Three signals of change: how digitalization is changing what informality looks like

August 4, 2022

By Tayo Akinyemi, Bas Leurs and Gina Lucarelli, UNDP Accelerator Labs

In this blog, we share what the UNDP Accelerator Lab Network is learning about the relationship between digitalization and formalization. This continues our journey as a Network to surface practice-based insights about informality as we also test out new ways of surfacing knowledge.

Why does the connection between digitalization and informality matter?

Informality continues to be a defining feature of many economies despite governments’ attempts to eliminate it. And thanks to COVID-19, informal businesses are becoming increasingly digitalized. Not surprisingly, we’re picking up signals that digitalization has a variety of effects on informal businesses. For example, going digital can shift or remove intermediaries in value chains. There are also signs that digitalization can boost the productivity of businesses, potentially opening pathways to formalization.

Our hunch is that by breaking down barriers to market access, digitalization is changing the relationship between informality and formality, and potentially redefining what is or isn’t “formal.”

From Analog to Digital: what does it mean to formalize a business?

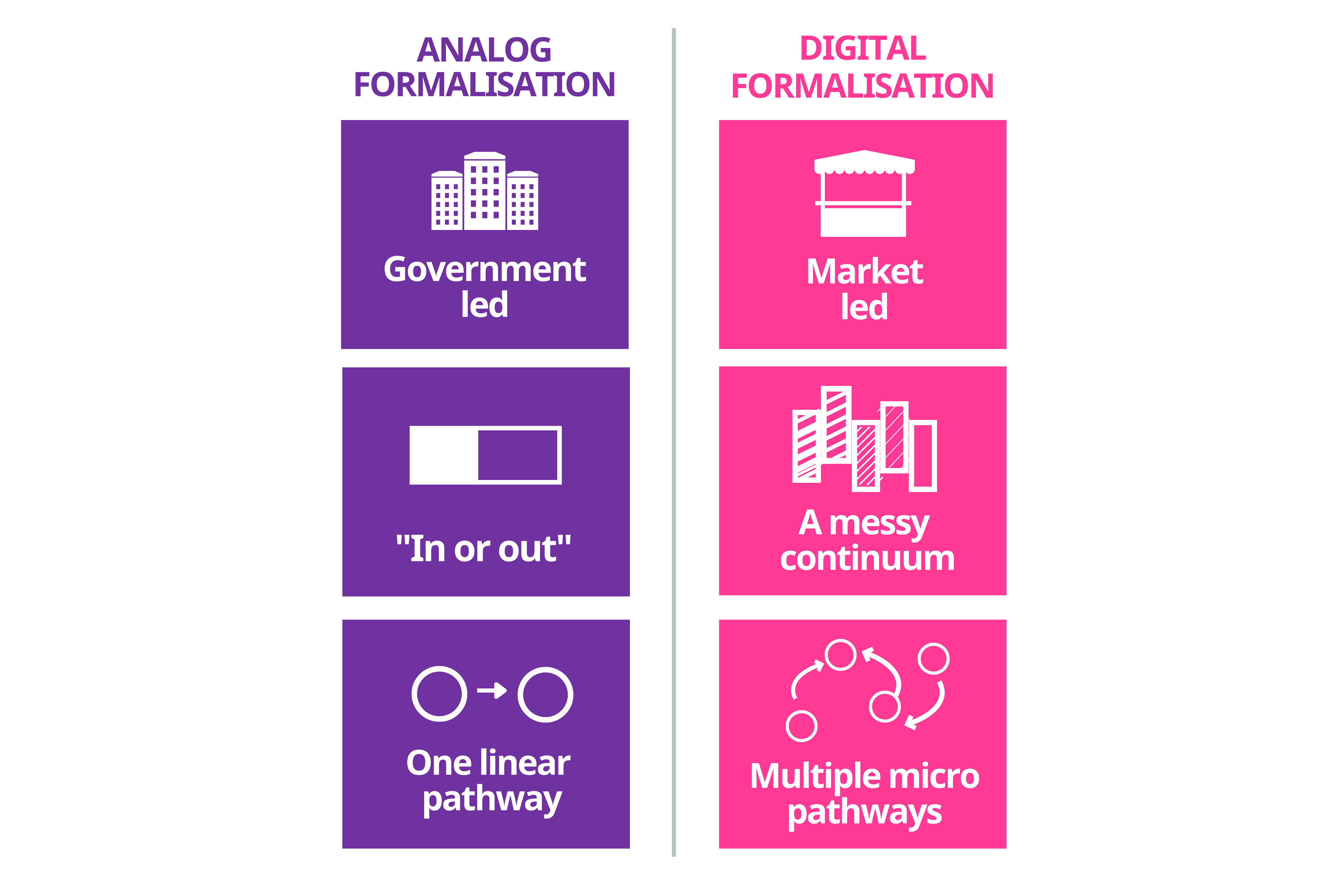

Cutting to the chase, we boiled down what we are seeing into this visual:

Three shifts we see in practice

Looking at the relationship between digitalization and formalization, we see three main shifts in what formality looks like, and how informal businesses achieve it.

1. Government to market-led formalization. While government reforms can ease the transition to formalization, they don’t automatically “reverse” informality. Naturally, governments want to see businesses become more productive and register formally to increase the tax base and stimulate economic growth. As a result, they roll out regulatory and tax reforms, making it easier to register a business, secure government benefits and pay taxes.

But when digital tools spread, private sector innovation becomes a key driver of formalization alongside government policy interventions. For example, when informal businesses gain access to digital products such as mobile money, they may organically opt into elements of formalization such as tracking expenses, paying invoices and even potentially securing loans, as the UNDP Accelerator Lab team in Zimbabwe is testing out. They’re experimenting with combatting urban hunger through urban gardening, while also partnering with a bank to provide intelligent loans to the farmers that account for borrowing limits and track use of funds.

2. Formalization: In or out or a messy continuum? Formalization operates like an “on/off” switch in the conventional sense. In the eyes of a government tax authority, a business is either legal and registered, or it’s not.

In the digital world, an informal business can transact on WhatsApp, secure loans on another app, and find customers on Facebook — all without seeking formal registration. And in some cases, using these private-sector digital services may provide enough formality-related benefits to prevent an informal business from seeking government-mandated formality.

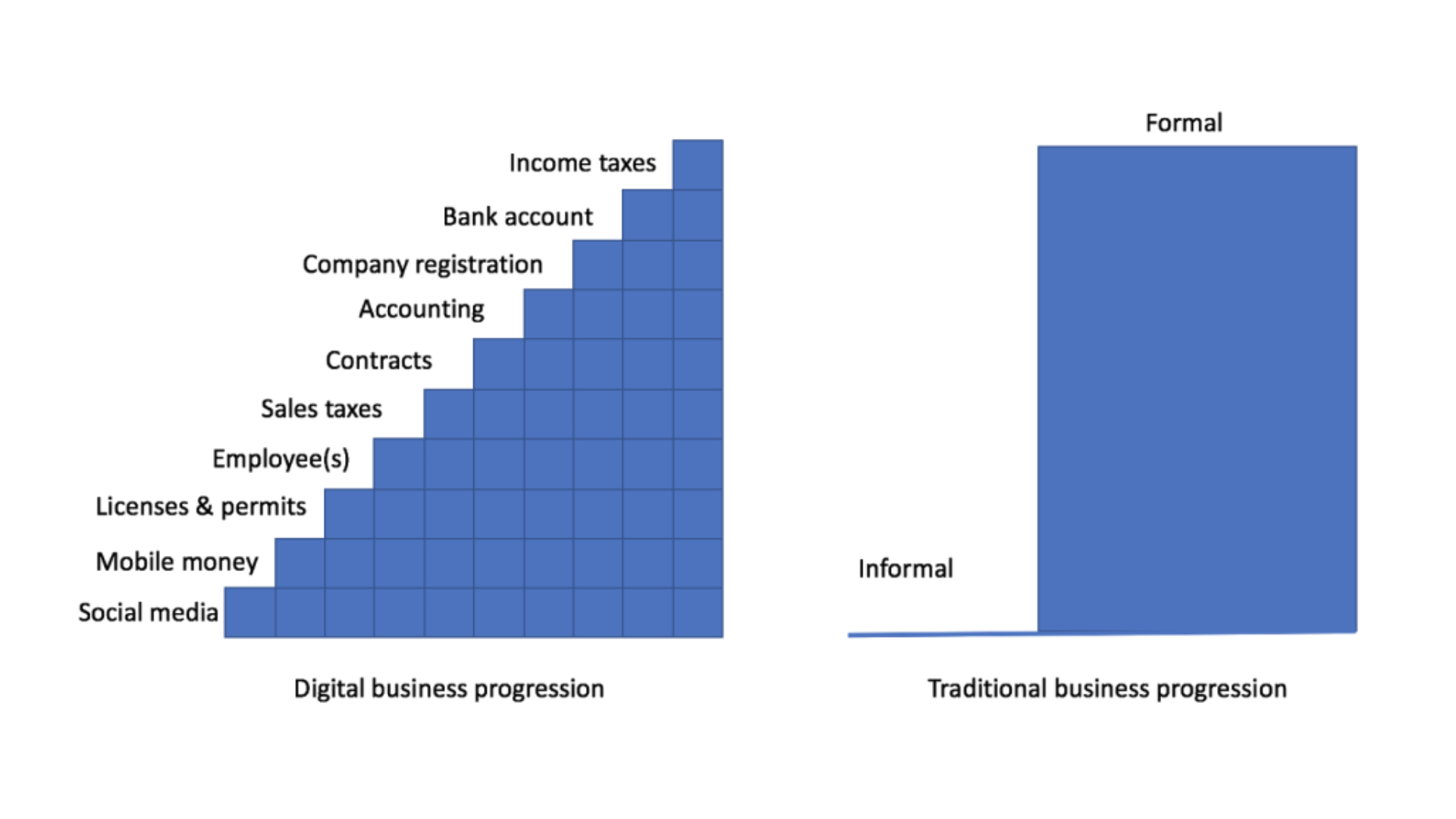

3. One linear pathway to formalization vs. micro pathways. The road to formalization has typically been prescribed and sequential. In other words, the path is familiar— you start a business, register it, secure licenses, make money, and then pay taxes. However, with the use of digital services, the journey can be disaggregated into small steps and take many directions.

Take this as an archetypical journey built from Lab experience in multiple countries: an informal business might start advertising its products and services on WhatsApp, generating enough demand for customers to start requesting formal receipts or quality assurance guarantees. These are all possible pathways that embody the shift from linear to micro-pathways on the road to formalization.

Alternatively, that same business may also try an app that enables it to apply for loans to purchase productive assets. It’s important to note that (assuming a certain level of digital literacy), the level of effort required to join a platform such as WhatsApp and transact, is lower than that needed to register a business or open a bank account. For example, in Guatemala, businesses are using platforms such as Facebook and Instagram to market and sell their products.

This brilliant visual from the Center for Global Development shows the formalization process as a series of “small, accessible low-cost steps” that a business can take.

So, if digitalization unlocks an adapted (and perhaps equally useful) version of formalization, why does this change matter? Put simply, our “traditional” understanding of formality assumes that it drives economic growth. But our preliminary observations about digitalization’s impact on formalization might call into question how and whether formalization is the only route to economic growth in a digital world. We also want to understand how digitalization leads to formalization (or doesn’t), and how the relationship between digitalization and formalization differs by gender for informal businesses.As always, get in touch if you are seeing similar or conflicting trends as we unpack informality and check out our upcoming Twitter Spaces in October: Digitalization in our post-pandemic world by following @UNDPAccLabs.

Thanks to Eduardo Gustale for spotlighting the paradigm shift, and to our Lab community members for participating in these exploratory conversations and sharing their insight: Ardita Zekiri and Lazar Ivanov (North Macedonia), Ayah Younis, Hadil Habashneh and Rua Al Abweh (Jordan), Buay Tut, Jackie Aringu and Tong Atak (South Sudan), Greg Smith (Trinidad), Gustavo Setrini (Paraguay), Juan Torres and Juan David Martin (Colombia), Hadijah Nabbale (Uganda), Ira Velasco (Philippines), Lorena Moscovich, Maria Moreno and Matias Acosta (Argentina), Omar Jagne (The Gambia), Paola Constantino (Guatemala), Paulina Aguilar (Ecuador), Ramiz Uddin (Bangladesh), and Rodro Moran and Victor Tablas (El Salvador).

Locations

Locations