Policy Dialogue Co-Hosted by UNDP and CCIEE Addresses the Challenges of Financing for Low-Carbon Transition

November 23, 2022

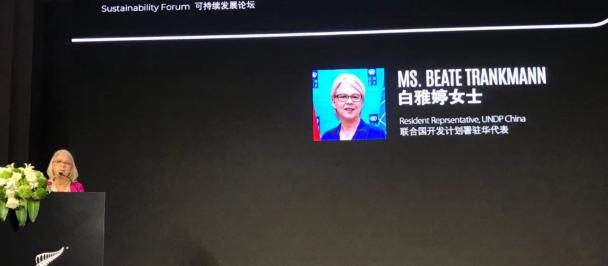

UN Under-Secretary-General and UNDP Associate Administrator Usha Rao-Monari delivers welcome remarks during the International High-level Policy Forum on Financing for Low-carbon Transition at the UN Compound in Beijing

23 November, Beijing – The United Nations Development Programme (UNDP) and the China Center for International Economic Exchanges (CCIEE) co-organized a high-level policy forum today in Beijing in the wake of the recent conclusion of the COP27 global climate summit, during which climate finance and the growing funding gap for a low-carbon transition was heavily spotlighted.

The forum discussed solutions to boost investment towards meeting carbon targets and advancing the Sustainable Development Goals (SDGs). Specifically, it explored different approaches, opportunities, and bottlenecks to accelerating financing for a net-zero future, and the tools available for policymakers to redirect capital flows and facilitate exchanges on innovative financing practices.

“The challenge is not a lack of resources–this is a world with 1.54 quadrillion dollars in assets. The real issue is where and how the money is spent,” said Usha Rao-Monari, UN Under-Secretary-General and Associate Administrator of UNDP. “We need to redirect financial resources to where they are needed most–the SDGs and climate commitments.”

With the world on track to more than double the 1.5-degree global warming target set in the Paris Agreement, urgent action from all stakeholders including governments, businesses, and individuals is required to reverse this trajectory.

A massive scale up of investments across all sectors and regions is needed to mobilize the annual funding of 5.7 trillion USD needed to reach net-zero by 2050. Instead, global subsidies for fossil fuels currently remain 1.5 times higher than investments in renewable energy capacity.

“Climate change is related to the future destiny of humankind and the development of all countries, and all countries need to work together to deal with it,” noted Zhang Xiaoqiang, CCIEE Executive Vice-Chairman and CEO. “We call on more international organizations, bilateral and multilateral institutions and market players to actively participate in climate investment and financing activities to contribute to the global green transition.”

Given its size and share in global carbon emissions, China’s contributions to addressing climate change are vital. China has made important efforts to effectively support the low carbon transition domestically by establishing a comprehensive policy framework for greening its financial system. The country has become one of the world’s major green finance markets and could play a role in scaling-up global financing for green and low carbon transitions.

The policy dialogue took stock of the good practices, strategies, and initiatives around the world that can pave a way for low-carbon development, achieve the Paris Agreement, and the promise of leaving no one behind. A diverse range of experts were invited including government officials, policy experts, scholars from research institutions, as well as representatives from UN agencies, the international community, and the financial and private sector.

The event’s plenary session emphasized the role of finance in promoting a green and just transition towards the achievement of the 2030 Agenda. In particular, speakers recognized social, environmental and economic benefits for sustainable development, and the role of different institutions in safeguarding the future of people and the planet.

The event’s first panel discussion explored green and sustainable finance market innovations in China and the world. By sharing best practices and experiences, and reflecting on global trends, panelists identified opportunities for synergies and coordination for future acceleration of green and sustainable finance.

The second panel examined concrete implementation tools currently available to scale up green and sustainable finance. Delving into green and sustainable finance standards, information disclosure systems, and digital technologies, the discussion identified gaps in sustainable finance and highlighted opportunities to redirect financial resources from business-as-usual to the implementation of climate commitments.

Discussions and takeaways from the high-level policy dialogue are expected to form the basis of a knowledge product exploring policy and market innovation on green and sustainable finance in China and Asia Pacific countries to inform decision-making that will accelerate achievement of the climate and environmental agendas, as well as the SDGs.

****

MEDIA CONTACT: Ms. Zhao Yue, Innovation and Communications Officer, UNDP China at yue.zhao@undp.org

Locations

Locations