Recognising the similar contexts between Kenya and Uganda, we were inspired to explore and map together, the role of mobile money in the pandemic response. Including how mobile money can support social distancing efforts and how it can be a vehicle for implementing cash transfers and mutual aid schemes. We believe that mobile money in East Africa will continue to play an integral role even as we shift into the Recover phase of the COVID-19 response. We also look forward to finding opportunities to leverage this robust technology in our respective Accelerator Labs particularly in the areas of social protection and digital disruption and to achieve the SDGs.

The Rise of Mobile Money in East Africa

Mobile phone-based money transfer services have been in East Africa for just over ten years, a revolution credited with succeeding to “bank the unbankable.” This technology has helped kickstart the fintech innovation ecosystem.

If you’re trying to accelerate sustainable development, the exciting story is how mobile money brings financial services to people working in informal sectors, previously excluded by banking systems and the access and opportunities that they bring.

Mobile money payment in East Africa is part and parcel of the fabric of life. Businesses in health, retail, and agriculture use it. It has played a role in digitising government systems and fueled new services like ride-hailing and food delivery apps. You can get it from most telecommunications companies in East Africa, including but not limited to, Safaricom, MTN and Airtel. According to the Central Bank of Kenya, mobile money transactions in Kenya in 2019 are valued at USD 38.5 billion, half the Kenyan GDP.

A closer look: Uganda’s Boda-Boda go digital

Coast Circuit — Traders. ©UNDP Kenya/Allan Gichigi

Reflections of Berna Mugema, UNDP Accelerator Lab Uganda

In March 2020, like most countries around the world, Uganda implemented a lockdown to control the spread of the global pandemic, COVID-19. As the President gave his final remarks on all the measures that were to take effect that night, I received a panic message from my regular “boda-boda” delivery man, Xavier, who felt threatened for his daily earnings as they were his primary source of livelihood. I quickly thought of all the informal businesses that thrive on daily earnings. Fast track to 3 weeks into the lockdown, Xavier is at my gate fully clad in his mask, sanitizing, handing over my weekly shopping to my house manager, and subsequently receiving his mobile money notification of payment. Three weeks into lockdown, the message I receive is one with hope; “Thank you for supporting me during this difficult time.” Oh! And did I mention, I shared his number to my entire family and friends, and he was now on a tight delivery schedule daily. Xavier’s story got me thinking, that even in the storms, there are lots of opportunities, and our ability to harness these opportunities is often a thin line between survival, thriving, and collapse.

98% of the total working population of Ugandans work in the informal economy, mainly vulnerable groups of people like women, youth, persons with disabilities who sell perishable produce like fruits and vegetables with meagre daily incomes.

Boda Boda riders like Xavier, whose livelihood depended on their daily interactions with people face to face, were threatened by travel and crowd restrictions. As I started piecing information together and looking at UNDP’s ongoing COVID-19 response in Uganda, I saw an immense opportunity to fast track people’s access to financial services through utilising inclusive digital payments like mobile money; being one of the silver bullets to get us there.

With a third of the world on some form of a lockdown or restricted movement as a measure to curb the spread of COVID-19, businesses that require face to face cash transactions are in jeopardy. Could a shift to digital cash transfers and mobile money be an answer to facilitate business continuity during these unprecedented times? Could the businesses even thrive given that people’s behavior may not quickly reset back to shopping in person?

Bahati a fruit vendor in Old Town Mombasa, reading the newspaper. ©UNDP Kenya/Allan Gichigi

Mobile Money takes on new meaning during social distancing

As the COVID-19 pandemic unfolds, mobile money is supporting physical distancing efforts and aiding business continuity during movement restrictions that have been implemented in Kenya and Uganda. The mobile money providers and regulators were quick to tap into this resource. They initiated response measures aimed at encouraging digital payments such as:

- Total or partial fee waivers on P2P (person-to-person) transactions

- Waivers on bank-to-wallet and wallet-to-bank transaction fees

- Increasing transaction and balance limits to incentivise small businesses to reduce their cash payments

- Some lenders are working with mobile money providers to waive penalties to defaulting borrowers and set up digital loan facilities for those impacted by the pandemic

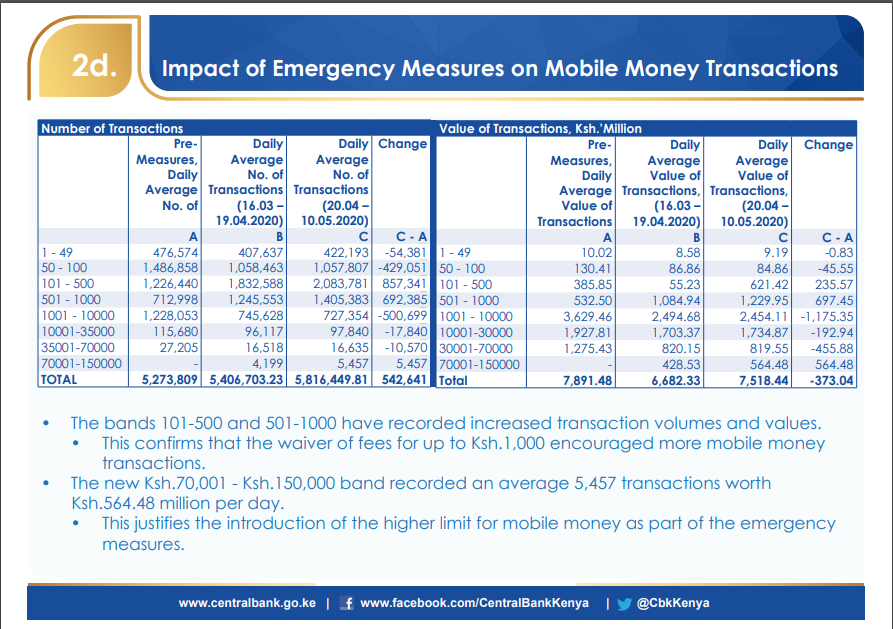

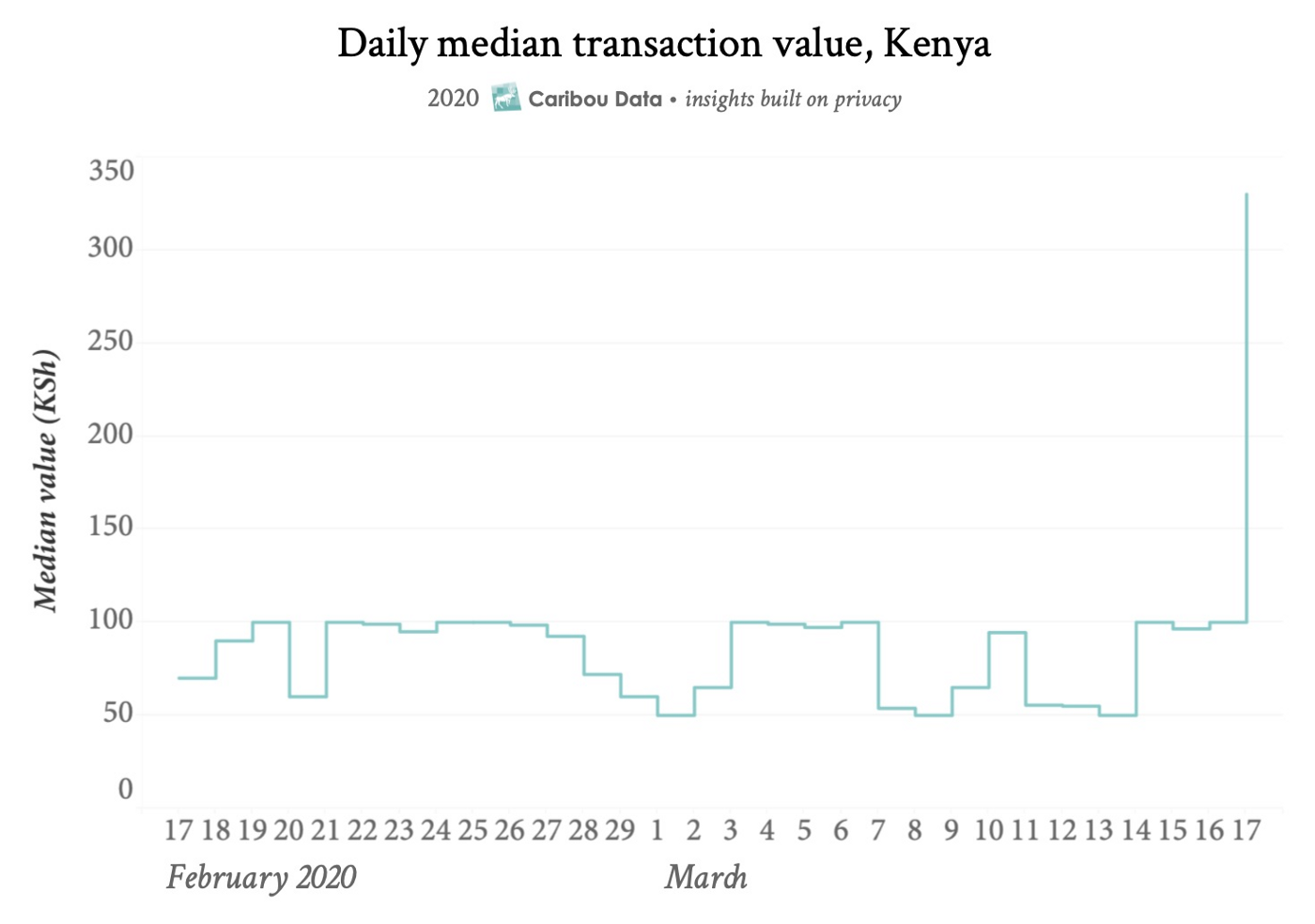

According to the Central Bank of Kenya, these measures have increased transaction volumes and values since they were introduced in mid-March.

Figure 1: Graph showing an increase in daily median mobile money transaction value after the waiver on costs for transactions up to KSh 1,000 was announced on March 16th.

Mobile money has also helped provide aid to vulnerable communities who have been hardest hit by the socio-economic effects of the pandemic crisis.

One example is Mutual Aid Kenya, led by youth community organisers and activists, who have been using mobile money to collect donations and working through a network of volunteers to distribute care packages. Another example is Give Directly in Kenya, a non-profit whose model is based on direct cash transfers to low-income households leveraging the existing mobile money infrastructure. In April 2020, the Government of Kenya through the Inua Jamii social protection programme, announced plans to direct cash transfers to households with beneficiaries who are elderly, living with disabilities, orphaned or vulnerable children.

Mobile money as a bedrock for e-commerce platforms during the pandemic

As I thought of Xavier and many other informal operators in our cities, I couldn’t help but wonder, why hadn’t these vendors shifted to e-commerce platforms? With the availability of easy payment options, I asked, why had the majority of existing e-commerce platforms not deliberately targeted this section of the population? And if they had, why weren’t they successful?

Widespread cash transfers in East Africa create opportunities for informal businesses to link up with their customers. Imagine the supply chain resilience if elevated with the help of e-commerce platforms. Xavier is one of the lucky few whose business continued by referral, otherwise, like most of his counterparts in the sector, he would be in a difficult position; yet they still find the means to thrive even more during this crisis.

Telecommunication Portrait of woman in Turkana. ©UNDP Kenya/Allan Gichigi

Post-COVID-19: The “new normal”

Since its inception, mobile money has gone through several iterations to the convenience of the customer at the forefront. Though initially resistant, banks quickly jumped onto this bandwagon, integrating their internet banking platforms to customers’ mobile money wallets. The ease to access finance services has somewhat been solved, at least for those with money and a mobile phone. The goods are in the markets, but the customers are locked down at home because the conventional thing to do is walk/drive to the market and pay using cash.

Physical distancing measures are likely to carry over into a post-COVID world, meaning that mobile money will continue to play a crucial role and result in increased prevalence.

A similar phenomenon happened in Kenya in the late 2000s, where the post-election violence of 2007/2008 and the resulting crisis were catalysts for the rapid adoption of mobile money; because of movement limitations that forced citizens to rely on mobile money as a safe, convenient and fast way of transferring money.

While we appreciate mobile money’s role in facilitating digital transformation, we recognise the risk of digital exclusion amplifying already existing inequalities. Many have posited that internet access should be considered a basic right for all, something we need to start actively thinking about as we re-imagine this new digital future. The unique financial infrastructure in East Africa allows us to explore how best to support informal businesses to survive and thrive by creating linkages to e-commerce platforms.

- - -

As part of the Accelerator Labs, we look forward to learning from emerging trends and finding ways of leveraging this technology to leapfrog interventions that support socio-economic recovery efforts.

Locations

Locations