An SDG impactful and investment-ready pipeline to be built for enterprises in Nigeria

July 12, 2023

Financing the 2030 Agenda is a systemic challenge requiring governments to incentivize private sector participation in allocating capital towards achieving the Sustainable Development Goals (SDGs) and the Paris Agreement. According to the OECD (2022), the SDG financing gap in developing countries surged by 56% after the COVID-19 pandemic, amounting to USD 3.9 trillion in 2020. In Africa, the cost to achieve the SDGs is estimated at USD 1.3 trillion a year, with a projected increase to $19.5 trillion due to population growth (UNECA, 2020). Yet, it would take less than 1% of global private financing assets to fill this gap and accelerate progress towards the SDGs. A likely reason for this misalignment of capital is the lack of concrete SDG-aligned investment-ready enterprises and projects. Identifying scalable and high-impact opportunities is thus essential to redirecting investments towards the SDGs.

The Growth Stage Impact Ventures (GSIV) programme

Developed by UNDP, the Growth Stage Impact Ventures (GSIV) programme seeks to identify enterprises from developing countries that have developed at-scale products and services that contribute to the SDGs while achieving commercial success. Identified ventures have a proven impact, demonstrated product-market fit, and a revenue-generating self-sustainable model to attract local and international capital.

In January 2023, building on the Nigeria SDG Investor Map, the European Union (EU) together with UNDP Nigeria and UNDP Geneva launched the Nigeria Growth Stage Impact Ventures program, in collaboration with the UNDP Africa Sustainable Finance Hub (ASFH), UNCDF, and FC4S Lagos.

The ultimate objective of the programme is to promote the development of the private sector in Nigeria by identifying and aggregating a pool of investment-ready enterprises aligned to the Investment Opportunity Areas (IOAs). Developing a pipeline of impactful and investable ventures will, in turn, reduce pre-investment costs for investors. It will also contribute to closing the access to finance gap for Small and Medium scale Enterprises (SMEs) and consequently increase private sector resource mobilisation aligned to the SDGs.

The unique added value of the GSIV is its ability to scan through the entire ecosystem of existing pipelines by collecting intelligence on the impact industry through third-party nominations from impact funds, foundations, family offices, governments, accelerators, and international organizations. This process allows UNDP to further map the investment ecosystem of the country by collecting valuable information that can be used to further nurture relationships with the private sector.

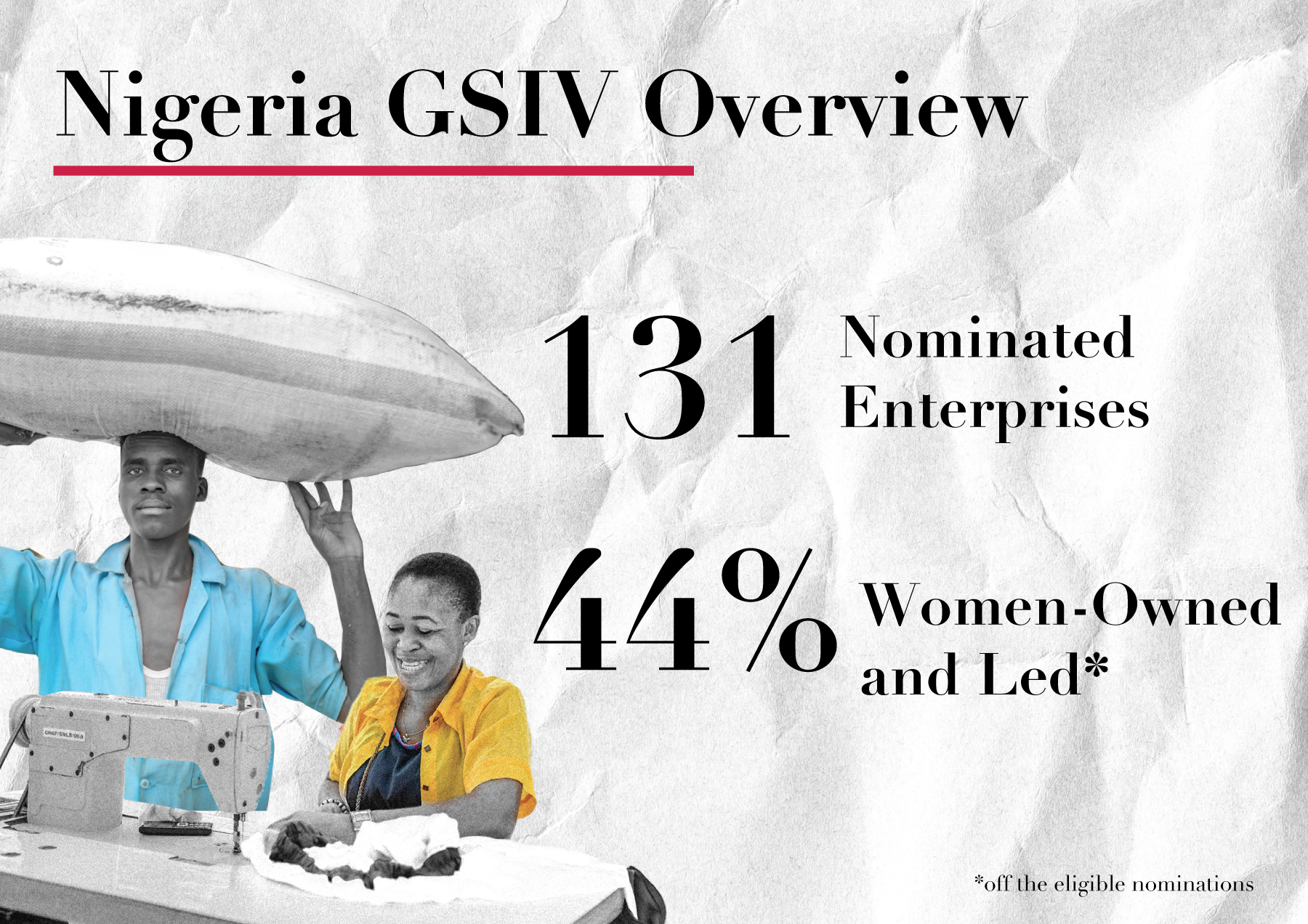

Results of the Nigeria GSIV Call for Nominations

Ventures have been identified through an open Call for Nominations launched by UNDP, inviting third-party nominators to put forward enterprises meeting the requirements. The call received over 131 nominations from 91 different third-party nominators. Nearly one-third of the nominators who participated in the call were investors (predominantly venture capital and impact funds), confirming the strong interest from the local and international financial sectors to further collaborate with UNDP. In addition to these investors, accelerators and incubators, and intergovernmental organisations actively participated in the call, contributing correspondingly 30% and 6% of the nominations received. In terms of women's economic empowerment, 44% of the qualified nominations come from businesses with female owners or executives.

“women-owned or/and led” defined as a woman in the position of founder, co-founder, CEO or deputy CEO.

UNDP would like to thank the third-party organizations that participated in the call for sharing their pipelines, and thus demonstrating their commitment to advance the development of the private sector in Nigeria.

Almost all the nominated ventures reported that at least 75% of their company employees are based in Nigeria, contributing to local employment, social development, and poverty reduction. Some ventures also have other offices located around the world, such as in the United Kingdoms, Ghana, Kenya and South Africa.

Within Nigeria, the Federal Capital Territory (Abuja), Lagos and Oyo are the states where most of the nominated ventures are headquartered, showing how the ventures are mostly located within major economic and financial centres of the country while providing solutions across the country. From the call, it was noted that a few ventures were located in other states such as Zamfara, Bauchi and Kwara, thus contributing to the economic development of local communities.

The Nigeria GSIV mainly targets Micro Small Medium Enterprises (MSMEs). Nearly half of the nominated ventures have between 11 and 50 employees. With 34% of the nominated ventures reported an annual revenue between USD 50,000 and approx. USD 500,000, in 2021. For the same year, 23% reported an annual revenue of over USD 1 million. Nearly 64% were earning before interest, taxes, depreciation and amortization (EBITDA) positive in 2021, thus being profitable at an operating level despite the economic impacts of the Covid-19 crisis. Most of the nominated enterprises have already raised at least one investment round, with investment tickets between USD 50,000 and approx. USD 500,000.

These trends overall suggest that there are several well-established and profitable enterprises in the ecosystem, as well as numerous more recently established companies looking to scale their activities and impacts.

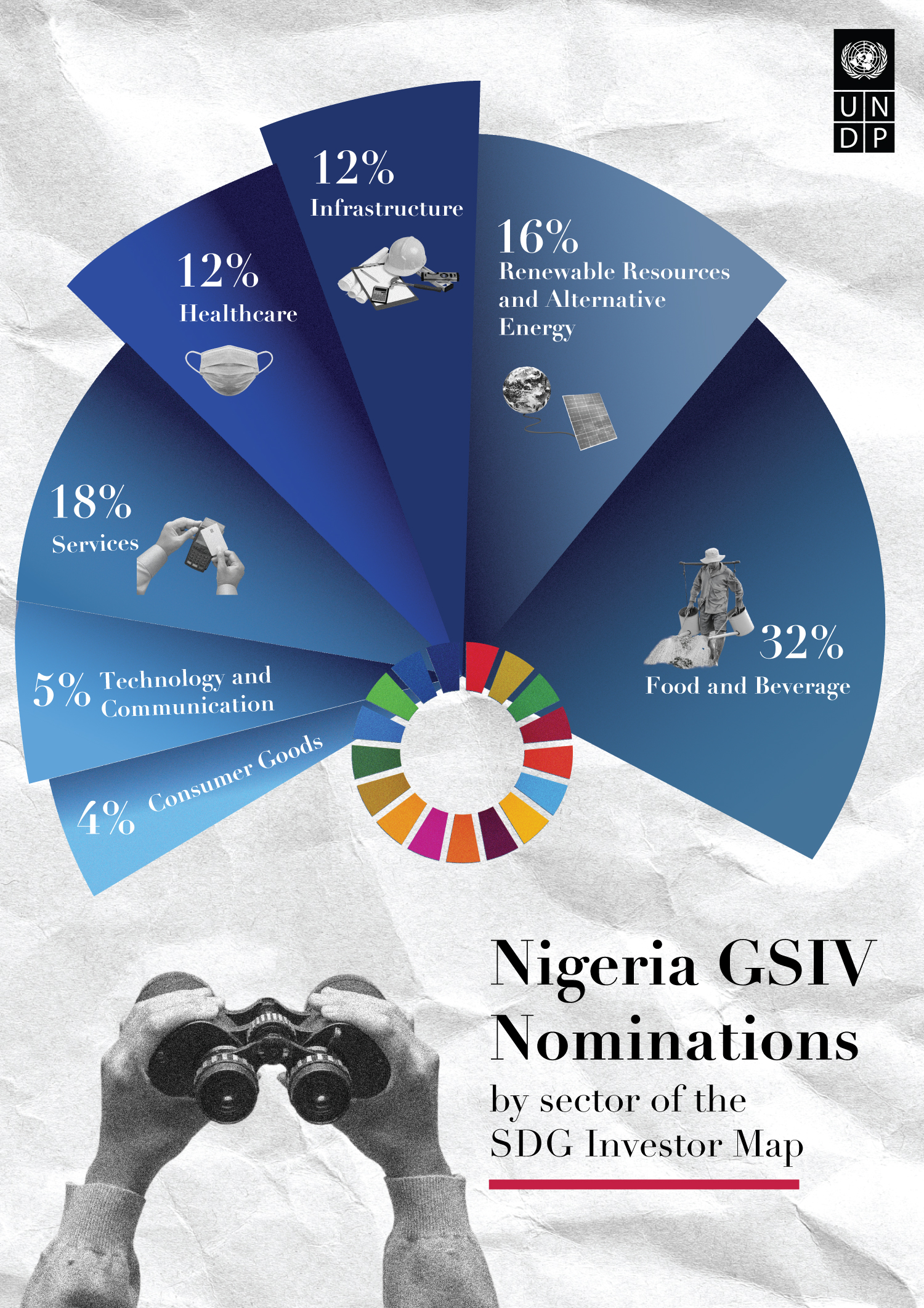

The SDG Investor Map is a market intelligence tool produced by UNDP Country Offices to help private investors identify Investment Opportunities Areas (IOAs) and business models that advance the SDGs. The Nigeria SDG Investor Map identified 17 investment opportunity areas across seven priority sectors: Food & Beverage, Renewable Resources & Alternative Energy, Infrastructure, Healthcare, Services, Technology & Communication and Consumer Goods. The map translates SDG needs and policy priorities into actionable investment opportunities, using an established methodology which combines secondary data research with interviews and discussions with public and private sector stakeholders.

UNDP assigned a sector to each nominated venture in line with the seven sectors of the Nigeria SDG Investor Map. The sectors most represented in the pool of nominated ventures are Food & beverage, Renewable Resources & Alternative Energy and Services. UNDP has also tentatively assigned to each venture, a subsector as well as an Investment Opportunity Area (IOA). While this process is still at its initial stages, it is already clear that there are several nominated ventures aligned with the IOAs of Digital Payment Platforms (19%), Plastic Recycling Facilities (12%) and Agro-industrial Processing (11%).

Moving forward: what’s next?

After a rigorous evaluation process, up to 12 ventures covering the sectors in the Nigeria SDG Investor Map will be selected in July 2023 by a Selection Panel composed of technical experts, financial and private sector experts, academics and development practitioners. The selected ventures will be endorsed by UNDP and will receive visibility to UNDP domestic and global partners. Enterprises will also have access to pre-and post-investment readiness support, as well as training on UNDP’s SDG Impact Standards to enable them to embed sustainability into their business strategies. They will also be exposed to potential financing vehicles from Development Finance Institutions, UN Agencies (including the UNCDF), and other domestic and international investors. Consequently, finalists will have the opportunity to engage with investors and other ecosystem players at a pitch event organised in partnership with the Impact Investors Foundation (IIF) in November 2023.

Locations

Locations