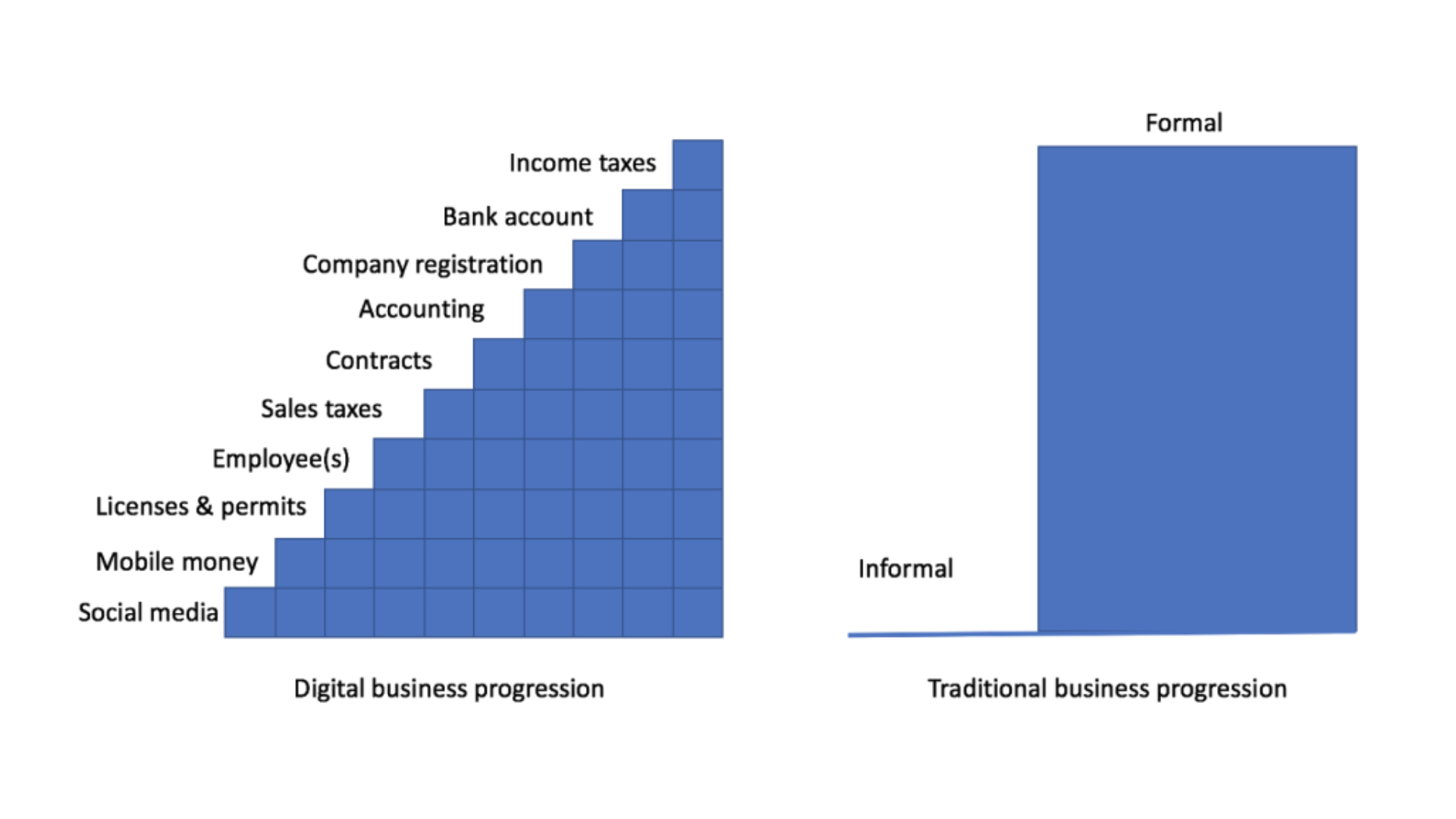

3. One linear pathway to formalization vs. micro pathways. The road to formalization has typically been prescribed and sequential. In other words, the path is familiar— you start a business, register it, secure licenses, make money, and then pay taxes. However, with the use of digital services, the journey can be disaggregated into small steps and take many directions.

Take this as an archetypical journey built from Lab experience in multiple countries: an informal business might start advertising its products and services on WhatsApp, generating enough demand for customers to start requesting formal receipts or quality assurance guarantees. These are all possible pathways that embody the shift from linear to micro-pathways on the road to formalization.

Alternatively, that same business may also try an app that enables it to apply for loans to purchase productive assets. It’s important to note that (assuming a certain level of digital literacy), the level of effort required to join a platform such as WhatsApp and transact, is lower than that needed to register a business or open a bank account. For example, in Guatemala, businesses are using platforms such as Facebook and Instagram to market and sell their products.

This brilliant visual from the Center for Global Development shows the formalization process as a series of “small, accessible low-cost steps” that a business can take.

Center for Global Development

So, if digitalization unlocks an adapted (and perhaps equally useful) version of formalization, why does this change matter? Put simply, our “traditional” understanding of formality assumes that it drives economic growth. But our preliminary observations about digitalization’s impact on formalization might call into question how and whether formalization is the only route to economic growth in a digital world. We also want to understand how digitalization leads to formalization (or doesn’t), and how the relationship between digitalization and formalization differs by gender for informal businesses.

Related Blogs

Making the Invisible Visible: Informal Innovation in South Africa

NDP, via its Accelerator Labs Network, in partnership with Utrecht University (the Netherlands), the University of Johannesburg (South Africa), and MIT Sloan School of Management (USA) conducted the first in-depth study of informal innovation on the African continent spotlighting household innovators. This joint research called “Making the Invisible Visible: Informal Innovation in South Africa” sheds light on the many informal innovators invisible to most organizations but whose knowledge could unlock progress toward the Sustainable Development Goals. It uncovers the immense untapped potential of innovation of the men and women of South Africa. As the first inquiry into informal innovation using internationally comparable methods for household innovation, this research allows benchmarking across countries and helps fill a major research gap in understanding informal innovation in Africa.

Businesses across the planet are embracing digital tools. Digital technology is changing how they do everything, from logistics to accounting, payments to marketing. But what about micro- and small businesses that make up the backbone of many Global South economies? Is the digital revolution a chance for them to catch up, or is it leaving them further behind? Some months ago, 13 UNDP Accelerator Labs ran a survey to better understand how micro and small enterprises in the Global South, many of which are not formally registered and therefore part of the grey economy, have been using Internet services in their everyday activity and more specifically during the pandemic. While the full results and open-source datasets are available here, we are eager to share some top line results and exciting findings in this blog post.

Digitalizing Informal Business: What Systems Mapping Reveals about Drivers and Effects

This blog captures learning from the UNDP Accelerator Labs’ ongoing process of surfacing lesser-known insights about informality, with a focus on the drivers of digitalization within informal businesses.

Three signals of change: how digitalization is changing what informality looks like

In this blog, we share what the UNDP Accelerator Lab Network is learning about the relationship between digitalization and formalization. This continues our journey as a Network to surface practice-based insights about informality as we also test out new ways of surfacing knowledge.

When informal markets go digital: emerging signals from our Lab network

“What does going digital mean for informal economies?” Could the quantum leap of digitalization help link people in the informal economy to market and financial opportunities and bridge divides? Could digital platforms designed for informal businesses and traders enable them to reach a broader consumer base and access financial services? What are the risks in this transition that we should be aware of to ensure fairness, equity and sustainability?

Lessons in Scaling: UNDP's Role in Digitalizing Informal Market Vendors in Uganda

This case study shares lessons learned from the partnership between UNDP in Uganda and Jumia, a global e-commerce company, to digitalize informal market vendors. It looks at an example of how COVID triggered a pivot for UNDP programming that was initially supported by the UNDP Accelerator Lab in Uganda and then received further investment from the CDO’s Digital X Partnerships for Scale Programme to take the work to scale. The story illustrates why, when and how UNDP is (or isn’t) well-suited to help social innovations scale, and what constraints can emerge when working with the private sector to do so. Here, we see the challenging journey to scale from pilot to nation-wide platform, and the even rockier struggle to expand lessons learned beyond national borders for regional or global learning. Ultimately, the narrative points to the internal reforms needed to define UNDP’s niche in scaling social innovation through commercial channels.

Locations

Locations