(Past Event) 17 Dec 8AM PST: Join UNDP Administrator, Draper University founder and others to learn how VCs can help address SDGs and COVID-19 challenges

November 8, 2020

"The world needs more heroes right now," Tim Draper, third generation venture capitalist and Founder of Draper Venture Network, recently said during the launch of our joint Impact Healthtech Pre-Acceleration Programme. The COVID-19 pandemic has highlighted existing weaknesses in many health systems and exacerbated inequalities and access to resources globally; we believe that healthcare innovation and health tech solutions can play an enormous role in the fight.

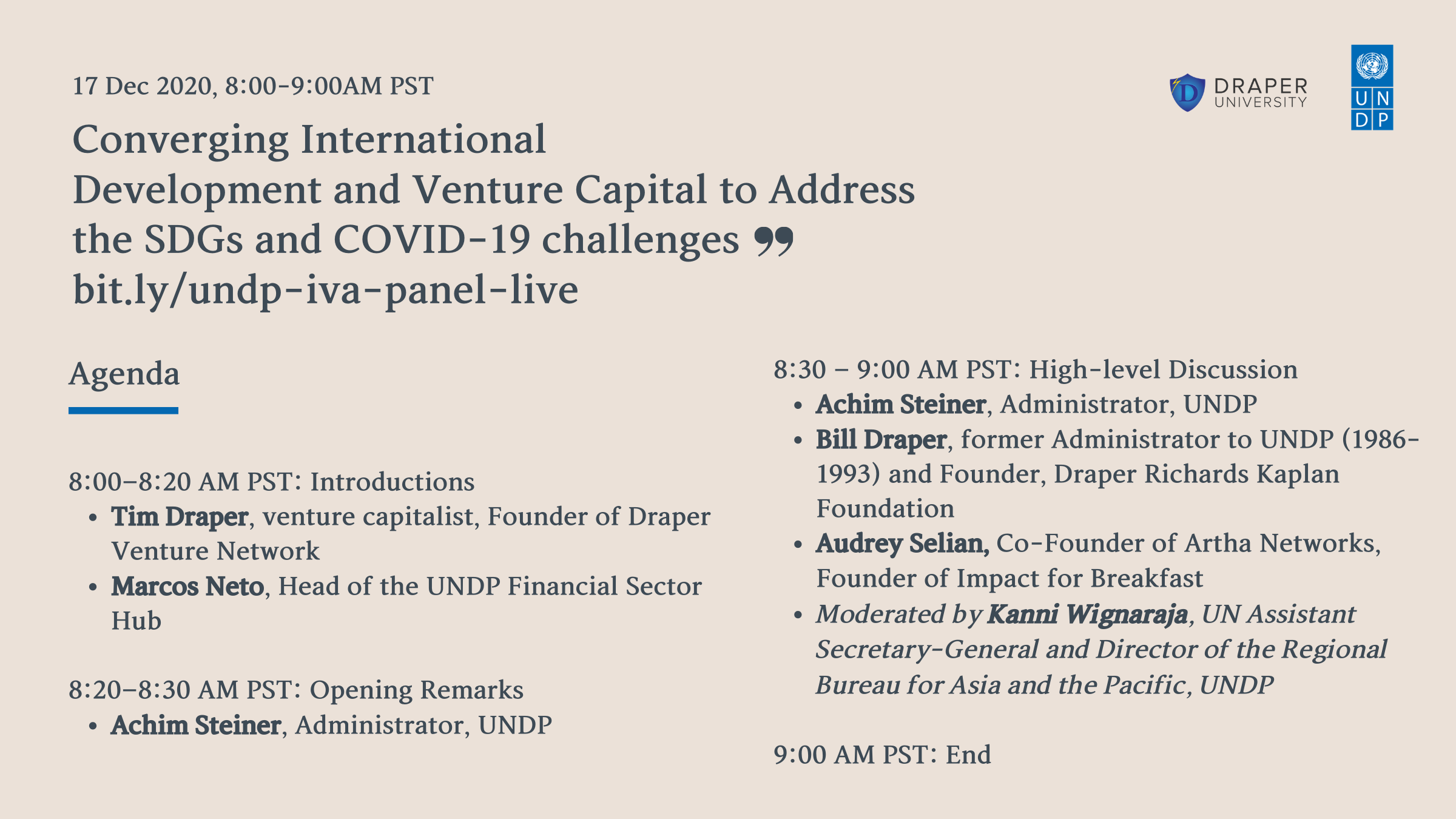

Join us on 17 December 2020 from 8:00 to 9:00am PST for a high-level discussion (streamed live) on the role that venture capital and impact investment can play in both addressing the pandemic, and also contributing to long-term support to the SDGs. Topics include why it is key for public and private to invest in ventures, and take on non-traditional financing methods, and how impact investing is making a difference in various contexts.

The livestream details for the panel discussion below:

Hear perspectives from:

- Achim Steiner, Administrator, UNDP

- Bill Draper, venture capitalist, former Administrator to UNDP (from 1986 to 1993) and founder of the Draper Richards Kaplan Foundation

- Audrey Selian, co-founder of Artha Networks, founder of Impact for Breakfast

- Moderated by Kanni Wignaraja, UN Assistant Secretary-General and Director of the Regional Bureau for Asia and the Pacific, UNDP

This panel will be followed by a demo day where the 20 top ventures from the Pre-Acceleration Programmme will pitch their solutions to a panel of invited investors and funders from Silicon Valley and other ecosystems specialised in healthtech. This portion will not be livestreamed and is available for a closed audience.

About the COVID-19 Response & Recovery Impact Venture Accelerator

The UNDP Global Centre for Technology, Innovation and Sustainable Development in Singapore and Draper University have recently established an Impact Venture Acceleration and Scaling Initiative to help impactful healthtech startups to scale and grow, so they can address issues brought on by the COVID-19 crisis.

On 2 December 2020, we launched the pre-acceleration programme alongside Haoliang Xu, UN Assistant Secretary-General and UNDP Director of Bureau for Policy and Programme Support, and Tim Draper, Founder of Draper Venture Network and Draper University, and a third generation venture capitalist behind over 34 renowned unicorn ventures.

Over 70 participants from the selected ventures joined in as well. These ventures have already been providing effective solutions to COVID-19 crisis through digital platforms, healthcare products and services to support public authorities, SMEs and vulnerable groups.

- Out of 105 applications, we have selected 45 impact ventures from 27 countries

- Collectively aggregated annual revenue of the selected ventures is around US$ 20m, while external investments attracted is US $124m

- The ventures will go through over 20 interactive and specially structured sessions on business, impact measurement and scaling subjects

- Through dedicated individual sessions the ventures will have access to 23 mentors from healthtech and VC ecosystems, and UNDP

In the last few years, UNDP has been piloting Impact Venture Accelerators which have proven to be effective at engaging private sector in a shared goal: to develop and scale up economically feasible, innovative technology and business solutions to contribute to the 2030 Agenda. UNDP IVAs bring value by combining business acceleration programs with SDG impact alignment, and impact measurement and management. This means that we help each venture to measure and articulate the impact of their innovations, and guide them in putting sustainability and impact at the centre of their decision-making.

Draper Venture Network, with its global influence, was chosen to support the accelerator. They also have committed to manage the VC-type Investment Facility, fully subsidise fund management fees, invest up to US$1m of their own capital and assume fundraising efforts for the rest of the Investment Facility.

Read more about the programme in the press release here.

Locations

Locations