Finding Unicorns: Investing in innovation-led growth in LAC

June 30, 2022

Private sector investment is a key engine of growth. This is particularly important for a region like Latin America and the Caribbean, which has experienced limited productivity-led growth in recent decades and has struggled with volatile patterns of economic expansion and retraction.

Cultivating a thriving business environment for start-up companies can help to unlock a more innovation-based model of growth—and foster additional related development gains such as job creation or complementary investments in areas such as skills training and digital infrastructure. Notably, in the context of restricted mobility during the COVID-19 pandemic, innovative companies which leveraged technology to overcome barriers to accessing various goods and services (such as e-commerce companies, financial technology companies, educational technology companies, and other types of digital platforms) exposed the limitations of many existing organizations (both private and public) to meet the needs of today’s consumers and citizens.

This #GraphForThought uses data from the market intelligence company Crunchbase to explore the changing pace of private sector investment in LAC. It explores how the creation of “unicorns” (defined as private start-up ventures with a valuation of more than $1billion USD) has changed over the past five years. It is important to note that the vast majority of all unicorn companies in the world are based in just two countries: the United States (home to ~50% of unicorn companies) and China (home to ~18% of unicorn companies). While the LAC region is home to just ~2.4% of all unicorn companies in the world, it still stands out among developing regions in this regard (trailing only behind Asia), and in 2021 it was recognized as the fastest growing region in terms of venture capital investment.

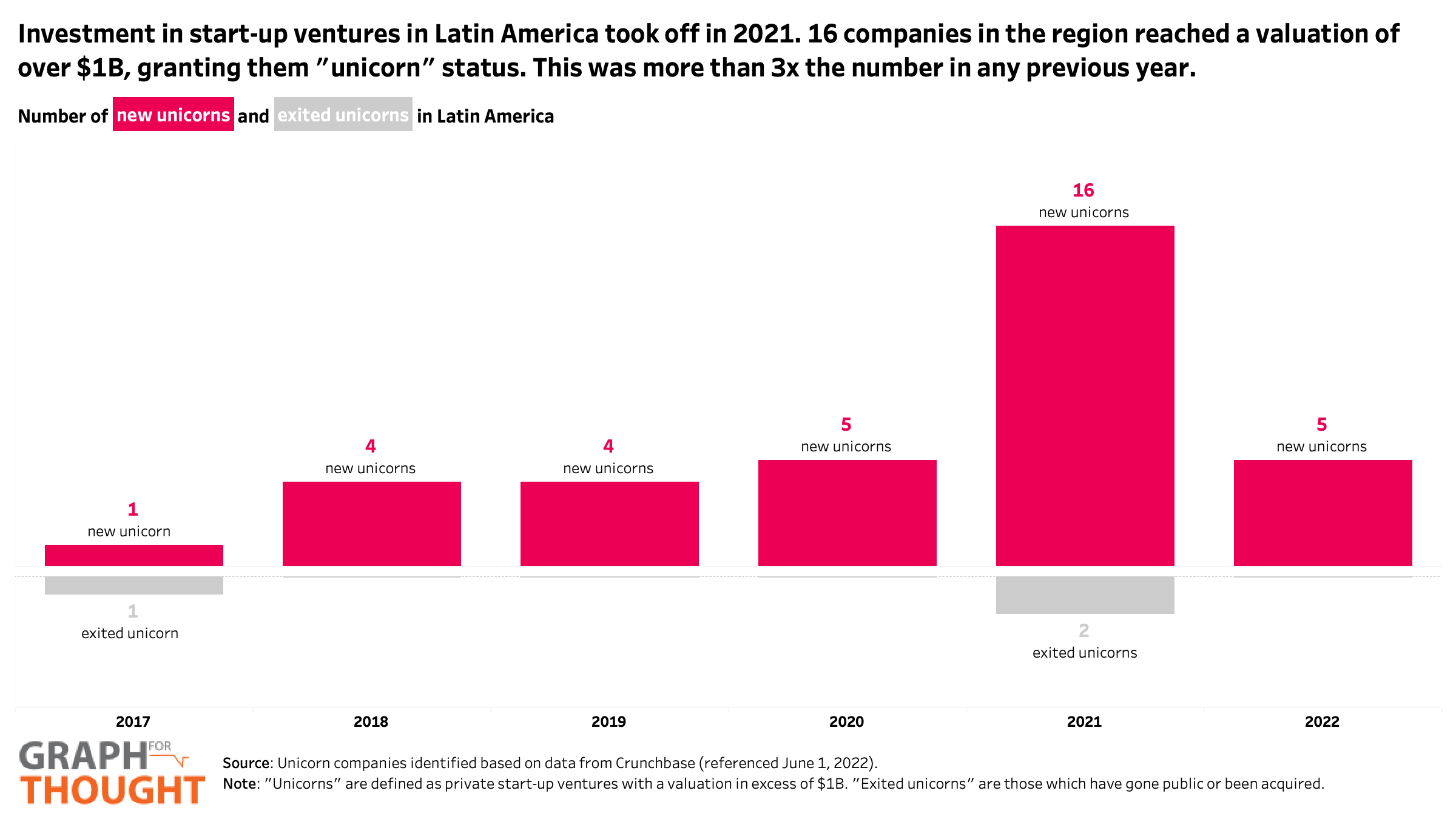

Indeed, as the graph below shows, 2021 was a record-breaking year for the number of unicorns in LAC. With over 16 newly minted unicorns (and 2 exited unicorns), this was more than 3 times the number of new unicorns created in any previous year. The overwhelmingly positive performance in 2021 also holds true when looking at venture investment in start-ups more broadly (going beyond unicorns to also consider smaller start-ups). For example, CB Insights estimates that start-ups in the region attracted over $20 billion USD in venture funding in 2021—which is almost 4 times more than the highest amount received in any previous year. As with elsewhere in the world, much of this growth was driven by investment in fintech companies—though new unicorns have emerged in a variety of other technology sectors as well (including “adtech, food tech, retail tech, deep tech e log tech.” However, it is not clear that this boom will continue. While 2022 is still underway, Q1 estimates suggest that investment is slowing in the region. A difficult economic environment marked by factors such as high inflation, rising interest rates, and market instability are stymieing the volume of incoming financial flows and several of last year’s start-up “success stories” are facing new challenges as evidenced in several recent large layoffs and delays of planned IPOs.

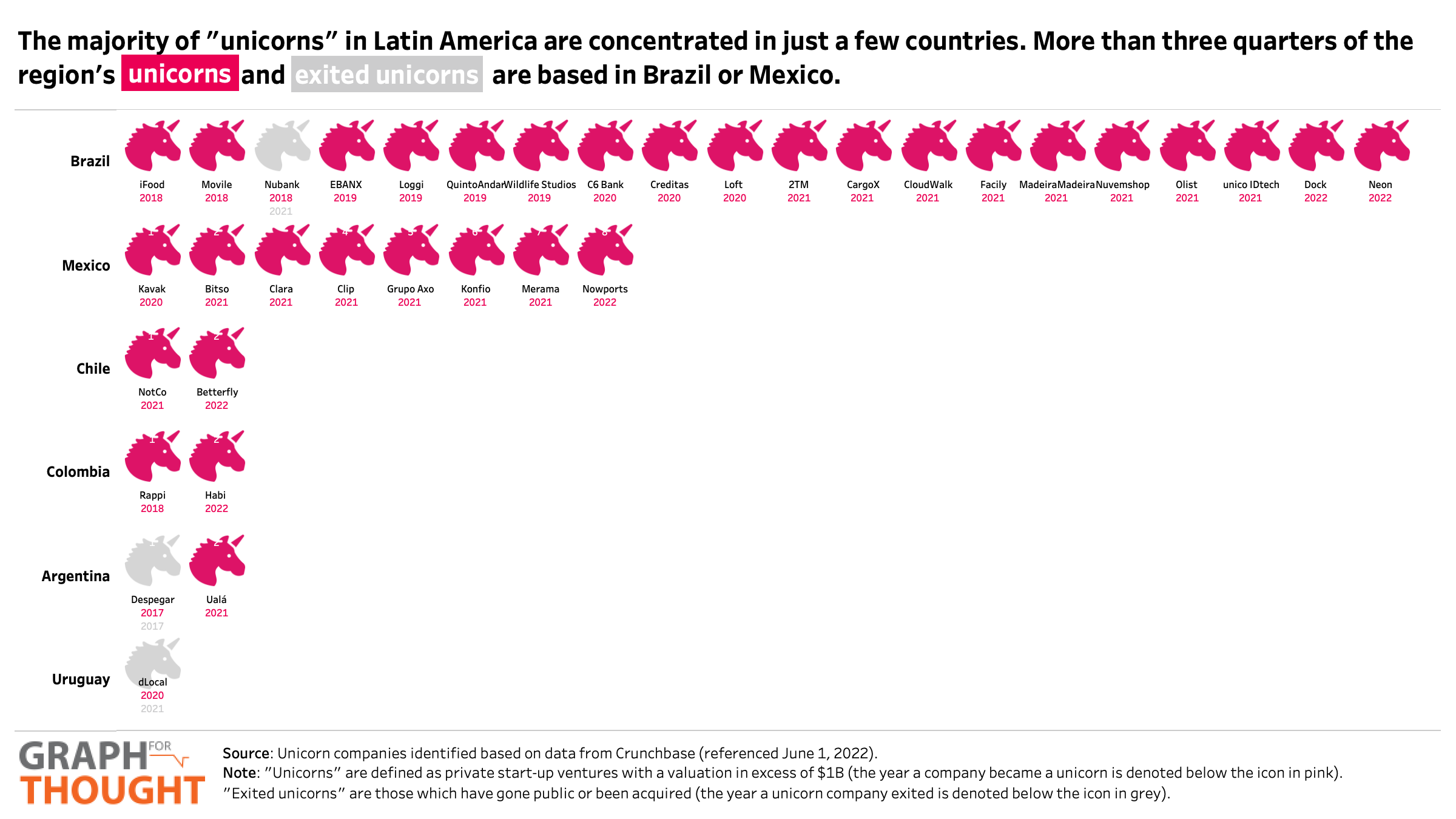

When looking at differences in where unicorn companies are based within the region, we see that the unicorn landscape is rather uneven. As the graph below shows, the vast majority of the region’s unicorns are concentrated in just a few large economies—with more than three-quarters of them based in Brazil and Mexico. Brazil and Mexico are not only regional top performers in terms of the number of unicorn companies, but they are also global top performers. With 19 unicorns, Brazil ranks #9 in the world in terms of countries with the most unicorns; and with 8 unicorns, Mexico ranks #15 (as of June 1, 2022).

The pandemic boom in unicorns and start-up investments in Latin America reflects a broader pattern of innovation that was fueled by the crisis. This manifested within the private sector through the emergence of new products, new ways of production, and new markets. Notably, in a context of increasing physical distance, technology played a fundamental role in transforming the delivery of existing goods and services. While financial investments in start-ups are slowing in the region, it is important that broader institutional investments in creating and shaping “innovation ecosystems” in countries throughout the region continue to grow. Indeed, institutions play a critical role in overcoming the coordination challenges inherent in promoting investment and innovation.

This involves, for example, exploiting complementarities such as investments in digital infrastructure and skills alongside efforts to build regulatory environments that favor fair and competitive markets that allow for processes of “creative destruction.” Importantly, also involves bringing together concerns of efficiency with concerns of equity. For example, this means working to ensure that legislation to protect workers and consumers (ranging from social protection policies to data privacy laws) is able to evolve in tandem with the emergence of new disruptive industries.

Locations

Locations