Lithium in Latin America: A new quest for “El Dorado”?

May 26, 2022

The legend of El Dorado tells the story of a place that allegedly harbored great resources of gold somewhere in South America. For almost two centuries expeditions were launched to find the mythical kingdom where anointed princesses were covered in gold powder and boats filled with gold pieces and emeralds were sinked as an offering to the gods. As the Werner Herzog movie brilliantly portrays, expeditions ended in tragic, expensive failures. In the 18th century, cartographic studies reduced the myth to a much less profitable and fantastic reality, an area 70km away from Bogotá where indeed some gold was found, but nothing close to what the legend suggested.

Lithium, a soft and silvery mineral, is at the center of the energy transition. As countries around the world make efforts to shift towards greener economies, they need rechargable batteries. These are used to power electrical vehicles and to store energy from renewable sources, such as wind and solar. Lithium, an essential component of these batteries, as well as those in mobile portable devices, acts as a medium for “energy storage’.

According to the most recent data, Latin America holds 60% of all identified lithium resources (1) around the world. These are located mainly in Bolivia, Argentina and Chile, sometimes referred to as the “lithium triangle”.

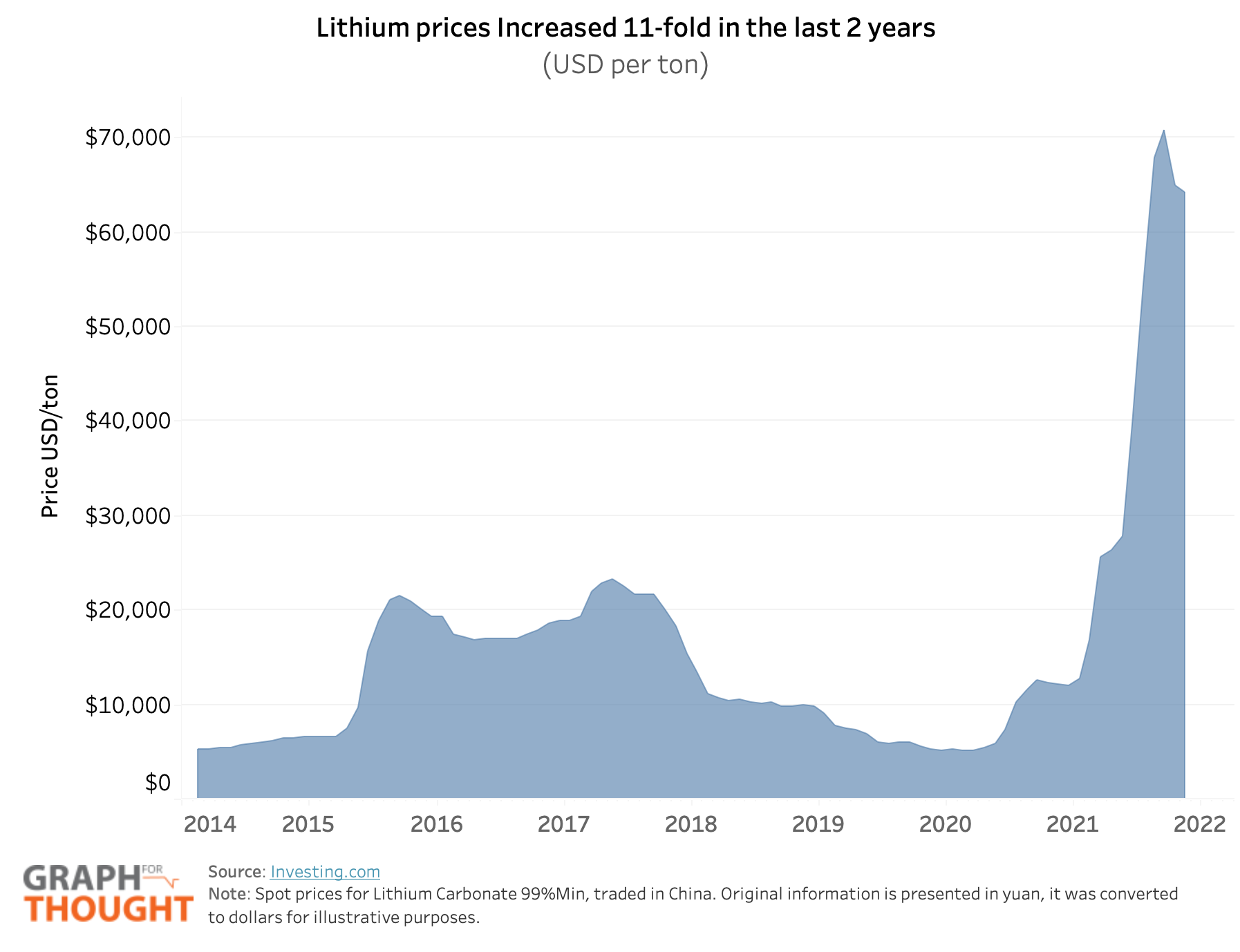

As you can imagine, demand for lithium has spiked in recent years, as more people choose electric vehicles, and is likely to continue growing as high gas prices push more to transition to electric modes of transportation. As a result, lithium prices have soared, increasing more than 11-fold in the last 2 years, from $6 thousand dollars per ton in March 2020 to more than $70 thousand in its peak starting 2022, as the graph below shows.

For countries with Lithium resources, this has generated great expectations that this mineral could be an important driver of growth in the years to come. However, lithium, even if abundant, is very hard to extract. Below are four reasons for caution before calling lithium the “white gold” of our days:

-

Most of the profit of the lithium industry comes from a long value chain that creates lithium batteries. Countries that just extract and export lithium are likely to have limited potential gains. In the elaboration of an ion battery cell, 40% of cost comes from the needed commodities to make the cathode. The cathode involves, of course, lithium, but also other various refined metals. The top 10 EV battery manufacturers by market share are all headquartered in Asian countries, concentrated in China, Japan, and South Korea. The top three battery makers—CATL, LG, and Panasonic—combined make up for nearly 70% of the EV battery manufacturing market. Latin American countries would need to significantly invest in R&D to keep larger parts of the value chain at home and be able to derive significant profits.

-

Mining and producing battery-grade lithium carbonate requires important investments. Recent estimates from lithium experts at Roskill has estimated that the marginal costs of producing refined lithium of both carbonate and hydroxide would range between $6,000-$8,000/t through to 2036. This might explain why only a few countries have been able to mine lithium. Currently, four mineral operations in Australia, two brine operations each in Argentina and Chile, and two brine and one mineral operation in China account for almost all lithium production in the world.

- There are important environmental and social costs of lithium production. Most of Latin American production comes from brines with fragile ecosystems. Lithium mining from salt brines in South America is associated with concerns of contaminating local water basins. These closed basins host biodiversity which depends on the delicate equilibrium between sweet and brackish water. Many of these areas are inhabited by indigenous communities who depend on water for their main economic activities. Given that historically, mining projects have not done well regarding the protection of human rights, significant measures must be taken to promote the local community wellbeing and ownership in such endeavors.

-

The pool of countries and places with identified resources is rapidly expanding. High prices are creating incentives to find new lithium resources. According to the U.S. Geological Survey, identified lithium resources went from 53 million tons in 2018 to 89 million tons in 2022, an increase of 41% in only 5 years. In other words, supply has the potential to grow and impact prices. Also, there is a growing sector of recycling lithium. About 25 companies in North America and Europe recycle lithium batteries or plan to do so. Partnerships between automobile companies and battery recyclers have been made to supply the automobile industry with a source of battery materials.

Lithium is an essential mineral for reducing greenhouse emissions, and it is found in large quantities in Latin America, therefore represents an opportunity. However, capitalizing on this opportunity requires significant investment and its sustainability is unclear. It requires a sustainable governance perspective to ensure that investment is available and that the gains of the lithium “rush” are distributed in a way that improves the well-being of societies, especially those of local communities. The gains that lithium presents to countries need to be reinvested in more ambitious, long run oriented technological transformation, that allows societies to overcome productivity traps. Natural resources can be a valuable driver of development, but without proper investment and sustainable governance their pursuit could become another quest for El Dorado.

(1) Identified Resources: Resources for which location, grade, quality, and quantity are known or estimated from specific geologic evidence.

Locations

Locations