Expanding investments in SMEs

June 9, 2023

Small and Medium Enterprises (SMEs) showcased their business ideas, products, and technologies on the sidelines of the Innovative Finance Lab’s second advisory board meeting and stakeholder roundtable discussion.

The IFL advisory board meeting, held in June 2023 in Addis Ababa, heard updates on the Technical Assistance Facility (TAF), held discussions on the alignment of MSME strategies, and reviewed and approved the design of the Enterprise Financing Facility (EFF).

The board also endorsed the formation of a regulatory sandbox, a platform for testing financial innovations (products and services), payment systems, disruptive business models and delivery mechanisms.

The 17-member board comprises representatives from the government, private sector, financial institutions, and development partners, with the National Bank of Ethiopia and UNDP co-chairing.

The SMEs showcasing at the advisory board meeting are part of the first cohort enrolled in a pre-and post-investment training and advisory programme.

The programme is part of the services provided by the recently established TAF, which is set up to support growth stage SMEs/start-ups with pre - and post - investment to strengthen their investment-readiness and create a strong pipeline of projects for the IFL’s investment fund – the Enterprise Financing Facility.

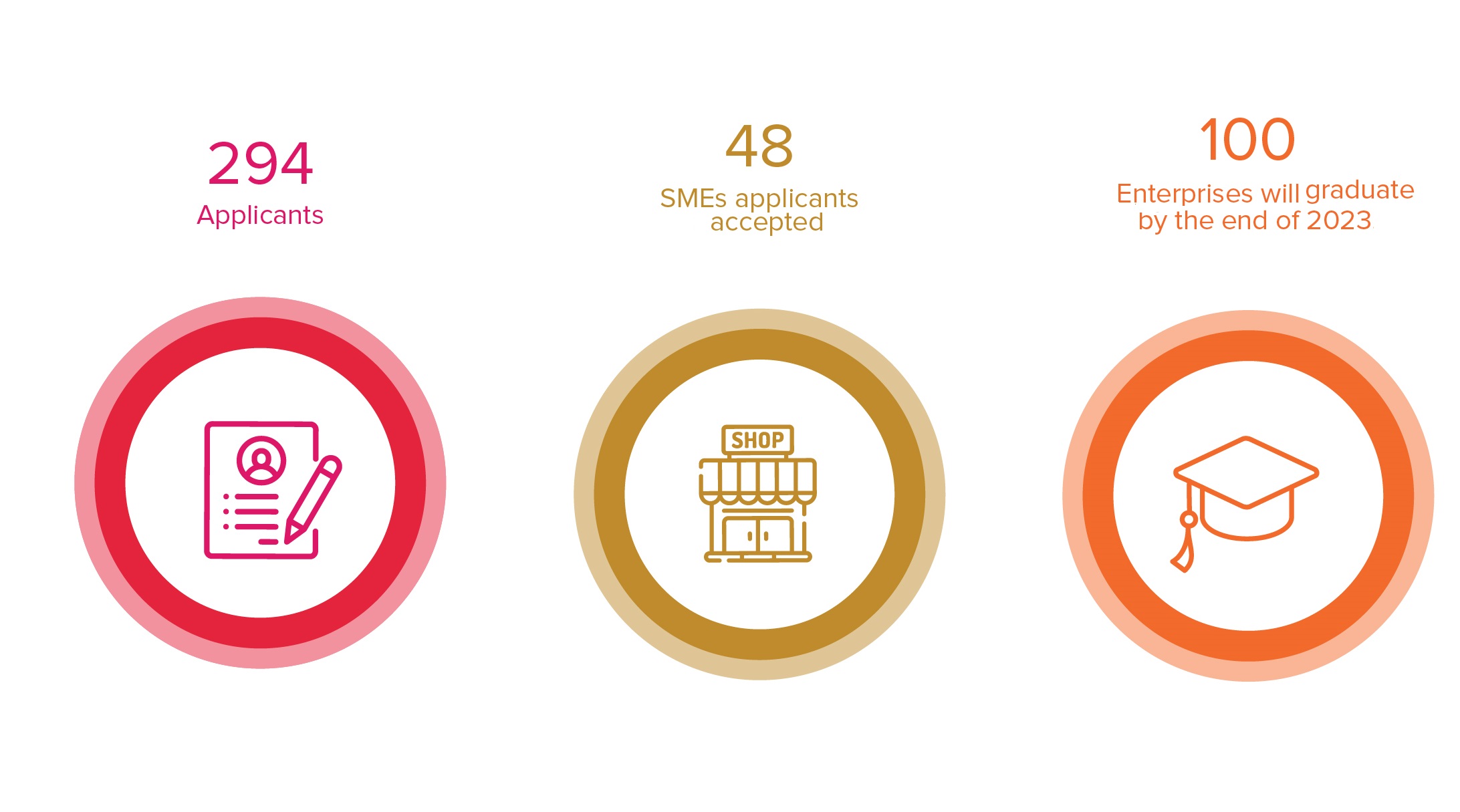

TAF selected 48 SMEs out of the 294 applicants following a public callout for pre-and post-investment categories following a stringent due diligence and screening process. 100 enterprises are expected to graduate from these programmes by the end of 2023.

Tackling access to finance

Yetnayet Assefa is the CEO of InfinEth Solutions. 20 years ago, Yetnayet and his friends decided to launch out on their own and set up a company that tackles the sector and provide solutions in ICT, telecom, and power & electromechanical sectors. InfinEth now employs 35 regular staff and 20 project-based staff. “Our journey has never been easy and free from challenges,” Yetnayet explains, “and we have been struggling to sustain the business due to financial instability. The banks’ requirement such as collateral, to access loans and other restrictive policies around it meant that access finance was challenging. Sometimes we are forced to use our families’ assets as collateral to get a loan from the bank and run the business. But this can’t be taken as normal practice for a business and has its own risk. This sets us back and limited our engagements when we could have expanded our coverage.”

Helping farmers access data fast

Abigia Fikremariam is the co-founder and manager of Omishtu Joy, an agri-tech engineering company set up two years ago, has invented a technology that she says helps improve time and cost associated with soil testing to customize help for farmers. According to Abigia, their technology can test the soil and provide the exact output within 15 minutes, and the company’s small testing farm in Jimma zone has started to test three private farmlands in the area. Abigia is encouraged, “The device is very helpful in indicating the missing nutrients important for the growth of various types of crops and vegetables. Accordingly, with our close advice and support, the farmers in Jimma have now started to diversify what they plantedg ” with informed decision on the application of fertilizer.

Solving cost of entry into the export market

Amir Abdellais the founder and general manager of Lata Agri Export, a family business engaged in the coffee sector for the last 13 years. According to Amir, Lata Agri Export is introducing Ethiopia’s first shared coffee roasting center which seeks to help other business to tackle the high start-up costs associated with entry into coffee export sector. “We have a facility equipped with high-end equipment, and people can be able to start their own coffee business with as little as around 20,000 birr including the service fee and other related costs,” Amir explains, and once the set up is up and running the center will provide businesses access to equipment, coffee and a two-week training. “Our goal is to open similar shared centers in the different regions and establish 250 coffee brands in the coming five years in Ethiopia and get at least one or two companies to win an international award,” Amir reflects on the long-term ambition.

Lack of access to finances, particularly accessing loan without collateral, limited market linkage and the novelty of their ideas and gaining trust by equity investors is highlighted by the SMEs as a key and common challenge that hinders their ability to expand and sustain their business and presence in the market.

The IFL’s Enterprise Financing Facility is aiming to set-up a USD 100 million blended finance investment fund as part of the innovative finance solution to address the need of SMEs. The fund will also serve as a partial collateral, a requirement in the conventional banking system in Ethiopia.

Locations

Locations