Tanzania Economic Transformation: Key Developments

November 3, 2023

This update on Tanzania’s economic transformation seeks to highlight key developments in the factors that are involved in the transformation process. Economic transformation involves the complex interplay among various economic and enabling environment conditions including macroeconomic stability, conduciveness of the investment climate, level of infrastructure development (especially in electricity supply, WASH and transportation), coherence of the national planning process, the state of human development (particularly in education and health) and the level of institutional capacity.

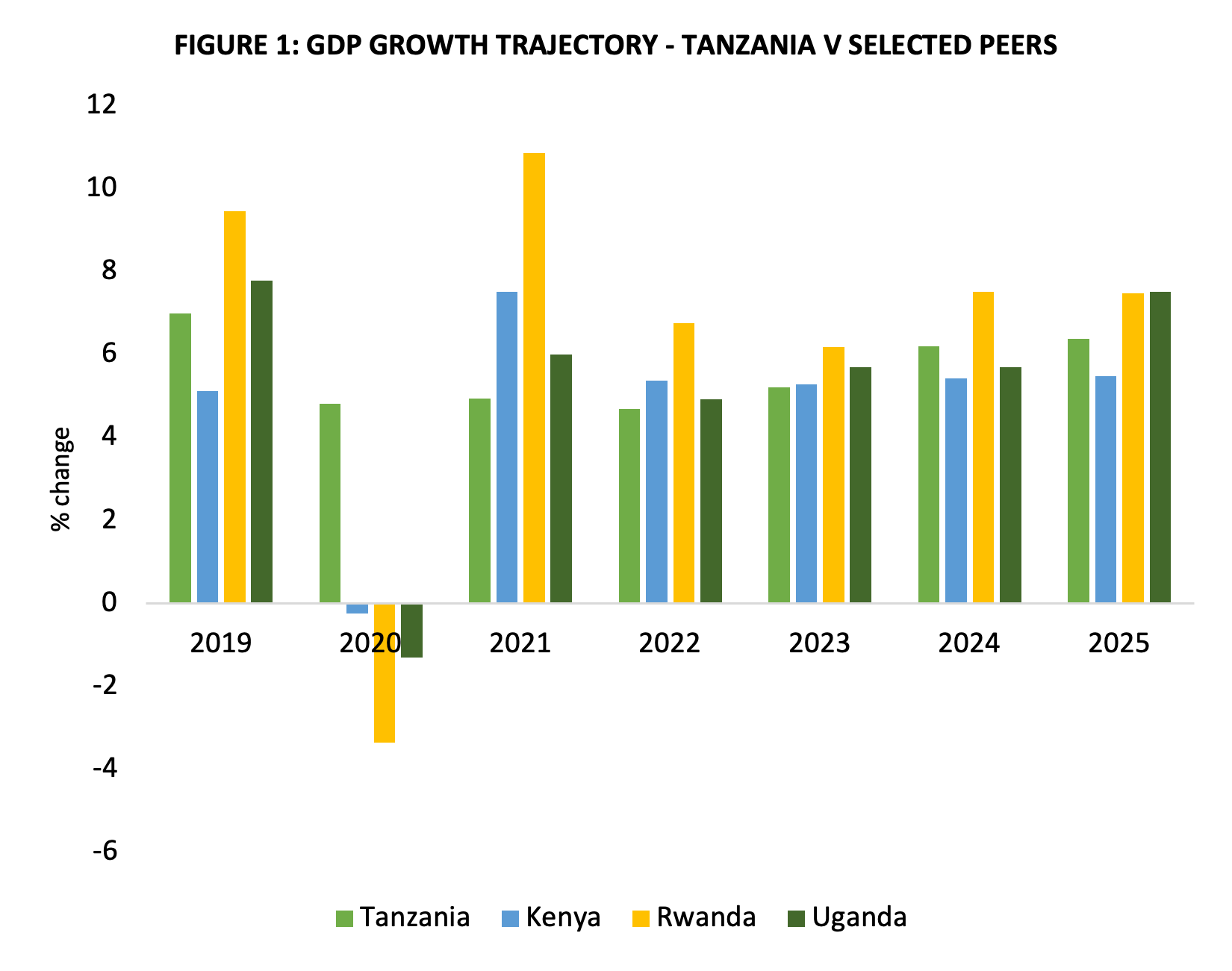

Government’s track record of prudent macroeconomic management has helped Tanzania weather multiple global headwinds relatively better than peers. Key indicators of macroeconomic performance continue to show remarkable resilience against the lingering effects of the COVID-19 pandemic and the war in Ukraine but remain vulnerable to reversals amid heightened global economic uncertainties. After recovering slightly to 4.9 percent in 2021, Tanzania’s gross domestic product (GDP) growth dipped back to 4.7 percent in 2022, which was lower than the level it reached at the height of the pandemic (figure 1), as the war in Ukraine derailed the country’s economic recovery. GDP growth is expected to rebound to 5.2 percent in 2023 on the back of expected improvements in global economic conditions and domestic reforms to support economic activity and inclusive growth under the government’s 40-month Extended Credit Facility (ECF) arrangement with the IMF. However, this level of growth is still far below pre-pandemic levels and the country’s long-run (2000-14) average of 7.0 percent and 11.0 percent respectively.

Source: IMF World Economic Outlook Database April 2023

Growth is not expected to rebound to pre-pandemic levels until around 2028. More worryingly, the country’s long-run (15-year) growth potential is expected to fall to 5.7 percent on average in part because of lowered development spending amid a tighter financing for development landscape in the post-Ukraine-crisis era (see financing landscape analysis for more analysis). This is far below the government’s medium-term average GDP growth target of 8 percent as set out in the third Five-Year Development Plan (FYDP III). Moreover, given the country’s persistently high population growth rate (2.9 percent on average between 2012 and 2022), together with a rapidly deteriorating growth elasticity of poverty (which fell from -1.02 in 2007/12 to -0.30 in 2012/18), the country’s projected long-term growth will be insufficient to deliver significant poverty reduction and improve livelihoods for the most vulnerable. Consequently, inequality has increased despite robust GDP growth with the country’s Gini coefficient increasing to 0.44 in 2021 from 0.41 in 2018.

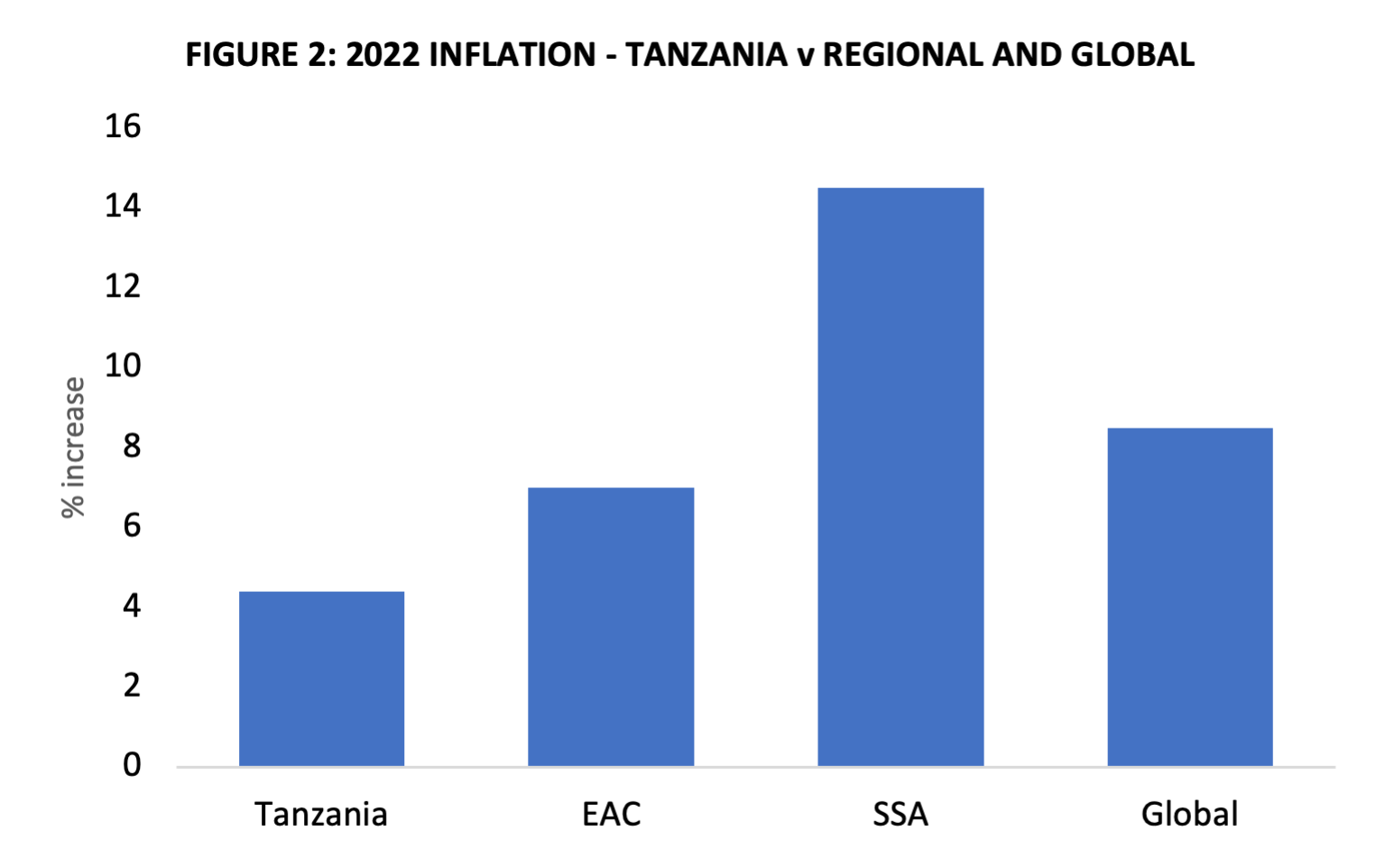

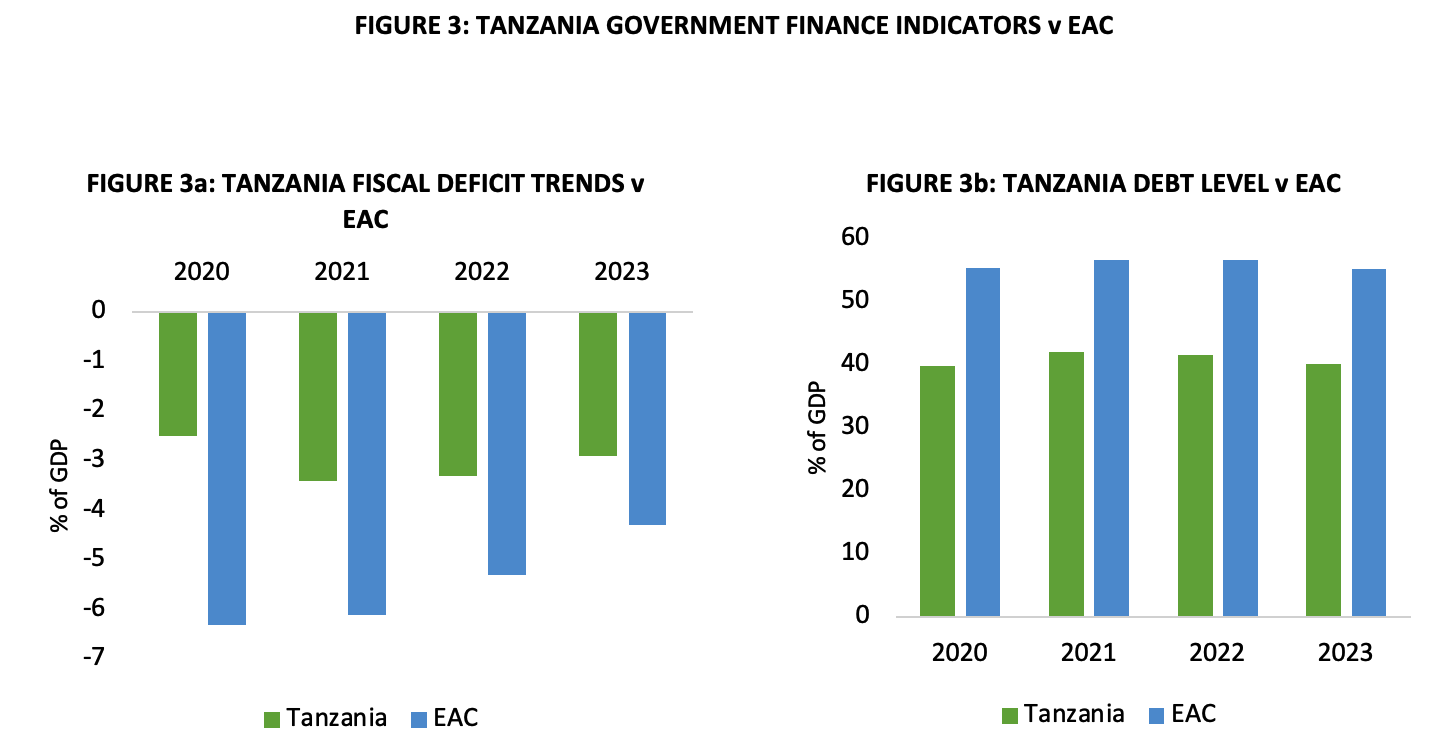

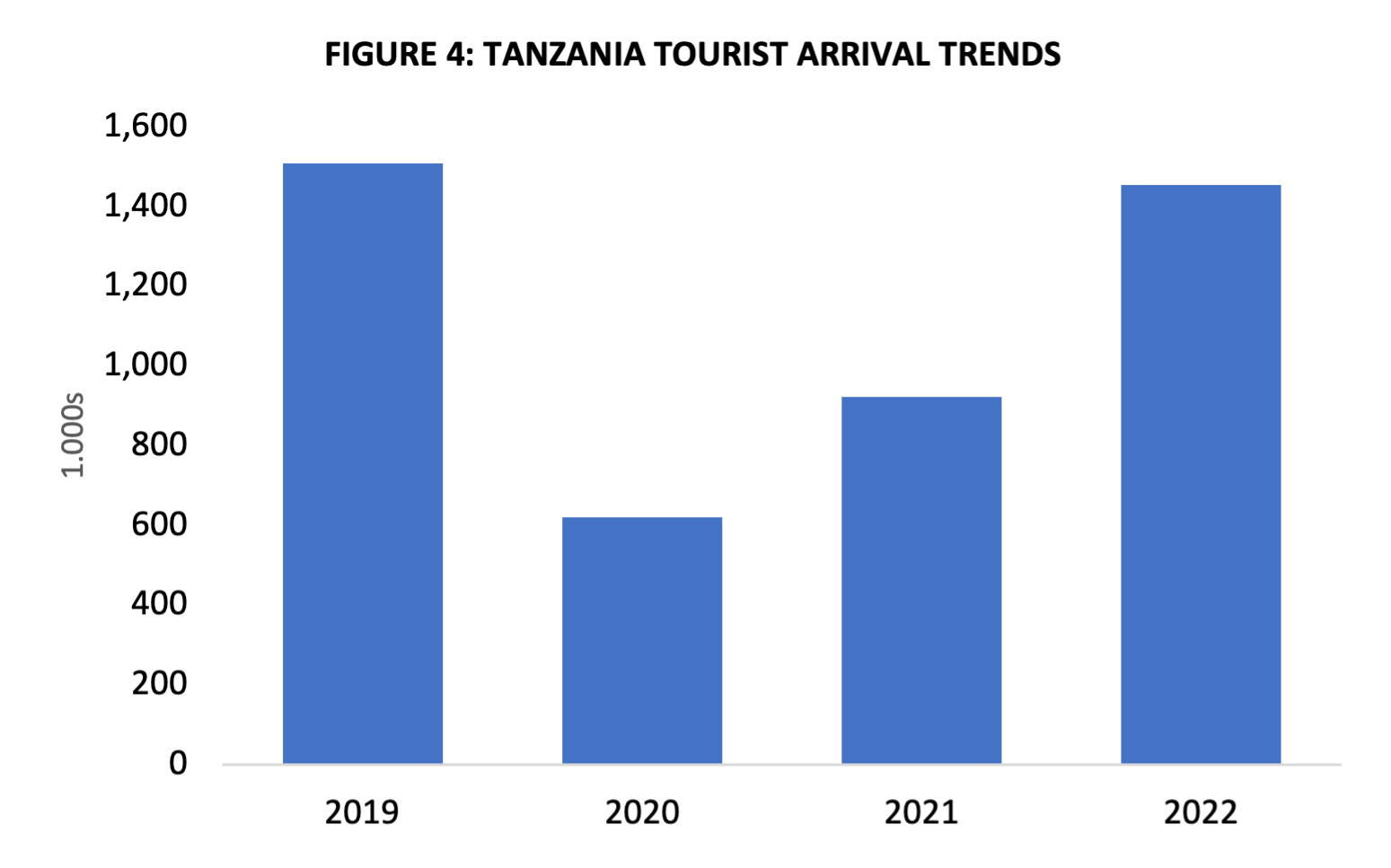

Other macro gauges have performed well but are becoming harder to sustain amid heightened global uncertainties and climate risks. Despite a sharp acceleration in global inflation following Russia’s invasion of Ukraine, Tanzania’s inflation rate peaked at just 4.9 percent in January 2023 (below the Bank of Tanzania’s target inflation rate of 5 percent) and has rapidly decelerated to 3.6 percent in June 2023. This compares favourably with East African, sub-Saharan African and global inflation rates, which averaged 7.0 percent, 14.5 percent and 8.5 percent respectively in 2022 (figure 2). Likewise, the fiscal deficit and debt level remained comparatively resilient to global headwinds (figure 3a and 3b), although the latter was supported by large drawdowns of foreign currency reserves, which impinged on the country’s external position despite the vaccinations-fuelled recovery in tourism to pre-pandemic levels (figure 4). The Bank of Tanzania’s (BoT) foreign reserves fell to USD 5.2 billion in December 2022 from USD 6.4 billion a year earlier, representing 4.3 months of prospective imports, which is below the BoT’s 4.5-month threshold for imports cover. At the same time, the current account deficit widened to 5 percent of GDP from 3.4 percent on the back of higher import prices for food and fuel and is expected to remain elevated in 2023 before falling back to 3.3 percent in 2024 (figure 3). However, the difficult external environment and climate risks – including tighter financing conditions, on-going geopolitical tensions, volatile commodity prices (especially for food and fuel), higher borrowing costs, slowing global demand and shortfalls in rainfall and thus agricultural exports – poses significant downside risks to these projections, implying that the BoT should hold more reserves than ‘normal’ to avoid a disorderly adjustment should risks materialize. The IMF recommends that a range of 4.5 – 5.5 months of prospective imports cover is a more appropriate range under these circumstances.

Source: IMF

Source: IMF Regional Economic Outlook: Sub-Saharan Africa; April 2023

Source: Tanzania National Bureau of Statistics

The government’s on-going ECF program with the IMF should help Tanzania better withstand the economic impact of the war in Ukraine, support macroeconomic stability and lay the foundation for higher, sustainable and inclusive economic growth. The government agreed a USD 1.05 billion arrangement under the IMF’s Extended Credit Facility in July 2022 with the overall purposes, of completing implementation of the Tanzania COVID-19 Socioeconomic Response and Recovery Plan (TCRP), safeguarding macroeconomic and financial stability, and sustainably accelerating economic growth and inclusive development. The ECF should also help catalyse additional donor grants and concessional funding, which is crucially important amid the current global financing squeeze. The first bi-annual review of the program was successfully completed in April 2023 after the government met all required quantitative and structural benchmarks despite the challenging global environment. This included targets on structural reforms to liberalize the exchange rate regime to shore up the country’s external position. Government also followed through on its commitment to end fuel price subsidies, which were implemented after the outbreak of war in Ukraine, in January 2023 to help restore fiscal sustainability, although other pro-poor targeted subsidies, such as subsidies on fertilizers to smallholders, have been retained.

The emphasis on agricultural development in the FY2022/23 budget signals a possible departure from FYDP III’s industrialization ambitions. In April 2022, President Samia Suluhu Hassan unveiled her new agricultural transformation strategy – dubbed ‘Agenda 10/30’ – which, as the name alludes, aims to accelerate the pace of output growth in the sector to 10 percent by 2030. At the centre of this strategy is a planned, massive expansion in the amount of labour and land allocated to the sector. An extra 3 million workers are expected to be added to the sector by 2025, a third of which are expected to be young people, and land under cultivation is expected to reach 20 million hectares by 2030. Other key elements of the strategy include a massive expansion in irrigation to cover 50 percent of all land under cultivation by 2030, from just 6 percent currently, institution of a ‘block farm’ system to aggregate smallholder farmers, where every farmer – with priority given to women and youth – will receive at least 10 acres of land to benefit from economies of scale, and deployment of seed multiplication innovations. The government increased the agricultural budget nearly threefold to TZS 954 billion shillings in the FY 2022/23 budget (from TZS 294 billion in the previous FY and plans to keep the budget elevated going forward. In addition to accelerating growth in the agriculture sector the new strategy aims to increase the value of agricultural exports from USD 1.2 billion per annum to more than USD 5 billion by 2030, led by an increase in horticultural exports from USD 750 million to USD 2 billion. The government also plans to leverage its position as one of Africa’s few surplus food producers to supply 20 percent of the region’s food imports demand, especially for cereals like rice and maize.

Agenda 10/30 results from the culmination of years of underinvestment in the agriculture sector, which has seen the sector’s growth rate fall to just 3.2 percent in 2021. The war in Ukraine, which led to shortages of wheat and edible oils in the country, also raised the urgency to take immediate measures to address the inefficiencies in the sector and stave off food insecurity. However, the reliance on increased (particularly female) labour and land for output growth in the sector, and the emphasis on crop production, is a continuation of past agricultural policies that resulted in a sharp drop in agricultural productivity, thereby dampening agricultural prices and undermining rural income growth. Total factor productivity in the agricultural sector (of land and labour) declined from 99 in 2000 to 89 in 2020. In fact, a simulation of the impact of increasing the supply of female labour in the agricultural sector conducted by UNDP found that this would decrease overall agricultural output and depress wage rates for all workers in the sector. Planned improvements in technology and innovation would help improve productivity in the sector but would need significant investments to be successful. For instance, UNDP’s simulation finds that meeting the government’s irrigation targets would not only increase performance in the sector in terms of output, incomes, and employment, but the resulting increase in productivity would lead to greater economic diversification into higher value activities in related manufacturing sectors. However, the cost of expanding irrigation to required levels is beyond the reach of government resources alone. Although the government increased the budget allocated to investment in irrigation more than seven-fold to TZS 360 billion in FY2022/23, this only provides 6 percent of the financing needs for the sector.

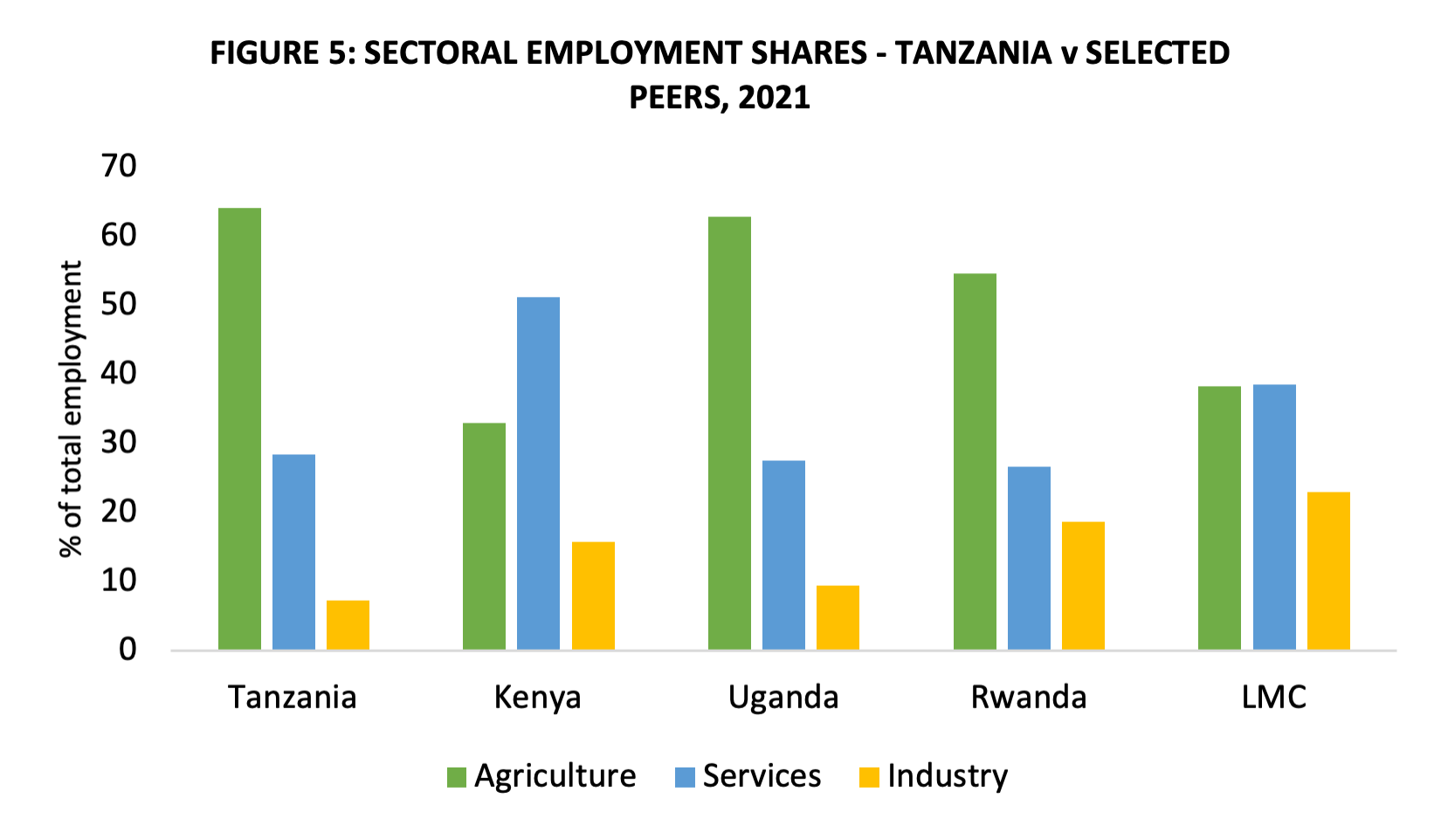

Adding more labour to primary sectors including agriculture is antithetical to the overall goal of structural transformation and more importantly, inclusive growth. Agriculture’s share as a percentage of GDP has risen from 26.5 percent in 2012 to 29.7 percent in 2021, indicating a reversal in structural transformation gains in the last decade. The labour shift out of agriculture (a better indicator of successful structural transformation) has also slowed, falling by just two percentage points to 65 percent of employment in 2021 from 67 percent in 2014, rather than an expected 62 percent based on past trends. This means that two-thirds of Tanzania’s labour force only receive around 30 percent of the income the economy generates, which poses serious limitations on progress towards poverty reduction, improvements in income inequality and human development. More workers in the sector will only compound the situation. By contrast, Tanzania’s lower middle-income peers have, on average, 41.2 percent of their workforce engaged in agriculture, while the sector accounts for 14.9 percent of the group’s collective GDP (figure 5).

Source: World Bank database

Other labour market indicators suggest that Tanzania’s incomplete structural transformation path is reaching its limits and successful and inclusive economic transformation will remain elusive in the absence of enabling reforms. The proportion of workers in waged employment has remained constant since 2014 at just 14 percent while the proportion of workers employed in the formal sector dropped from 12 percent to 10 percent. This implies that it is becoming increasingly difficult for the economy to create enough formal jobs to absorb the 800,000 new workers that enter the labour force every year leaving the low-productivity, vulnerable informal sector to bear the country’s sizable employment burden. More significantly, these trends underscore the precarious nature of Tanzania’s incomplete structural transformation trajectory, which has been driven by cyclical natural resource booms rather than more sustainable, labour-intensive industrialization (particularly in manufacturing). Rather, natural resource booms tend to fuel the construction and, to a much greater extent, nontradable services sectors (think domestic workers, petty traders and road-side restaurants). Natural resource booms also bid up all prices in urban areas (including wages), giving the illusion of better living conditions there compared with rural areas, which drives increased urbanization. However, when urban sector wages are deflated against the higher cost of urban living, the magnitude of the urban wage premium (which is estimated at 30 percent) dissipates. Moreover, since these higher wages are not driven by higher productivity, they cannot be sustained during commodity-price down-cycles, which has been on-going since the end of the commodity super-cycle in 2014 and has accelerated since the onset of the global polycrisis in 2020.

The acceleration of informality with the proliferation of ‘machingas’ is another indication of falling productivity levels in the urban sector. Value added per worker (a measure of labour productivity) in the services sector declined to TZS 3062 per year in 2019 from TZS 3147 in 2016, reflecting an increase in low-productivity jobs of which a key supplier is the burgeoning machinga (petty traders) sector. Petty trading is popular with youth and women because they typically lack the resources and formal skills and qualifications needed for formal employment. By contrast, the sector’s low barriers to entry in terms of capital, operating costs, legal eligibility, and educational requirements provide a means of subsistence employment for the millions of disadvantaged people within these groups. However, employment in the sector is notoriously vulnerable and risky – especially for women – and creates additional constraints on already-stretched urban infrastructure. Thus, the machinga issue is beginning to garner policy interest not only because of their growing role in job creation, but also because they present a route to greater formalization of Tanzania’s economy. In the FY2022/23 budget, government committed TZS 10 billion to each district to support machinga leadership and an additional TZS 45 billion for provision of infrastructure and capital through TZS 1 billion revolving funds in each region and directed LGAs to allocate 10 percent of their internally generated revenue to develop infrastructure and support women, youth and persons with disabilities in the sector.

Low human capital levels, infrastructure development, private sector dynamism and institutional strength remain significant drags on economic transformation. Limited access to skilled labour is a key constraint on the development of the formal sector with roots in Tanzania’s low educational attainment and foundational learning levels for those who manage to go to school. High enrolment rates at primary school level (figure 6, panel 1) belie the country’s low and declining learning outcomes with just 5.2 percent of standard 2 and 3 students currently able to read proficiently and only 20 percent reaching benchmark levels in numeracy. In 2012, 20 percent of school children at this level were proficient in reading and 44 percent in mathematical skills. Enrolment in secondary and tertiary education significantly lag those of peers (figure 6, panel 2). Completion rates are even lower at just half of secondary school entrants, leaving the country bereft of the STEM and management skills needed to drive a modern industrial, well-run learning economy. Severe government underfunding of the education sector largely explains these low outcomes. The education budget fell from 22.2 percent of the total budget in 2016/17 to 18.9 percent in 2021/22. Likewise, low government expenditure on health at just USD 45 per capital on the mainland and USD 34 in Zanzibar (compared with World Health Organisation’s recommended USD 86 per capita to ensure basic healthcare provision) has contribution to elevated stunting levels among children at around 30 percent in 2021 (albeit down from 42 percent in 2010) meaning that too many children lack the cognitive skills to perform well in school to begin with. The country’s education situation is so dire that one of the structural benchmarks in the IMF’s ECF with Tanzania is to increase the number of teachers by 15,000 by June 2023 to reduce the pupil-teacher ratio and improve the quality of education, particularly in rural areas.

Source: World Bank Database; World Economic Forum

Finally, persistently low institutional capacity and state dominance continues to erode vital private sector dynamism. Indicators of institutional capacity still lag those of peer countries (figure 6, panel 3), most notably, government effectiveness (important as a gauge for government’s ability to provide public goods and services) and rule of law (important gauge for assessing public institutions’ ability to uphold and enforce contracts), which deter private investment. Thus, provision of public goods remains low with just 40 percent of the population having access to electricity, which is even below the level in LICs, and under half the level in LMIC peers (figure 6; panel 4). The upshot is that annual private investment growth has been falling steadily from 12.3 percent on average in 2010-2015 to 7.5 percent in 2015-2020 and just 4.5 percent in 2022. Similarly, FDI has fallen from 3.2 percent of GDP in 2015 to 1.6 percent in 2021, reflecting prevailing global conditions but also the legacy of inward government policies. Meanwhile, despite numerous reforms, Tanzania’s global competitiveness and doing business rankings have made little progress at just 117 out of 141 countries and 141 out of 190 countries in 2019 respectively (figure 6, panel 5). To improve private investment, the government adopted a new investment policy in 2023 which aims to ease barriers to private investment including by guaranteeing investment repatriation and procedures for hiring foreign workers.

Locations

Locations