Written by : Mehdi Fathallah, Head of Solutions Mapping - Accelerator Lab , Tunisia Selma Cheikh Malainine, Chief Technical Advisor - Entrepreneurship for Development Project, UNDP Tunisia Laurine Peyronnet, Project Officer - Entrepreneurship for Development Project, UNDP Tunisia

Financial inclusion for women entrepreneurs : Building the bridge of trust

January 6, 2022

The success of an entrepreneur depends not only on her or his personality but also on the decisions and actions she/he undertakes. Thus, a realistic analysis of individual and collective behaviors can be extremely useful in the design, evaluation, and implementation of entrepreneurship-related projects. Behavioral insights and a data-driven approach help identify barriers and levers to business creation and development.

What does “Behavioral Insights” (BI) mean?

OECD defines BI as an inductive approach to policymaking that combines insights from psychology, cognitive science, and social science with empirically tested results to discover how people make choices.

Practitioners like the Behavioral Insights Team (BIT) define BI through 3 elements: i) Evidence; ii) Practical issues; iii) Evaluation. Based on these elements, BIT developed a practical methodology to tackle complex development challenges.

UNDP regional office, supported by BIT’s methodology, launched an initiative to understand the behavioral enablers and barriers to a robust, vibrant, and youth-inclusive and responsive environment that can empower young women and men to engage in entrepreneurship and become successful entrepreneurs.

As part of the regional team engaged in the project, UNDP Tunisia through the Accelerator Lab and the Entrepreneurship for Development (E&D) project, joined the initiative and defined a scope of work on conducting experimentation on financial inclusion for women entrepreneurs in the Southern regions of Tunisia.

Tell me more about it

In Tunisia, only 51% of women are clients of a formal financial institution (the Post Office and MFIs are particularly popular among women). The situation of financial inclusion in Tunisia shows that the categories that have the most difficulty accessing financial services and products are women, the poorest populations or those residing in remote areas, as well as micro and small enterprises[1]. Also, in the actual context of sanitary crisis, most women entrepreneurs became the main breadwinners for their families and their main motivation is to ensure a bright future for their children.

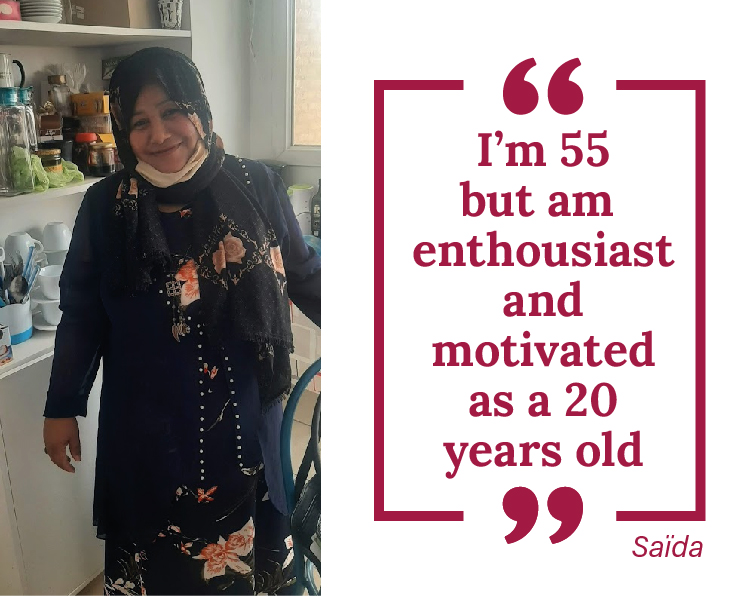

Hence, as a starting point, we selected one of the most vulnerable groups of the southern governorates, handicraft women micro-entrepreneurs, beneficiaries of UNDP Tunisia’s E&D project.

[1] World Bank Group, 2015

Then, we initiated the second step, the exploration phase. It aimed at identifying barriers that limit these women’s ability to engage in the desired behavior as well as the opportunities that could be used to encourage that behavior. We studied this group of women’s behaviors to understand the barriers to financial inclusion. Once the behaviors identified, we focused our intervention on changing their perception of the Bank and their use of financial services and products.

The interviews conducted with 20 women micro-entrepreneurs showed that the limited awareness and the fear of consequences are leading to a major lack of trust towards the banking system as a financial institution. Banking products and offers are perceived as unsuitable, difficult to understand and confusing. To most of these women, the Bank is seen as a Blackbox!

In addition, most of these entrepreneurs have experienced a microfinance loan. The bad experience with these loans increased their lack of trust and their fear of banks and financial systems.

Let's meet halfway

As part of the solution, we brought to the table UNDP’s partner, Attijari Bank, to build a trust relationship between the bank, as a financial institution, and the women entrepreneurs.

To do so, we organized two collective intelligence workshops in two different cities where bank representatives and women entrepreneurs met for two days to exchange ideas and co-create an accurate offer. Women got the chance to express their frustrations towards banks, ask questions about products and services. On the other hand, Attijari Bank seized the opportunity to demystify the bank’s image and was open to discussions to integrate women entrepreneurs’ needs into their offer.

Interesting insights came from concertation and discussions and led to the design of new potential financial packs, based on the entrepreneurs inputs and recommendations and adapted to their specific needs.

We identified some components that need to be mainstreamed into the bank pack:

· Needs for training on business management

· Financial literacy

· Payment flexibility

· Transparency and communication

· Administrative support (specifically for business formalization)

What’s next?

Now that the communication is established and a path to building trust is created between women and the bank by leveraging some BI tools, it is time for these entrepreneurs to decide to go to a branch of the bank, push the door and meet with a financial advisor.

The advisor will provide information on the and existing and new banking services that will support the sustainable growth of entrepreneurs' businesses.

As part of our commitment to entrepreneurship in Tunisia, we will continue supporting these women using BI methodology to act as ambassadors and spread the information, share their experience with the bank and help their peers overcome the Blackbox fear.

We will also continue to work with Attijari Bank on women entrepreneurs’ empowerment, through support and guidance, to make sure they are not left behind.

Locations

Locations