--- Image caption ---

The seventeen (17) financial solutions and practices mapped by the UNDP AccLab in Congo in the local informal sector last August, revealed trends in solidarity financing (cf. Immersion with the actors of the informal sector in Congo: the Ethnography of basic financial mechanisms ). This breakthrough is another step towards addressing the challenge of the resilience of actors in this sector to the pandemics’ effects as these trends will serve as decision-making tools for the establishment of the UNDP Revolving Credit Fund.

A work session to classify and filter these solutions by maturity level was organized at the end of October 2021 between UNDP Congo's AccLab and different stakeholders (incubators, startups, popular market committees, mobile phone companies and microfinance institutions). During this integrative activity, a mature digital solution was selected for the management of flows in this Revolving Credit Fund. This innovation is timely given the ongoing digital revolution in the international context and the launch of the Posts, Telecommunications, and Digital Economy White Paper along with the inclusion of the Digital Economy as one of the six (6) priority axes of the 2022-2026 National Development Plan.

Robust solutions for financing this sector after the classification and filtering session

This exercise allowed the participants to assess the maturity level of each of the presented solutions, based on the eligibility criteria defined by the Acclab and in collaboration with the supporting NGO Fongwama. Out of the seventeen (17) solutions evaluated, seven (7) were considered robust (having the highest maturity level with a tested and functional prototype), five (5) as having potential (with an existing prototype but not tested) and five (5) as embryonic (in the ideation or prototype design phase).

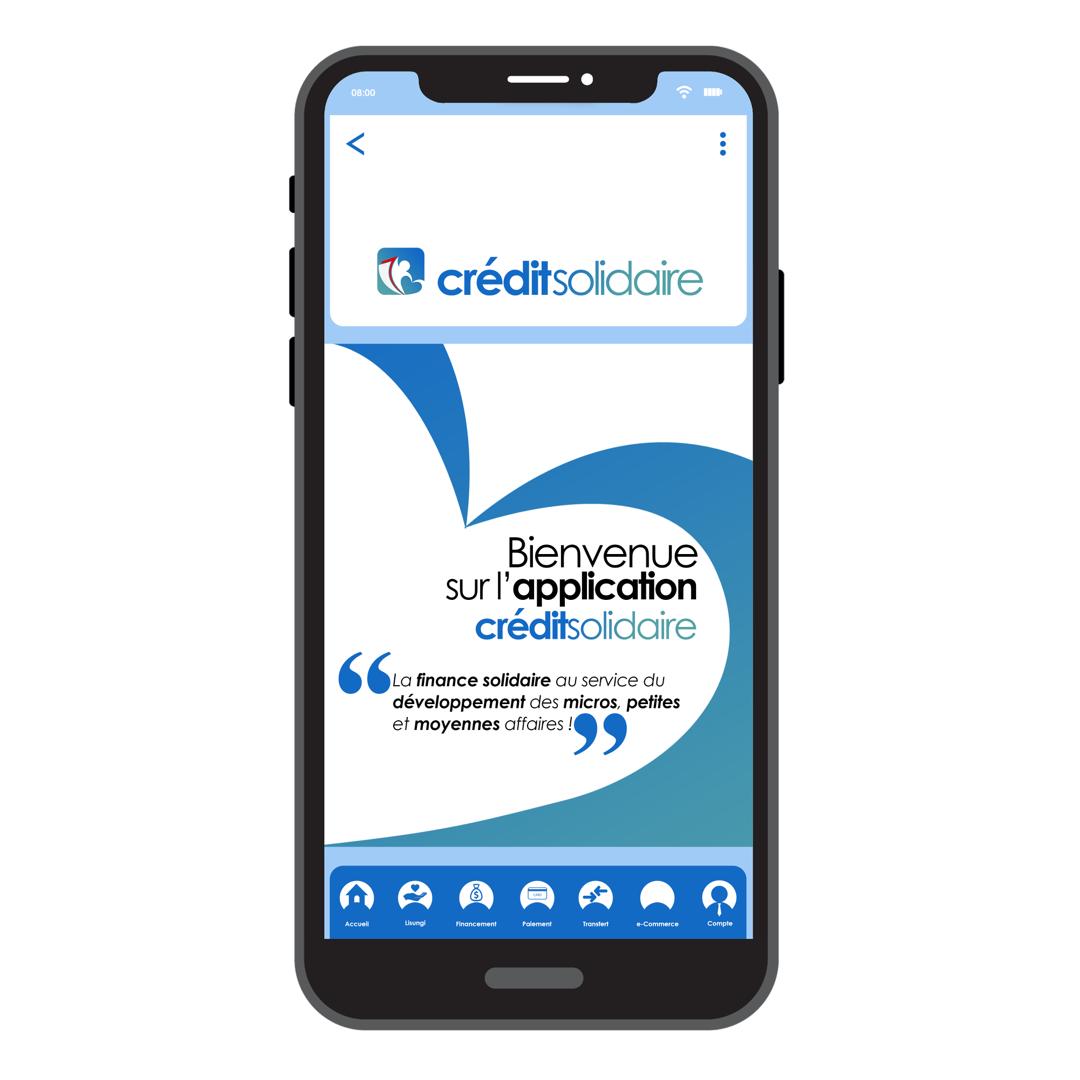

The robust solutions included mechanisms for fund transfers from cooperatives, credits and microcredits open to actors in the informal sector through microfinance, and digital platforms developed by an incubator. One of the aforementioned digital solutions, the solidarity credit platform Crédit solidaire platform of the Kosala incubator, was collegially selected by stakeholders as the most relevant solution to the challenge of the sector, with a high degree of financial and participatory inclusiveness. Subsequently, a collective intelligence activity was organized to improve the platform..

Collective intelligence for a restructuring of the digital management platform intended for players in the sector

In early November 2021, the stakeholders held discussions to restructure the functionalities of this application and to map the potential partners (institutional and private) who can interact in the implementation of this digital solution in order to achieve an improved version. This latest version considers the realities experienced by these actors on a daily basis in the field.

The Solidarity Credit platform has a USSD interface (main) and will be a writing gateway between the actors of the informal sector (traders, artisans, micro-enterprises etc.) and financial structures (microfinance institutions, mutual societies etc.) which could be responsible for hosting the financial mass of the UNDP Revolving Credit Fund.

Its capacity to ensure the management and digital financing of these actors allows the provision of a multitude of remote services, namely:

- financing via current operations (deposit, withdrawal, transfer, invoice, exchange, transfer);

- crowdfunding to solicit donors online, in support of actors in the informal sector;

- support through basic training on management.

- online payment via mobile telephone services (Mobile Money and Airtel Money) at negotiated preferential rates;

- social assistance for medical support through partner structures such as pharmaceutical networks.

This application represents an auspicious solution in these times of restrictions linked to the health crisis, as it offers the possibility for all those in the informal sector to carry out transactions without moving, through any type of mobile phone.

Where are we going with this platform?

The AccLab will once again partner with stakeholders to conduct a process of experimentation with the Crédit solidaire platform, to make it a real tool for facilitating financial inclusion in Congo. Should the results prove promising, this platform will generate a lot of data (user profiles, transaction flows etc.). The issues of hosting, managing, and ownership of these will be addressed during our next discussions.

By Matt SEINZOR, Head of Solution Mapping-AccLab Congo

Locations

Locations