When informal markets go digital: emerging signals from our Lab network

When informal markets go digital: emerging signals from our Lab network

November 23, 2021

Digital technology is pervasively transforming all work sectors including the informal sector and with COVID-19, the world has been going digital at an accelerated pace. McKinsey’s Global survey recently suggested that “digital adoption has taken a quantum leap at both the organizational and industry levels during the pandemic.” As consumers across the globe are now moving dramatically towards online channels, we’re seeing more industries, businesses, startups, Micro, Small, and Medium Enterprises (MSMEs), small-scale traders, market and street vendors are leaping to integrate more robust digital tools and join digital marketplaces to meet the demand.

The International Labour Organization (ILO) tells us that about two billion people – more than 61 per cent of the world’s employed population – make their living in the informal economy. ILO defines the informal economy as “all economic activities by workers or economic units that are – in law or practice – not covered or sufficiently covered by formal arrangements.” To deep dive further into this, the UNDP Accelerator Labs have started our own journey to unpack the drivers and dynamics of informality in a Wiki here.

COVID-19 lockdown measures such as restrictions on movement and stay-at-home guidelines have impacted the informal economy, cutting off hundreds of informal market vendors from their usual customers, affecting incomes, and straining their livelihoods.

Our UNDP Accelerator Lab Network is seeing major disruptions (and opportunities) in trade, business operations and supply chains in key sectors of the informal economy. Our Labs are leaning into digitalization as means for the informal sector to access new markets by integrating digital tools and developing digital marketplaces for informal businesses and traders to continue to sell their goods and services and connect them with existing and new clients.

So, we asked ourselves, “what does going digital mean for informal economies?” Could the quantum leap of digitalization help link people in the informal economy to market and financial opportunities and bridge divides? Could digital platforms designed for informal businesses and traders enable them to reach a broader consumer base and access financial services? What are the risks in this transition that we should be aware of to ensure fairness, equity and sustainability?

That’s our north star, and we’re certainly on a mission to find out.

Learning Circle: Digitalization and Informality

As part of our prototype in network learning, the UNDP Accelerator Labs hosted a learning circle (second of a series of many) bringing in 11 Accelerator Labs that specifically work at the intersection of digitalization and informality. This learning circle was designed to understand what our Labs are doing on the ground and surface (from the bottom up) common patterns on how digitalization is affecting informal economies. In this session, we dove into our Labs' current learning and action cycles and surfaced three common themes on what digitalization means for the informal economy, namely: 1) access to markets, 2) financial inclusion and 3) cross-border trading.

Access to [digital] marketplaces

In March 2020, when the first COVID-19 case was recorded in Uganda and the government took action via a nationwide lockdown, the UNDP Uganda Accelerator Lab partnered with Jumia, a leading e-commerce company, to link the informal market vendors with their customers online. So far, the UNDP Accelerator Lab and Jumia have connected over 2,000 market vendors on this e-commerce platform. A new product line, "Kikumi Kikumi," was also launched within Jumia's platform, tailored to low-income earners to buy groceries at a low cost and make orders without a smartphone by calling in using a self-help menu on their feature phones. The Lab is now looking at pathways to scale this platform nationally and transform informal enterprises in Uganda through inclusive e-commerce.

In The Gambia, the Lab supports local informal traders, particularly women and youth, through “My Lumo,” a digital e-commerce platform allowing local informal traders to market their goods and services and transact electronically. Over 200 informal market traders are on the platform, with an average of 100 users visiting monthly. In Namibia, UNDP partnered with Tambula, a local online shop, to provide informal small businesses and traders with a digital commercial platform to reach more clients and generate more income. The Lab has successfully onboarded 50 informal fruit and vegetable vendors to the platform as part of the pilot phase of this initiative.

On the other side of the world, the UNDP Malaysia Accelerator Lab is accelerating the adoption of digital solutions among rural micro, small, and medium enterprises to achieve broader market access through e-commerce platforms. During the pandemic, they onboarded informal producers and aggregators to sell their products and services through WhatsApp Business.

And in Barbados, UNDP through the Accelerator Lab is sparking digital transformation for small-scale fisherfolks through BlueDIGITAL, an app-based network which aims to improve the value chain for fish by introducing greater sustainability measures, providing accurate data and more responsible regenerative seafood purchasing.

We are still in the early days and have a lot more to learn, but we’re starting to sense how new digital platforms and digital marketplaces can support the informal sector to gain wider market access. These insights also lead us to ask further questions around the sustainability of what going digital means, such as:

- How long will markets stay digital after lockdowns (hopefully) cease?

- Who benefits from digitalization, and are benefits equitably distributed?

- Will this rapid digitalization trigger longer-term investments in internet access across the digital divide?

Closing the [wide] financing gap

Although there's been progress around the world, large segments of the population in the informal economy are still unable to access and use financial services like facilitating transactions (exchange of goods and services), mobilizing savings, acquiring loans and capital funding to sustain their livelihoods. A G20 policy guide report suggests that digitalization can offer an opportunity to close the financing gap – enabling the informal sector to gain access to available financial systems. As most commercial banks regard lending to the informal sector a high risk due to the sector’s challenge to meet formal requirements and provide collateral assets, one can also see promise that digital technologies can bridge that gap. Our Labs are exploring hybrid and alternative financing solutions such as integrating fintech models as financing intermediaries, borrowing funds through mobile money platforms such as M-pesa and scaling online crowdfunding platforms to raise capital as a means for the informal sector to gain better access to financial services.

We're seeing how some of our Labs are working on digitalization to aid informal small businesses and traders' access financial services as well as identifying new, hybrid or alternative financial technology modalities which are a better fit for informal businesses. In Sudan and South Sudan, one of the major challenges women face is gaining access to savings and loans schemes to strengthen their economic standing and resiliency. Over time, to solve the problem themselves, women developed a traditional savings scheme called ‘Sanduk- Sanduk’ (the name can be traced to the South Sudanese concept of “sanduk,” or box), where each member deposits money periodically. This system has helped women plan savings and raise start-up capital at an interest-free rate. Our Labs in Sudan and South Sudan are teaming up to digitize and scale the Sanduk savings scheme and exploring the potential of transforming these groups into more robust savings and credit cooperatives.

In Angola, our Accelerator Lab is learning and mapping the financial flows of local small businesses and traders in urban markets to support the financial management of their markets and improve the daily efficiency of their trade activities. Analyzing financial flows point the Lab to experiment on alternative digital financial tools to increase efficiency, such as digital wallets, mobile banking and e-money transactions.

Although our Labs see the promise of digitalization as way for the informal sector to access financial services, early experience also indicates that low financial and digital literacy rates within the informal sector are a bottleneck to wider take up.

To better understand this phenomenon, the UNDP Argentina Accelerator Lab and El Fondo Nacional de Capital Social (FONCAP) conducted a series of conversations on the challenges faced by vulnerable communities to access basic digital finance services. These conversations uncovered the compounding issues of digitalization in Argentina - such as the unequal access to mobile phones and digital finance services like micro-finance which impacts those that already have so little. Much of this was amplified and increased in visibility during the pandemic.

In the Philippines, UNDP launched the Adaptable Digitally-Enabled Post-crisis Transformation (ADEPT) initiative to provide digital cash transfers to vulnerable and informal groups during the pandemic. During the implementation of this initiative, the UNDP Philippines Accelerator Lab saw low digital adoption rates due to low digital and financial literacy rates within these communities as a bottleneck to disbursement. The Lab is now providing digital and financial skills training for these groups to learn how to enroll, register, cash out and use mobile money features. And the UNDP South Sudan Accelerator Lab provides training to 400 women and adolescents, most of which are from vulnerable and informal groups, to develop financial confidence and empower them to start their local businesses.

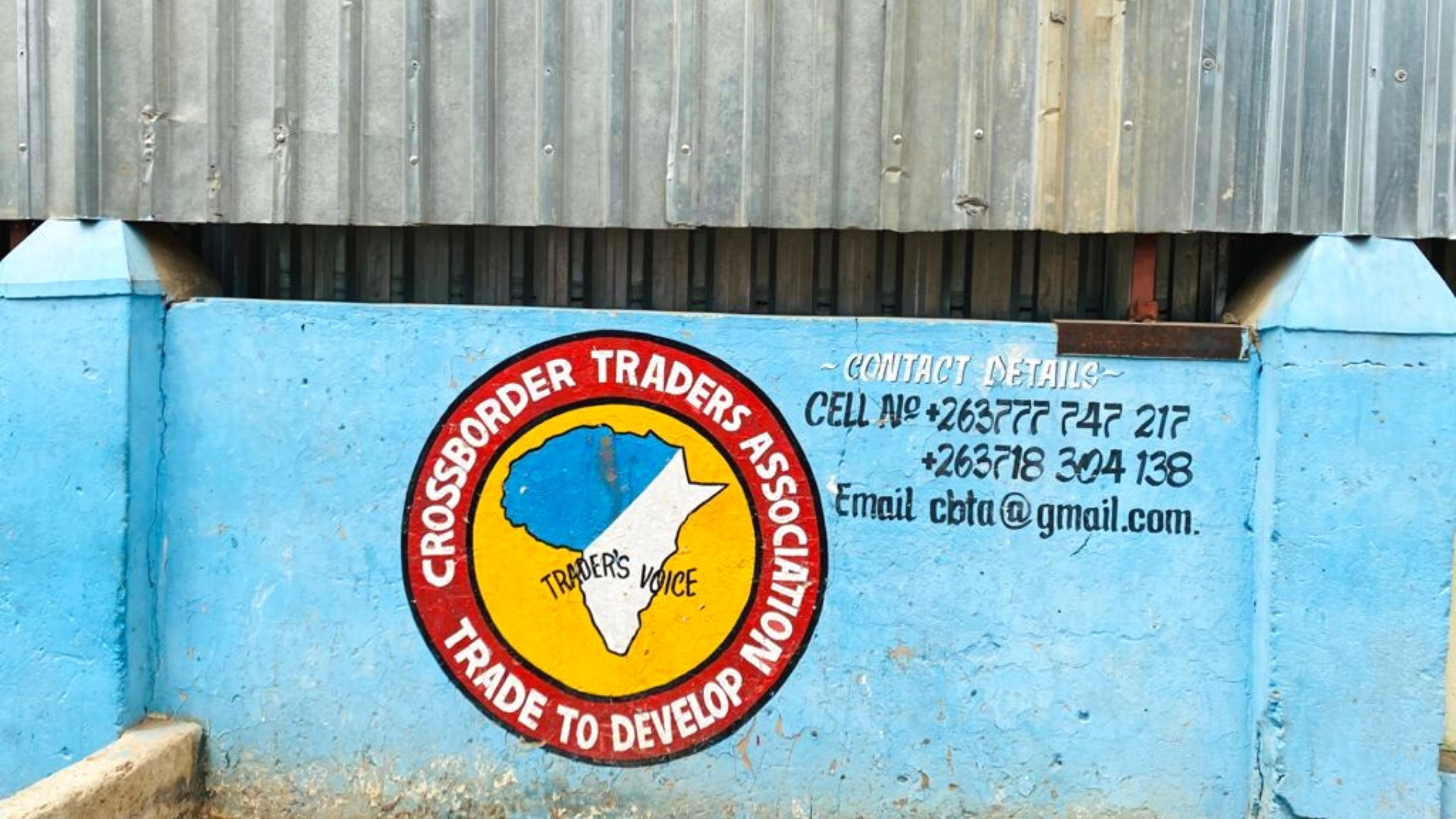

Accelerating border[less] trading

In Africa, borderland communities rely heavily on informal cross-border trade for their livelihoods, but COVID-19, climate change and conflict increase the requisite complexity.

Over the recent years, weekly markets called “Lumos” in many rural communities have emerged in both The Gambia and neighboring Senegal. Seeing this growing trend across borders, UNDP The Gambia is looking at scaling their digital marketplace app “My Lumo” to Senegal to improve sub-regional trade.

Zooming in to the border of Zambia and Zimbabwe, informal traders relied heavily on middlemen and runners to transport goods, which further exacerbated insecurity during the pandemic. The UNDP Zambia and UNDP Zimbabwe Accelerator Labs are exploring the potential of technology to digitize trade and limit the dependency of informal traders on intermediaries. To succeed, both Labs are looking into digital solutions which don’t require informal traders to use complex technologies or require constant internet connectivity yet still serve informal traders' needs to track goods, make payments, and access financing.

The UNDP Zambia and UNDP Zimbabwe Accelerator Labs are working with Lab teams in Niger, Mali, Burkina Faso, Sudan, South Sudan, Togo, Ghana and Benin to take on the UNDP's African Cross Border Challenge.

At the moment, it looks like cross-border trade is suffering due to the COVID-19 pandemic. For instance, travel restrictions clearly reduce economic activity and create delays in transporting goods, increasing the overall cost of goods. Our Labs are leaning into digitalization, leveraging digital tools and platforms as a means for borderless communities to enhance and continue their trade, track goods, make payments and access financing opportunities.

What’s next

Our learning journey on this front has just begun – we are only seeing the tip of this complex iceberg.

We now know more about the activities of our Labs and have seen common themes in their work on digitalization and informality. But it has also brought out new learning areas for us:

- Connecting informal businesses to digital platforms raises questions on trust. Trust in banks, governments, and technology – as barriers or enablers to digital adoption. We’re now using systems mapping to understand these dynamics and unpack these assumptions.

- Second, the need for data governance. With more data produced due to the rise of digital platforms for the informal sector, questions emerge around data quality, ownership and access, stewardship and management, and what value these data can bring. We're on a mission to put some guiding principles on paper with the goal of raising awareness and action on e-commerce platform data exhaust within the development community.

Stay tuned for more as we embark on this learning circle series focused on “what going digital means for informal economies” and as we continue to test our learning network prototype in an attempt to re-invent knowledge management suited to help a 21st-century organization.

---

Get in touch via accelerator.labs@undp.org or send us a dm via @undpacclabs.

With contribution from:

Special thanks to Bas Leurs and Eduardo Gustale from the UNDP Accelerator Labs Global Team, who facilitated this learning circle.

- UNDP Accelerator Labs Global Team

- UNDP Uganda Accelerator Lab

- UNDP The Gambia Accelerator Lab

- UNDP Namibia Accelerator Lab

- UNDP South Sudan Accelerator Lab

- UNDP Sudan Accelerator Lab

- UNDP The Guinea Accelerator Lab

- UNDP Zimbabwe Accelerator Lab

- UNDP Niger Accelerator Lab

- UNDP Mali Accelerator Lab

- UNDP Burkina Faso Accelerator Lab

- UNDP Togo Accelerator Lab

- UNDP Ghana Accelerator Lab

- UNDP Benin Accelerator Lab

- UNDP Philippines Accelerator Lab

- UNDP Barbados Accelerator Lab

- UNDP Malaysia Accelerator Lab

- UNDP Argentina Accelerator Lab

Locations

Locations